Legal And General Car Insurance Reviews Moneysupermarket

Friday, January 20, 2023

Edit

Legal And General Car Insurance Reviews Moneysupermarket

What is Legal and General Car Insurance?

Legal and General Car Insurance is a trusted provider of car insurance services in the UK. It has been providing cover for motorists since 1836, so it is one of the oldest car insurance companies around. It is part of the highly respected Legal and General Group, which is a FTSE 100 company and one of the largest insurers in the UK. This group has over 6 million customers and provides a range of financial services, such as life insurance, pensions and investments.

Legal and General Car Insurance offers a range of different policies, which are designed to meet the needs of different motorists. The company provides third-party fire and theft cover, as well as comprehensive cover. It also offers a range of optional extras, such as windscreen cover and breakdown assistance. All policies offer a range of benefits, such as a courtesy car, personal accident cover and legal protection.

What Do People Say about Legal and General Car Insurance?

When it comes to reviews, Legal and General Car Insurance is generally well-regarded by customers. On the independent review website Moneysupermarket, the company has a score of 8.4 out of 10, with over 2,000 reviews from customers.

Most customers report that the claims process is straightforward and that the customer service is good. Many customers also describe the cover as comprehensive and good value for money. However, there are also some complaints about the premium costs, with some customers finding them to be more expensive than other providers.

What Does Legal and General Car Insurance Offer?

Legal and General Car Insurance offers a range of benefits and features to customers. Its policies include a courtesy car, personal accident cover, legal protection and breakdown assistance. Customers can also benefit from optional extras, such as windscreen cover, personal belongings cover and motor legal protection.

The company also offers a range of discounts for customers who choose to pay for their policy upfront. This includes a 10% discount for customers who pay for a full year's policy upfront, as well as a 5% discount for customers who pay for six months upfront.

How Does Legal and General Car Insurance Compare?

When it comes to car insurance, Legal and General is generally competitively priced compared to other providers. On average, its premiums are around the middle of the market, so customers can expect to get a good deal. However, it is important to shop around to make sure that you get the best deal available.

In terms of customer service, Legal and General Car Insurance is generally well-regarded by customers. It has an 8.4 out of 10 rating on Moneysupermarket, with many customers reporting that the claims process is straightforward and the customer service is good.

How Do I Get a Quote from Legal and General Car Insurance?

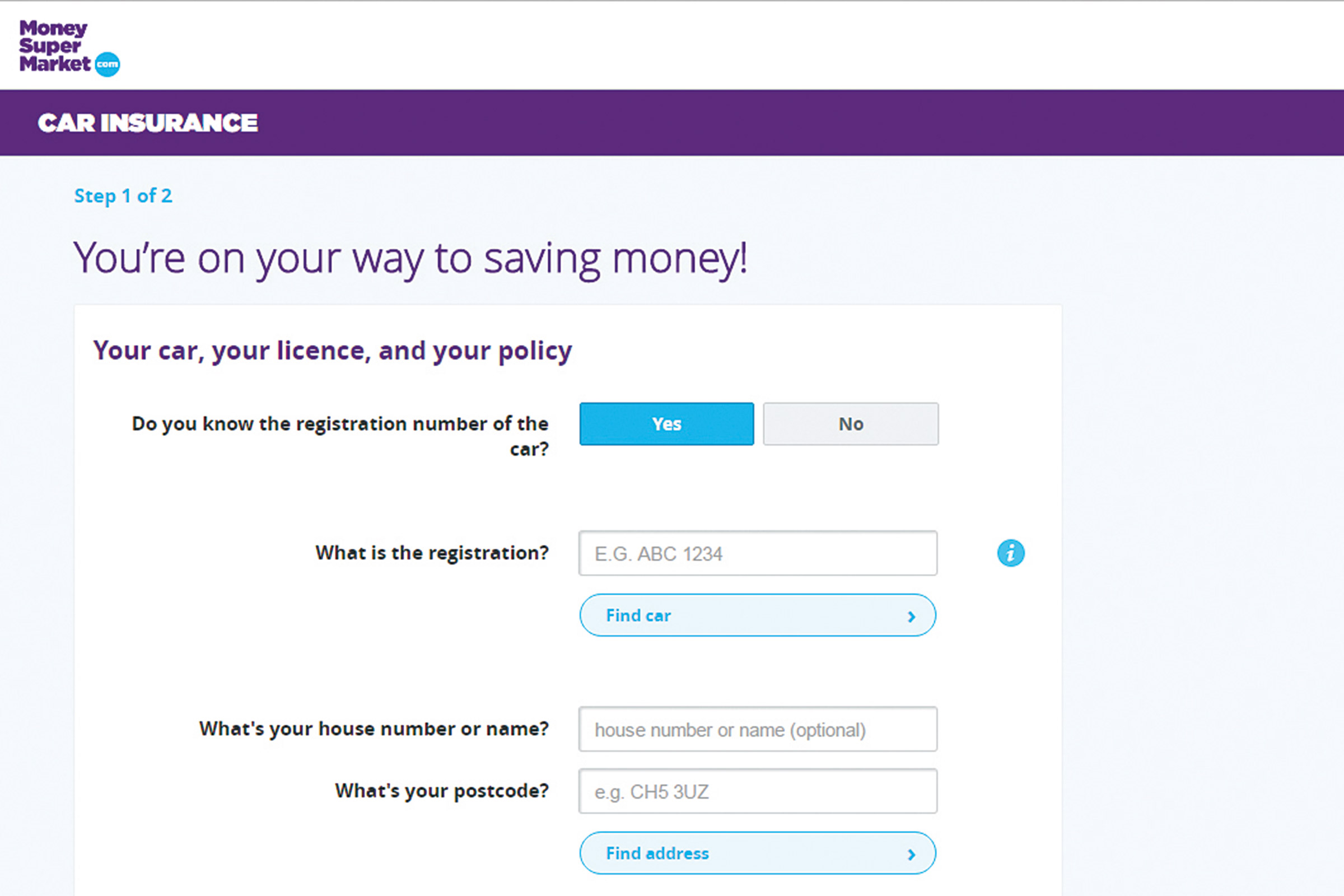

If you are interested in getting a quote from Legal and General Car Insurance, you can do so by visiting their website. You will need to enter some basic information about yourself and your car, such as your age, the make and model of your car, and your estimated annual mileage. You will also need to provide details of your current policy, if you have one. Once you have entered this information, you will be able to get a quote for your car insurance.

Conclusion

Legal and General Car Insurance is a well-established and trusted provider of car insurance services in the UK. It has been providing cover for motorists since 1836, and is part of the highly respected Legal and General Group. The company offers a range of policies, which are designed to meet the needs of different motorists. Most customers report that the claims process is straightforward and that the customer service is good. The company also offers a range of discounts for customers who choose to pay for their policy upfront. If you are looking for car insurance, Legal and General may be worth considering.

Moneysupermarket.com car insurance – consumer app of the week | Car

Compare Cheap Car Insurance Quotes | MoneySuperMarket in 2020 | Cheap

MoneySuperMarket | Auto Express

The General Car Insurance Reviews | Policy Advice

Moneysupermarket One Day Car Insurance / Temporary Insurance - Converge