How Much Is Private Long Term Care Insurance

How Much Is Private Long Term Care Insurance?

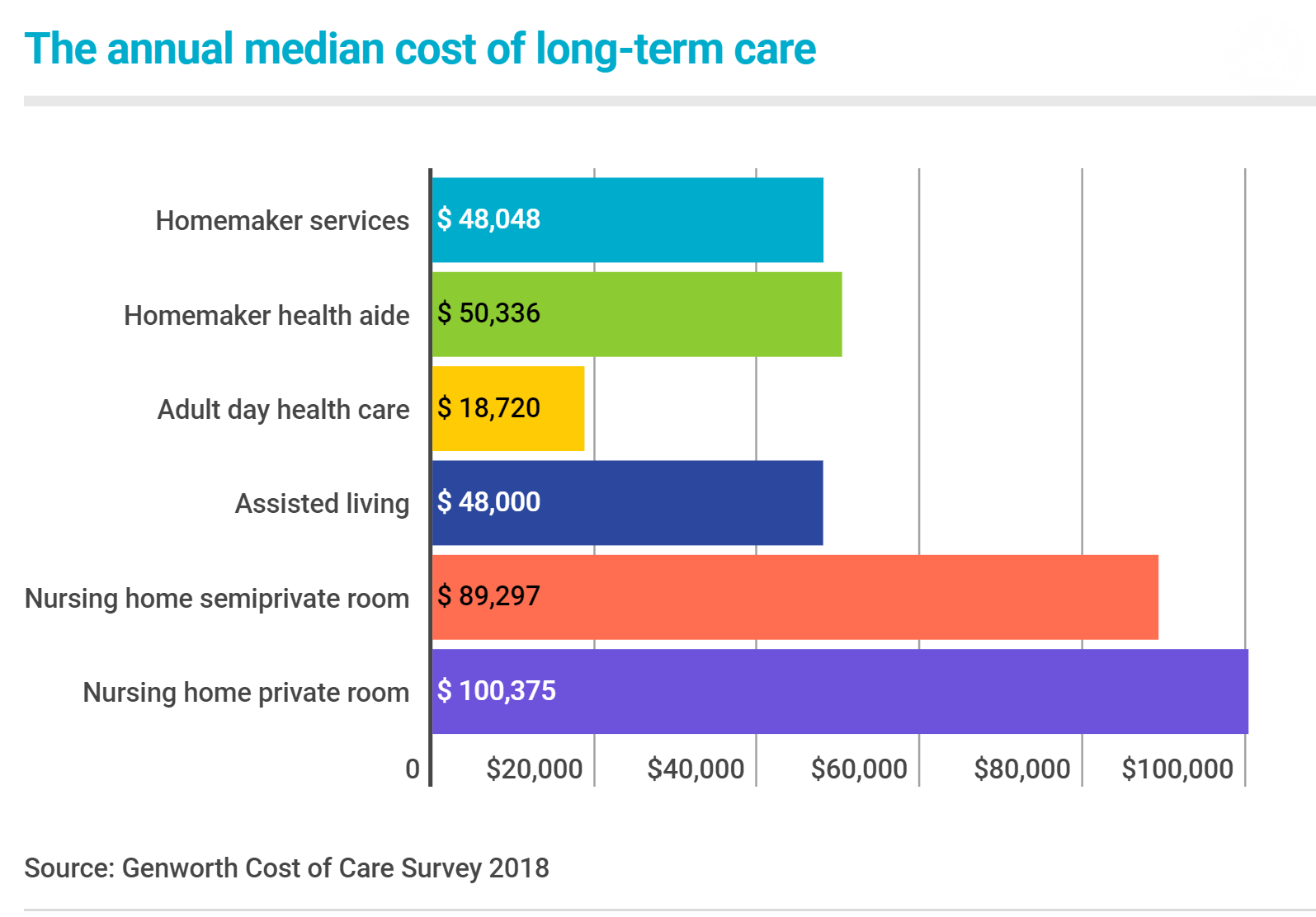

Long term care insurance is an important form of insurance that provides coverage for a person’s long-term care needs. The care needs can range from nursing home care to in-home care, depending on the policy and the particular needs of the individual. Long term care insurance is an important form of insurance because it can help individuals in their later years of life when they are no longer able to care for themselves. In many cases, long term care insurance pays for the costs associated with nursing home care, which can be expensive.

The cost of private long term care insurance depends on a variety of factors, such as the type of policy, the amount of coverage, the age and health of the individual, and the length of the policy. Private long term care insurance can be expensive, but it can also provide a financial safety net for individuals and their families in the event of a long-term care need. It is important to shop around and compare quotes from different insurance companies to find the best policy for you.

Types of Private Long Term Care Insurance

There are two main types of private long term care insurance: indemnity and managed care. Indemnity policies pay a set amount of money each month for a specified period of time. Managed care policies provide coverage for specific services, such as nursing home care, home health care, and hospice care.

Managed care policies typically have lower premiums, but they may not cover as much as an indemnity policy. Indemnity policies, on the other hand, provide more coverage, but they typically have higher premiums. It is important to consider both types of policies when shopping for long term care insurance.

Factors That Affect Premiums

The cost of private long term care insurance can vary significantly depending on several factors, including the type of policy, the amount of coverage, the age and health of the individual, and the length of the policy. A person’s age and health are two of the most important factors that insurers consider when calculating premiums. Generally, younger individuals and those in good health will pay lower premiums than older individuals and those in poorer health.

The amount of coverage is also an important factor in determining premiums. Generally, the more coverage an individual has, the higher the premium will be. Additionally, the length of the policy will also affect the cost of the premium. Policies that have a longer term, such as 10 or 15 years, will typically have higher premiums than shorter-term policies.

How to Find the Best Policy

When shopping for private long term care insurance, it is important to compare quotes from different insurance companies. Additionally, it is important to understand the types of coverage offered and the different factors that can affect premiums. Additionally, it is important to read the policy carefully and ask questions if anything is unclear.

It is also important to consider how long the policy will last and how much coverage it will provide. Private long term care insurance can be expensive, but it can also provide a financial safety net for individuals and their families in the event of a long-term care need. Shopping around and comparing quotes can help individuals find the best policy for their needs and budget.

Who Is Covered by Private Long-Term Care Insurance? | Urban Institute

Nursing Home Insurance Policy Cost - Insurance Reference

Long-Term Care Insurance Overview - ESI Money

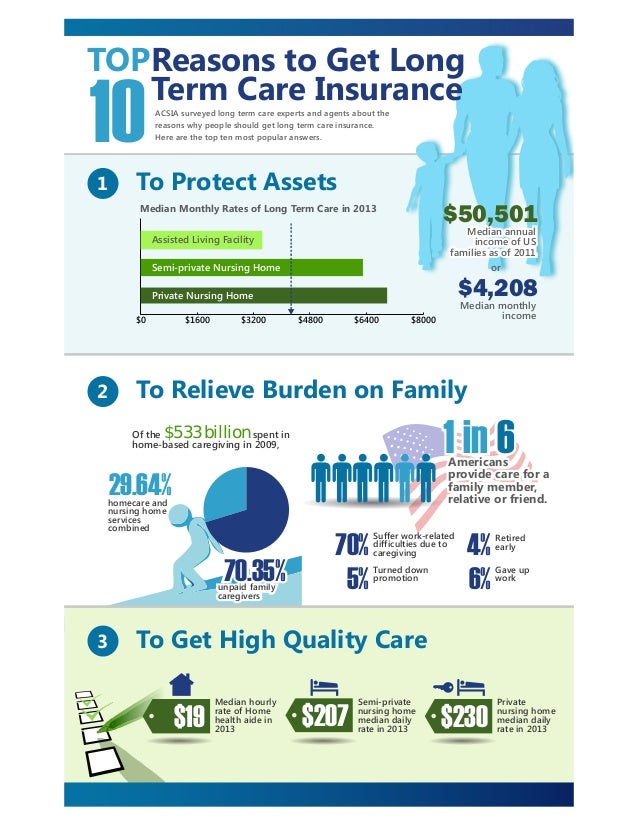

Top 10 Reasons to Get Long Term Care Insurance