Florida No Fault Insurance State

Florida No Fault Insurance: What You Need to Know

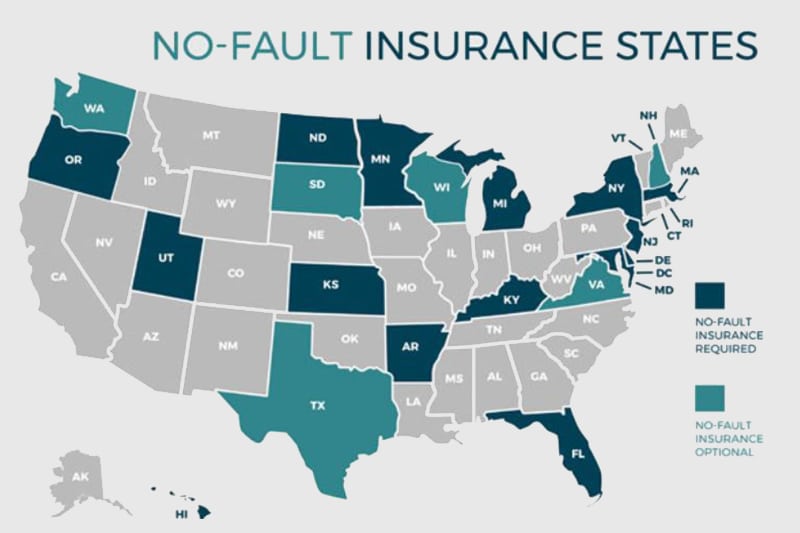

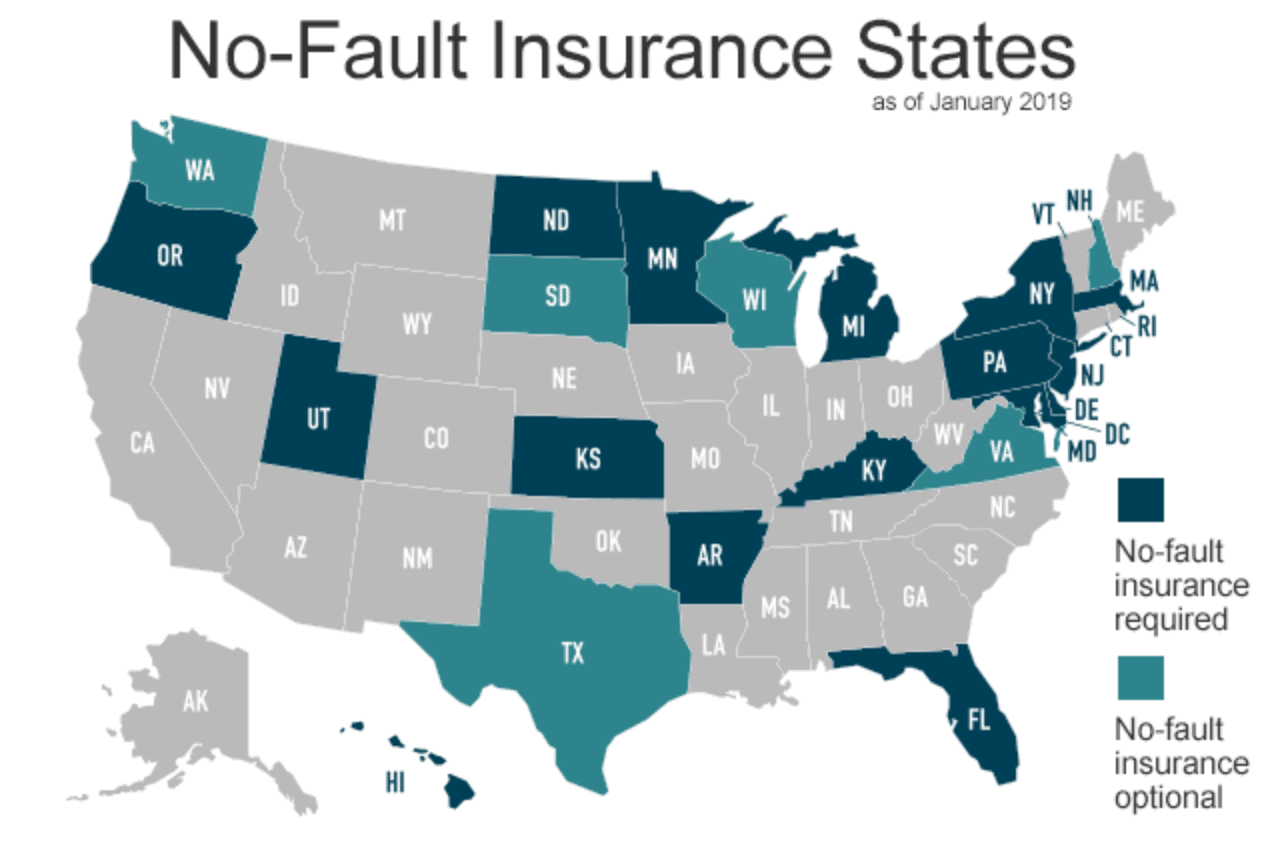

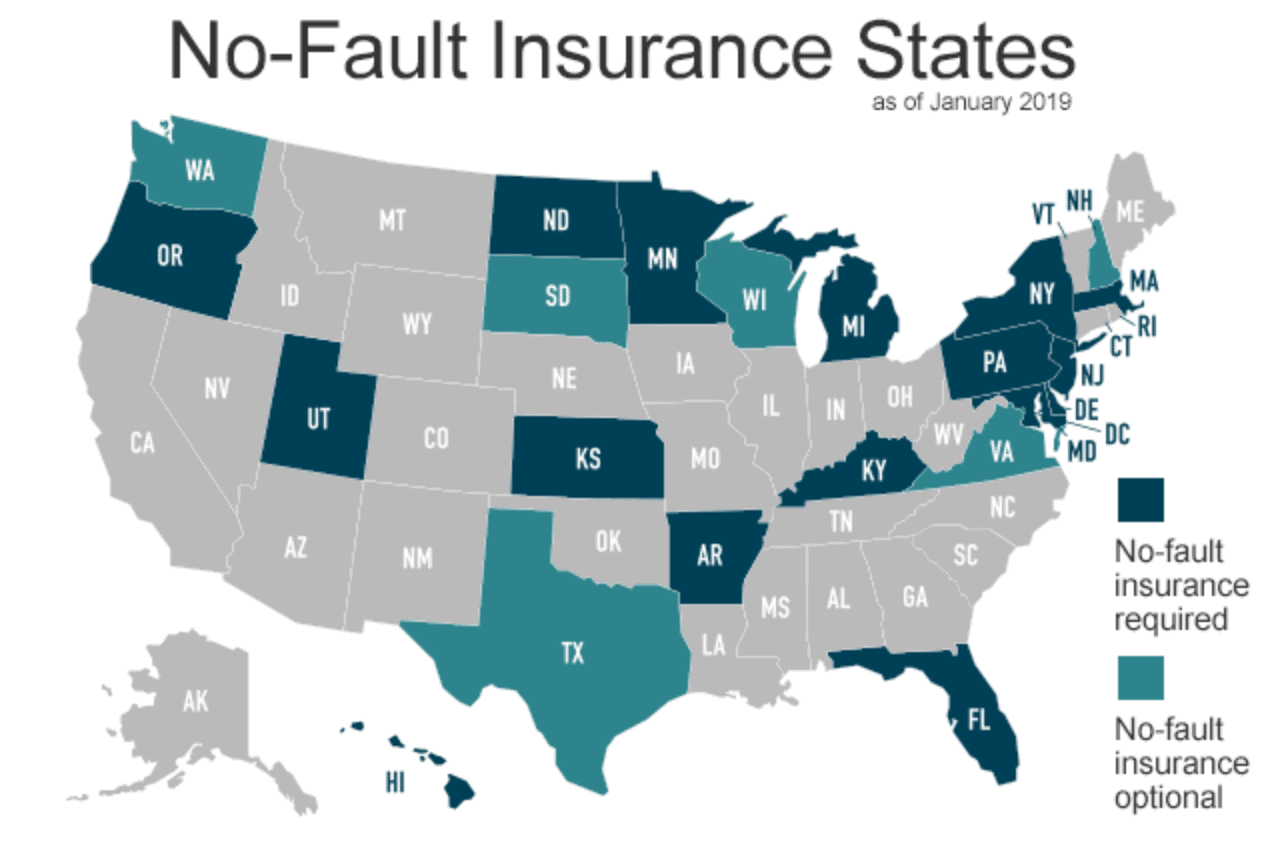

If you live in the state of Florida and you own a car, then you are likely familiar with the Florida No Fault Insurance State requirements. This type of coverage, also known as “personal injury protection,” is required by law in the state of Florida, and it is designed to help pay for the medical bills and related expenses of the victims in an automobile accident, regardless of who is responsible for the accident.

What Does Florida No Fault Insurance Cover?

Florida No Fault Insurance covers both medical and disability expenses, within certain limits. It can also cover lost wages and funeral expenses, depending on the type of policy that you have. This type of coverage is designed to pay for the expenses associated with an accident, regardless of who is responsible. This means that, regardless of who caused the accident, Florida No Fault Insurance will provide coverage for the victims who have been injured.

Who Needs Florida No Fault Insurance?

Anyone who owns and operates a car in the state of Florida is required to have Florida No Fault Insurance. This includes both individuals and businesses. Even if you do not use your car for business purposes, you still must have the required coverage. This is because Florida No Fault Insurance protects both the driver and passengers in the event of an accident, regardless of who is responsible.

How Much Does Florida No Fault Insurance Cost?

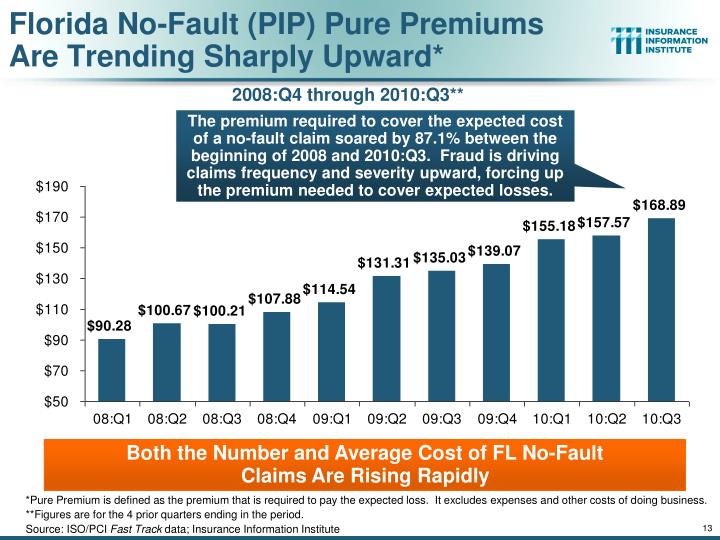

The cost of Florida No Fault Insurance can vary depending on a variety of factors, such as the type and amount of coverage you choose, the age and driving record of the driver, and the type of vehicle that is being insured. Generally, the cost of this type of coverage is fairly low. Many insurance companies offer discounts for those who have a good driving record and a clean driving history.

What Happens If I Don't Have Florida No Fault Insurance?

If you do not have the required Florida No Fault Insurance, then you may face serious consequences. Depending on the severity of the violation, you could be subject to fines, suspension of your driver's license, or even jail time. In addition, if you are found to be at fault in an accident, you may be held responsible for paying any damages resulting from the accident, including medical bills and related expenses.

Do You Need Help Understanding Florida No Fault Insurance?

If you have questions about Florida No Fault Insurance, then it is important to speak to a qualified insurance professional. They can help you understand the requirements of the law and provide you with the information you need to make an informed decision about your coverage. Additionally, they can help you compare the different types of coverage available and make sure that you are getting the best possible deal.

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

Florida No-Fault Auto Insurance Under Annual Review | Terrell • Hogan

What No Fault Car Insurance Is?

PPT - No-Fault Auto Insurance Fraud in Florida Trends, Challenges

Did Your Car Accident Happen in a No-Fault State? - Dailey Law Firm