Difference Between Standard And Non Standard Auto Insurance

What Is The Difference Between Standard And Non Standard Auto Insurance?

Auto insurance is a must for anyone who owns or drives a car. It can help you financially when you have an accident or other damage to your vehicle. But not everyone needs the same type of auto insurance. Depending on your circumstances, you may need either standard or nonstandard auto insurance.

Standard Auto Insurance

Standard auto insurance is the most common type of car insurance and is what most people choose. It covers the basic risks associated with owning and driving a car, such as property damage and medical bills. Standard auto insurance typically includes liability coverage, which pays for any damage you cause to another person or their property. It also covers you in the event of an accident, including medical costs and damage to your vehicle.

Nonstandard Auto Insurance

Nonstandard auto insurance is for people who do not qualify for standard auto insurance. This can include drivers with DUIs, past accidents or other risk factors. Nonstandard auto insurance provides more coverage than standard auto insurance, but with higher premiums. It may also include additional features such as towing and rental car coverage. Nonstandard auto insurance may also cover additional risks such as uninsured or underinsured motorist coverage.

Differences Between Standard And Non Standard Auto Insurance

The biggest difference between standard and nonstandard auto insurance is the cost. Nonstandard auto insurance is generally more expensive than standard auto insurance due to the higher level of coverage and additional features. Standard auto insurance is typically cheaper, but may not provide the same level of coverage as nonstandard auto insurance. Another difference is the types of drivers that can qualify for each type of insurance. Standard auto insurance is generally available to everyone, while nonstandard auto insurance is usually only available to drivers who have poor driving records or other risk factors.

Which Is Right For You?

The type of auto insurance you need depends on your individual circumstances. If you have a good driving record and don’t have any risk factors, standard auto insurance may be your best option. However, if you have a poor driving record or other risk factors, then nonstandard auto insurance may be the right choice for you. It’s important to compare both types of auto insurance to make sure you’re getting the best coverage for your needs.

What Is The Difference Between Standard and Non-Standard Auto Insurance

Non-standard Car Insurance | Car Insurance Guidebook

The Difference Between ‘Standard’ and ‘Nonstandard’ Car Insurance

Auto Insurance Agency in Roseville CA | Sky Insurance Brokers

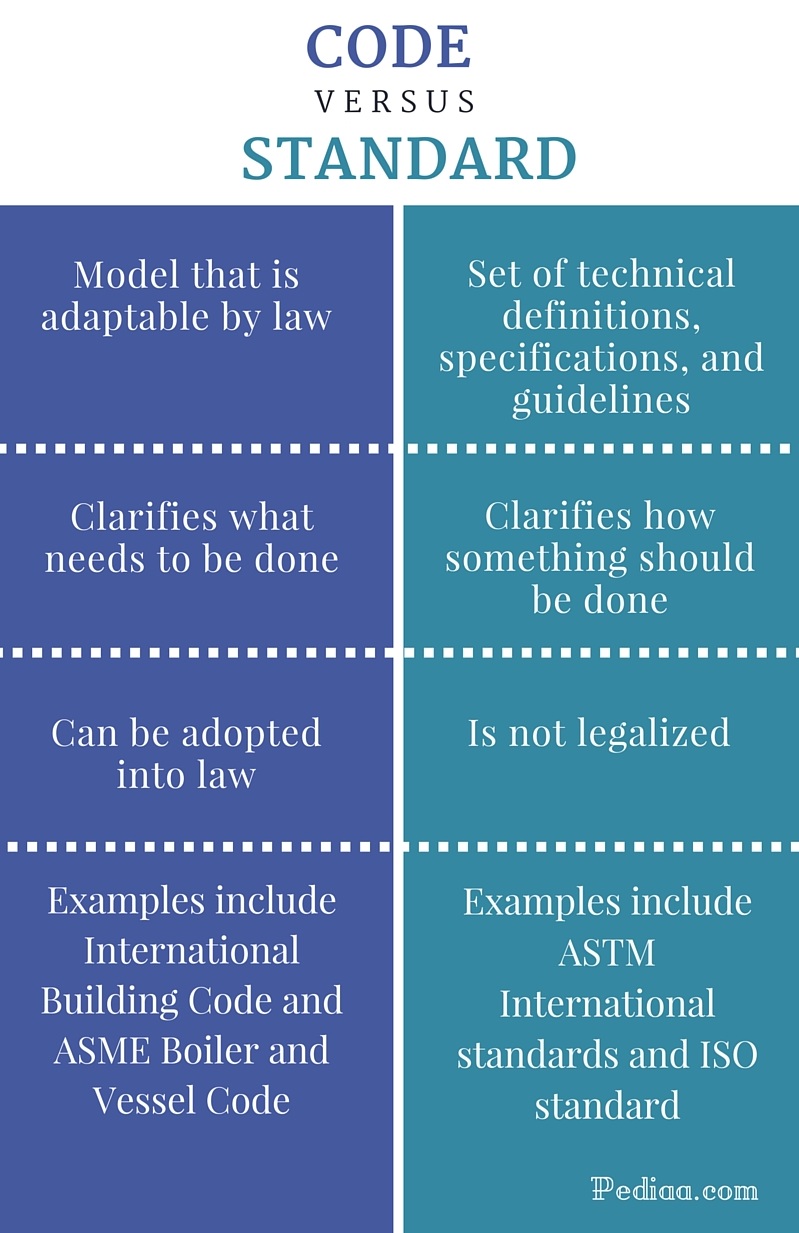

Difference Between Code and Standard