Full Coverage Insurance For Car

What Is Full Coverage Insurance For Car?

Full coverage insurance for car is a type of auto insurance policy that covers the cost of damages and losses caused by a car accident. It provides protection against physical damage to your car, as well as liability protection in case you are held responsible for someone else's injury or property damage. It also covers medical expenses related to an accident, as well as any legal fees you may incur as a result of the accident.

What Does Full Coverage Insurance for Car Include?

Full coverage insurance for car typically includes: collision coverage to repair or replace your vehicle when it is damaged in an accident; comprehensive coverage to repair or replace your vehicle when it is damaged by a covered event other than a collision; liability coverage for damages or injuries to another person or property caused by you or another driver listed on the policy; and uninsured/underinsured motorist protection which provides coverage for your damages or injuries if an uninsured or underinsured motorist is responsible for the accident.

Why Do You Need Full Coverage Insurance For Car?

Full coverage insurance for car is important because it provides protection and financial security in the event of an accident. Without it, you could be held responsible for the cost of repairs or medical expenses, or even a lawsuit if someone else is injured in an accident caused by you. It also provides coverage if your car is stolen or damaged by a covered event other than a collision, such as a fire or vandalism.

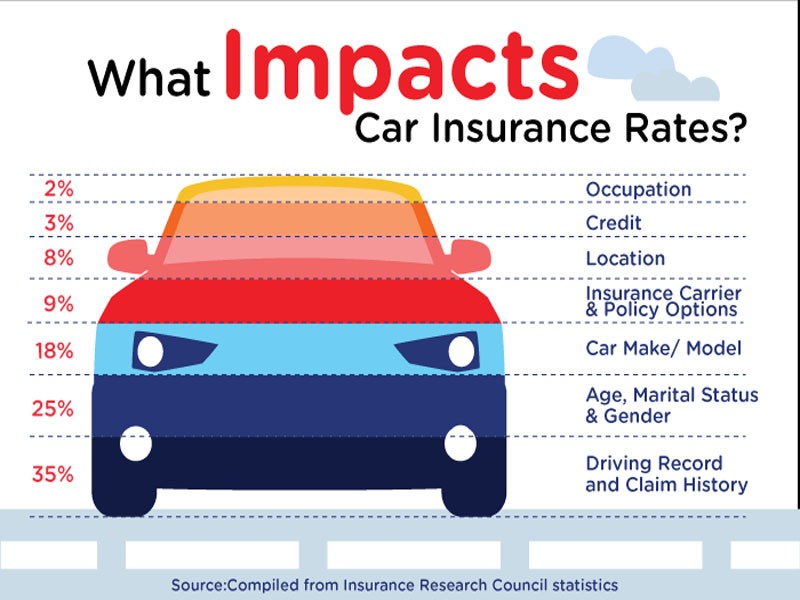

How Much Does Full Coverage Insurance for Car Cost?

The cost of full coverage insurance for car can vary depending on your insurer, the type and amount of coverage you purchase, and the age, make and model of your car. Generally speaking, the more coverage you choose, the more expensive your policy will be. However, it's important to remember that the cost of the policy is much less than the potential cost of an accident or theft with no coverage.

How To Get Full Coverage Insurance For Car?

Getting full coverage insurance for car is easy. The first step is to shop around and compare different insurance policies to find the one that offers the coverage you need at the best rate. Then, you'll need to provide your insurer with information about your car, including the make, model and year, as well as any additional drivers listed on the policy. Finally, you'll need to pay your premium and any applicable deductible in order to start your coverage.

Conclusion

Full coverage insurance for car is an important type of auto insurance that provides protection against physical damage to your car, as well as liability protection in case you are held responsible for someone else's injury or property damage. It is important to shop around and compare different policies to find the one that offers the coverage you need at the best rate. Getting full coverage insurance for car is easy and provides peace of mind and financial security in the event of an accident.

Full coverage car insurance in california by Promax Insurance Agency

What is Full coverage car insurance? It is a term which describes

What is Full Coverage Car Insurance? - eTrustedAdvisor

Cheap Full Coverage Car Insurance

What Is Full Coverage Auto Insurance | ALLCHOICE Insurance