Does Personal Car Insurance Cover Business Use

Does Personal Car Insurance Cover Business Use?

If you use your car for business purposes, you may be considering whether or not your personal car insurance will cover you. Unfortunately, the answer isn’t as straightforward as you might think. It depends largely on your individual circumstances, and the details of your policy.

What’s Covered by Personal Car Insurance?

When it comes to personal car insurance, there are a few different types of coverage. Liability insurance covers you if you’re at fault for a car accident. It will also cover any property damage or injury you cause. Comprehensive insurance covers damage to your car from incidents like theft, vandalism, fire, or weather. Collision insurance covers damage to your car when it collides with another vehicle or object. Personal Injury Protection covers medical expenses for you, any passengers in your car, and pedestrians in the event of an accident. Finally, Uninsured/Underinsured Motorist coverage will cover you if you’re in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damage.

Personal Car Insurance for Business Use

Generally speaking, personal car insurance doesn’t cover business use of your car. This means that if you use your car for business purposes, such as delivering packages or driving for a ride-sharing service, you won’t be covered if you get into an accident. Additionally, if you use your car to carry passengers for a fee, your personal car insurance won’t cover you.

However, it’s important to note that some insurers may offer coverage for limited business use. To be sure, you should contact your insurer and ask if your policy covers business use.

What About Hired or Non-Owned Auto Coverage?

Hired or Non-Owned Auto Coverage is an insurance policy that covers you if you use someone else’s car for business purposes. This type of coverage is typically offered as an add-on to your personal car insurance policy. It’s important to note, however, that this coverage typically only applies if you use someone else’s car, not your own.

Business Car Insurance

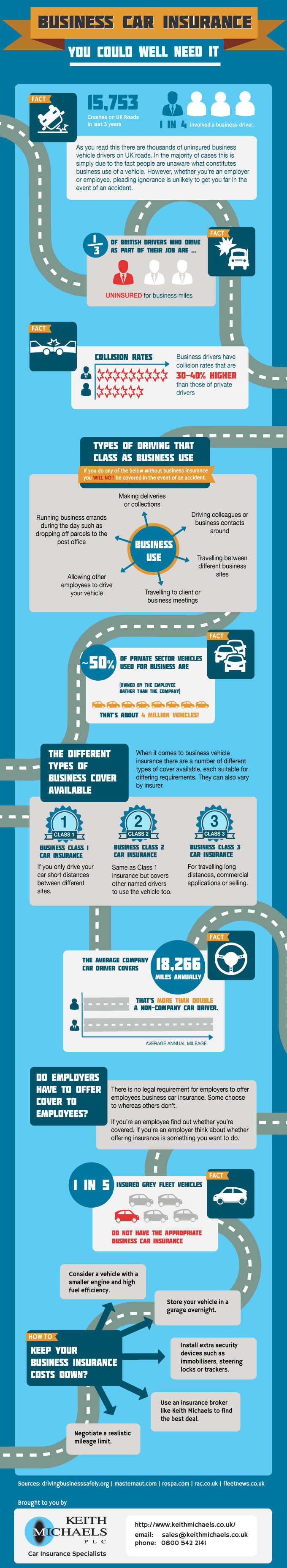

If you use your car for business purposes, it’s important to make sure you have the right insurance. Business car insurance is specifically designed to cover business use of your car. It typically covers liability, property damage, and medical expenses. Additionally, some policies may cover any tools or equipment stored in the car.

When it comes to business car insurance, it’s important to make sure you have the right coverage. It’s also important to make sure that you’re getting the best rate. You should shop around and compare quotes from different insurers to make sure you’re getting the best deal.

Commercial or Personal Car Insurance: Which is Best for Your Business Use?

Car insurance infographic | 20 Miles North Web Design

What is Business Car Insurance? | Business Insurance | Keith Michaels

Does Insurance Cover Business Use of a Personal Vehicle?

🚘🚘 Does My Personal Car Insurance Cover Me For Business Use?