Cancel General Accident Car Insurance

Cancelling General Accident Car Insurance

Reasons to Cancel Your Car Insurance

There are plenty of reasons why you may want to cancel your car insurance policy. Perhaps you’ve sold your vehicle or are switching providers to get a better rate. Perhaps you’ve moved to a new city and no longer need coverage in your old location. Or maybe you’ve decided to take a break from driving altogether and need to cancel your policy. Whatever your reason, cancelling your car insurance is a simple process that can be done in a few steps.

When cancelling your General Accident car insurance policy, it’s important to be aware of the potential consequences. Depending on your policy, you may be required to pay early cancellation fees or may be subject to a penalty if you cancel before the end of your policy period. It’s important to read over your policy documents to ensure you’re aware of all the potential charges you may incur when cancelling your policy.

Process to Cancel Your Car Insurance

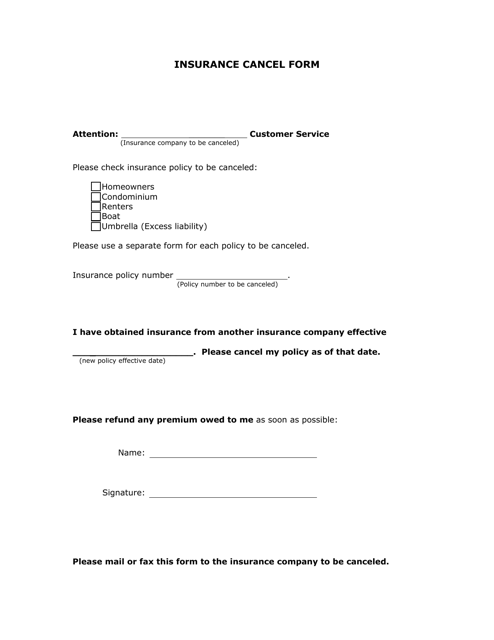

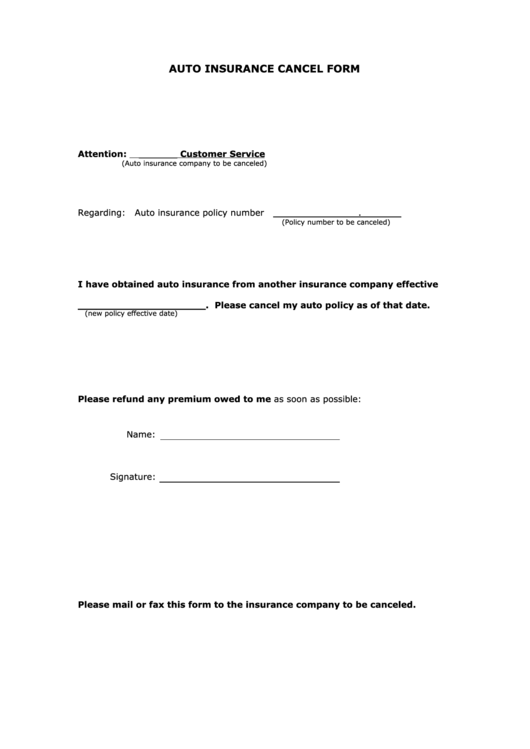

Cancelling your General Accident car insurance policy is a straightforward process that can be done in a few steps. First, call your insurance provider to inform them of your intention to cancel your policy. You will need to provide them with the details of your policy, such as the policy number and the date you’d like the cancellation to take effect. They will then send you a cancellation letter or form to sign and return. Once you’ve completed the necessary paperwork, you’ll be refunded for any unused months on your policy.

What to Do After Cancelling Your Car Insurance

Once you’ve cancelled your General Accident car insurance policy, it’s important to take a few additional steps to ensure you’re fully covered in case of an accident. First, you’ll need to inform the DVLA that you no longer have insurance coverage. This can be done by sending them a V5C form. You’ll also need to inform your car lender, if you have one, that your policy has been cancelled.

Do You Need Another Policy?

Depending on your situation, you may need to take out a new car insurance policy after cancelling your General Accident policy. If you’re planning on getting a new car, for example, you’ll need to take out a new policy before you can begin driving. It’s important to shop around for the best deal for your needs as different providers offer different premiums and coverage options.

What to Do if You’re Unhappy with Your Policy

If you’re unhappy with your General Accident car insurance policy, you may be able to make a complaint. You can do this by contacting your insurance provider directly and explaining your concerns. They may be able to offer you a better deal or provide some advice on how to get the most out of your policy. If you’re still unsatisfied, you can also contact the Financial Ombudsman Service who can provide impartial advice and guidance.

Conclusion

Cancelling your General Accident car insurance policy is a simple process that can be done in a few steps. However, it’s important to be aware of the potential consequences and fees associated with cancellation. After cancelling your policy, you may need to take out a new policy if you plan on driving again. If you’re unhappy with your policy, you may be able to make a complaint or get a better deal.

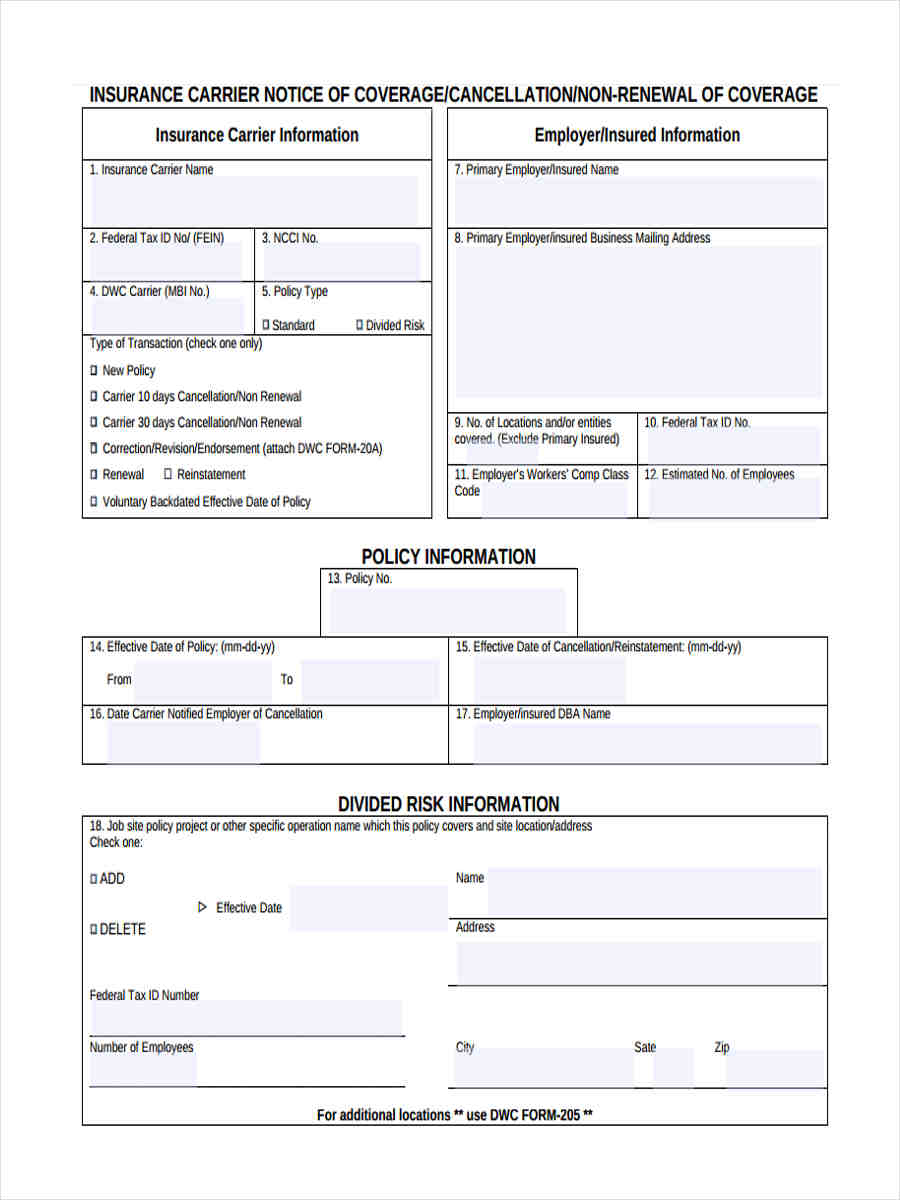

FREE 8+ Sample Notice of Cancellation Forms in MS Word | PDF

Top 5 Insurance Cancellation Form Templates free to download in PDF format

Car Insurance Cancelled After Accident / General Accident Car Insurance

How to Cancel Car Insurance - A Guide - Car.co.uk

Insurance Cancel Form Download Fillable PDF | Templateroller