Provisional Licence Insurance Rules Uk

Understanding Provisional Licence Insurance Rules in the UK

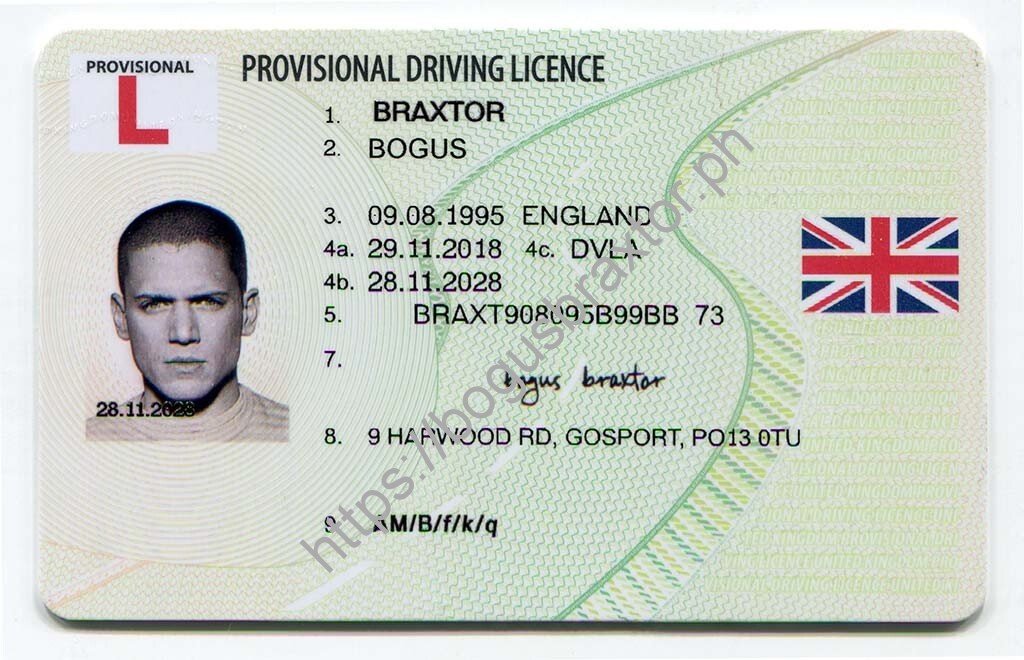

What is a Provisional Licence?

A provisional licence is the licence that a person must obtain before they are allowed to drive a vehicle in the UK. This licence will allow the holder to drive on the public roads with certain restrictions, such as not being able to drive on motorways. The licence must be renewed every year and it is important to understand the provisional licence insurance rules in the UK before taking out a policy.

What is Provisional Licence Insurance?

Provisional licence insurance is a type of car insurance that is specifically tailored for drivers who are learning to drive and have a provisional licence. This type of car insurance is usually more affordable than standard car insurance as it is intended to cover the driver while they are still learning and not yet fully confident behind the wheel. The insurance will cover the driver and their car in the event of an accident.

What are the Rules for Provisional Licence Insurance?

The rules for provisional licence insurance in the UK depend on the insurer and the type of policy that is taken out. Generally, the driver must be aged between 17 and 25 and they must have a valid provisional licence. The driver must also be supervised by a qualified driver who is aged over 21 and has held a full driving licence for at least three years. The supervisor must be in the car with the learner driver at all times when they are driving.

What are the Benefits of Provisional Licence Insurance?

The main benefit of provisional licence insurance is that it is more affordable than standard car insurance. This type of insurance is tailored for young drivers who are just starting out and therefore the premiums are much lower. Additionally, the insurer will often provide additional benefits such as providing a courtesy car if the policyholder’s car is damaged in an accident.

Are There Any Restrictions?

Yes, there are some restrictions when it comes to provisional licence insurance. Generally, the insurer will not cover the driver if they are found to be driving recklessly or if they are driving a car that is not registered to them. Additionally, the insurer may not cover the driver if they are found to be driving under the influence of drugs or alcohol. Finally, the driver must be supervised by a qualified driver at all times.

Conclusion

It is important to understand the provisional licence insurance rules in the UK before taking out a policy. Provisional licence insurance is more affordable than standard car insurance and it can provide additional benefits such as a courtesy car if the policyholder’s car is damaged in an accident. However, there are some restrictions when it comes to provisional licence insurance and the driver must be supervised by a qualified driver at all times.

Driving Licence Types | Driving Licence Categories | Tempcover

Insurance Companies That Insure Provisional Drivers - noclutter.cloud

Provisional Driving Licence - What It Is For - Cuisine Europe

Launch diagnostic: How much is provisional licence

Apply for your Provisional Driving Licence