Icici Bank Motor Insurance Online

Icici Bank Motor Insurance Online - Get the Best Insurance for your Vehicle

What is Icici Bank Motor Insurance?

Icici Bank Motor Insurance is an online insurance service provided by the Indian multinational banking and financial services company, Icici Bank. The bank offers a wide range of motor insurance plans to its customers. It provides protection against any financial loss that may occur due to accidental damage to the vehicle, theft, or fire. It also covers third-party liabilities, in case of an accident. Various types of motor insurance are available with different features and benefits.

What are the Benefits of Icici Bank Motor Insurance?

Icici Bank Motor Insurance offers various benefits to its customers. It provides coverage against any financial loss that may occur due to accidental damage to the vehicle, theft, or fire. It also covers third-party liabilities, in case of an accident. The bank also provides a cashless claim facility at more than 4500 network garages. Customers can avail discounts on premiums depending on the type of cover they choose. The bank also provides 24x7 customer support.

How to Buy Icici Bank Motor Insurance?

Icici Bank Motor Insurance can be purchased easily online. The customer can visit the bank's website and choose the appropriate plan. The customer has to fill in the required details and make the payment. The customer must ensure that all the details provided are correct. The bank will then issue the policy and the customer can start availing the benefits.

What are the Different Types of Icici Bank Motor Insurance?

Icici Bank Motor Insurance offers a wide range of plans to its customers. It provides comprehensive cover which includes protection against any financial loss that may occur due to accidental damage to the vehicle, theft, or fire. It also covers third-party liabilities, in case of an accident. The bank also offers add-on covers such as Roadside Assistance, Engine Protector, No Claim Bonus Protection, and more. The customer can choose the appropriate plan as per their needs and budget.

What are the Documents Required for Icici Bank Motor Insurance?

The documents required for Icici Bank Motor Insurance are minimal. The customer has to provide the copy of the Registration Certificate (RC) of the vehicle, copy of the vehicle’s Insurance Certificate, and address proof. The customer must also submit the duly filled application form. The bank may ask for additional documents if required.

Conclusion

Icici Bank Motor Insurance is an easy and convenient way to insure your vehicle. It provides coverage against any financial loss that may occur due to accidental damage to the vehicle, theft, or fire. The bank also offers add-on covers such as Roadside Assistance, Engine Protector, No Claim Bonus Protection, and more. And the documents required for availing the insurance policy are minimal. Thus, Icici Bank Motor Insurance is a great way to ensure the safety of your vehicle and your pocket.

How to Renew Policy ICICI Lombard Motor Insurance Online - YouTube

ICICI Lombard launches mobile self inspection feature for lapsed motor

ICICI Direct : Login, Download Holding Statement, Tax P&L Report and

ICICI Bank Online Banking Guide | Login - Sign up - YouTube

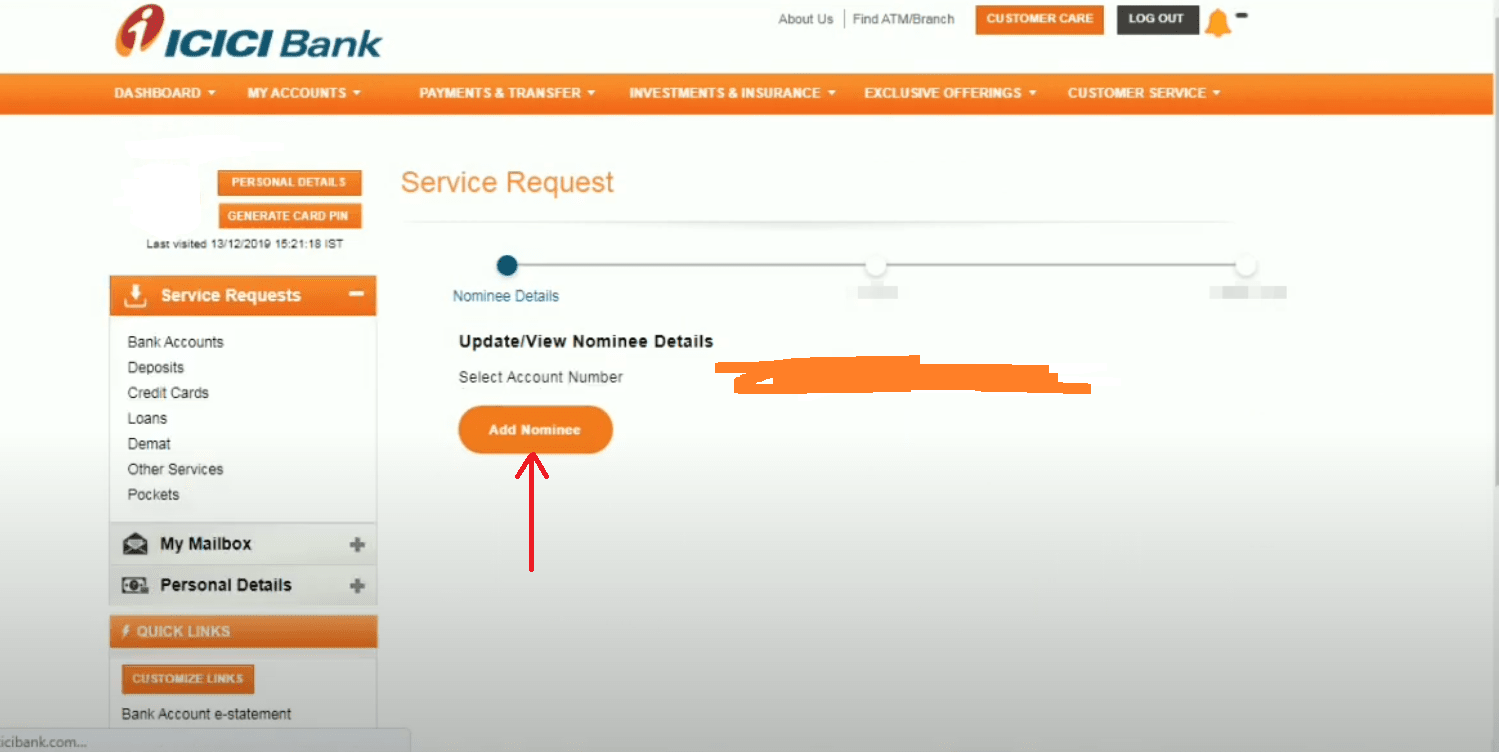

How To Add Nominee In ICICI Bank Online