Ria Errors And Omissions Insurance

What is Ria Errors and Omissions Insurance?

RIA errors and omissions insurance (E&O) is a form of professional liability insurance that is specifically designed to protect financial advisors, registered investment advisors (RIAs) and other financial professionals from claims made by clients due to errors or omissions in the services they provide. In other words, it provides protection to financial advisors and related professionals when a mistake is made, whether through negligence, errors, or omissions in their professional services.

RIA errors and omissions insurance is essential for any financial advisor or RIA, as it offers protection against the financial losses that can occur when a mistake is made in the course of providing advice or services. This type of insurance is also known as professional liability insurance or malpractice insurance, and is usually required by state law or industry regulations.

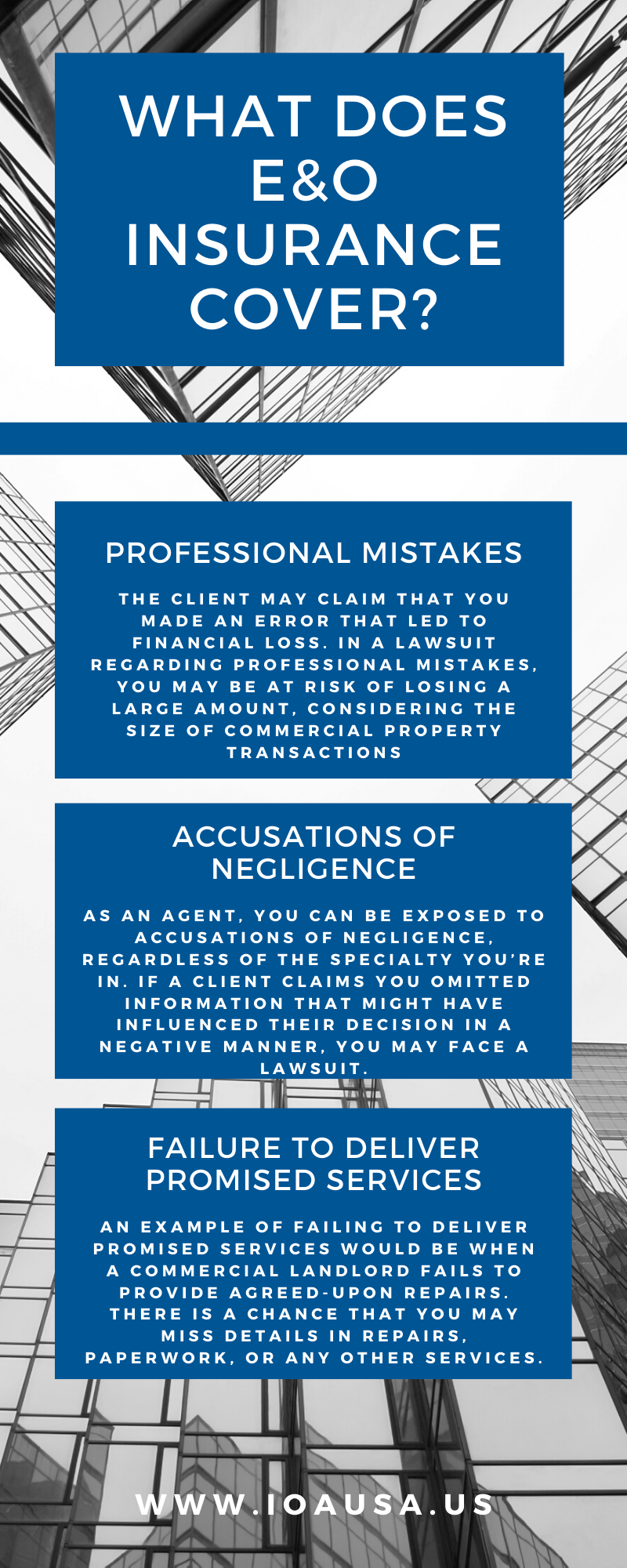

What Does RIA Errors and Omissions Insurance Cover?

RIA errors and omissions insurance covers a wide range of potential mistakes, errors and omissions that a financial advisor or RIA may make in the course of providing services. This includes: negligence in providing advice and services, failure to comply with regulations, misrepresentation of facts, inaccurate investment advice or planning, and failure to disclose material information.

RIA errors and omissions insurance also covers the legal costs associated with defending a claim, as well as any damages or settlements that may be awarded in the case of a successful claim. It is important to note that this coverage does not include protection against criminal or other intentional acts, or for any losses that result from market fluctuations.

Why Do Financial Professionals Need RIA Errors and Omissions Insurance?

RIA errors and omissions insurance is an essential form of protection for financial advisors, RIAs and other financial professionals. Without this type of insurance, they would be personally liable for any mistakes or errors they make, which could result in expensive legal fees and potentially large settlements or awards.

This type of insurance also provides financial advisors and RIAs with peace of mind, knowing that they are protected against claims made by clients. It is important to note that the amount of coverage required varies depending on the type of services provided and the amount of risk involved.

How Much Does RIA Errors and Omissions Insurance Cost?

The cost of RIA errors and omissions insurance varies depending on the type of services provided and the amount of coverage required. Generally speaking, the cost of this type of insurance is relatively low compared to the potential financial losses that can occur in the case of a claim.

It is also important to note that costs can vary depending on the insurer and the type of policy. It is important to compare quotes from different insurers in order to find the most cost effective coverage for the services provided.

Conclusion

RIA errors and omissions insurance is an essential form of protection for financial advisors, RIAs and other financial professionals. It provides protection against claims made by clients due to errors or omissions in the services they provide, as well as the legal costs associated with defending a claim. The cost of this type of insurance is relatively low compared to the potential financial losses that can occur in the case of a claim, and it is important to compare quotes from different insurers in order to find the most cost effective coverage.

How do I obtain Errors & Omissions (E&O) insurance as an RIA?

Understanding Errors and Omissions Insurance - Insurance Office of

Errors omissions insurance

Errors and Omissions - Senior Marketing Specialists

Errors & Omissions Insurance Update: Brokers' E&O Exposure