Bodily Injury And Property Damage Liability Insurance

What is Bodily Injury and Property Damage Liability Insurance?

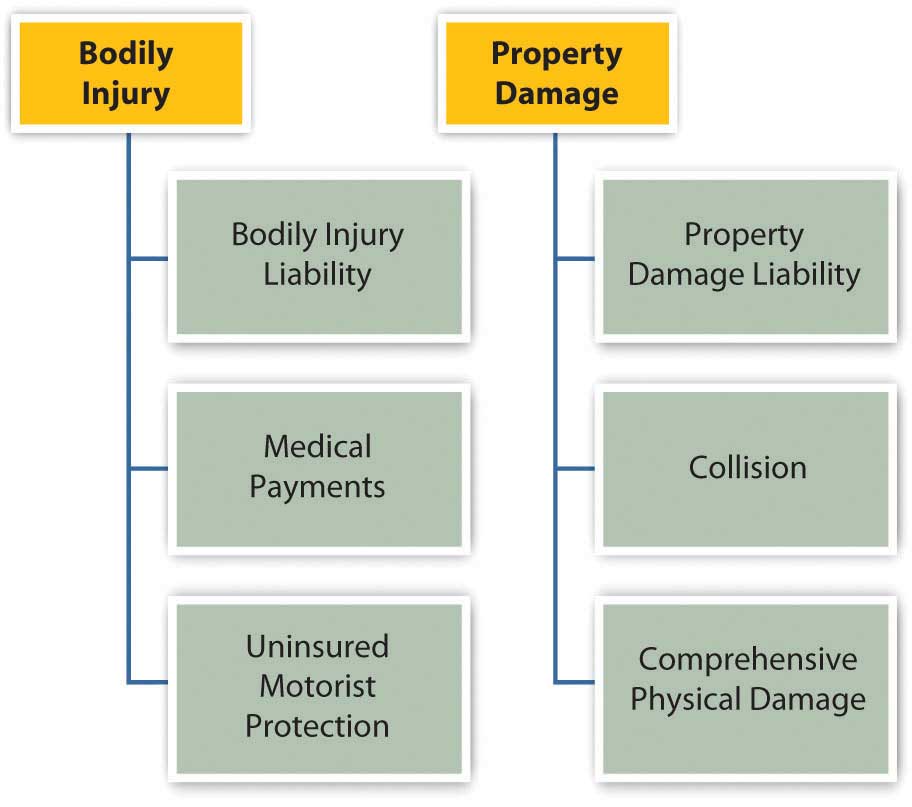

Bodily Injury and Property Damage Liability Insurance (BIPD) is a type of insurance that covers companies and individuals from certain liabilities. It is a type of third-party liability insurance that is designed to protect the insured from losses due to bodily injury or property damage caused by their negligence or the negligence of their employees. The main purpose of BIPD is to provide financial protection in the event that someone is injured or their property is damaged as a result of the insured's actions.

BIPD policies typically cover legal expenses, medical bills, and court costs associated with a lawsuit. The policy will also pay for any damages that may be awarded by a court if the insured is found to be at fault. The amount of coverage is usually based on the policy limits, which are determined by the insurance company. BIPD can provide coverage for a wide range of activities, such as business operations, recreational activities, and property damage.

What Does Bodily Injury and Property Damage Liability Insurance Cover?

BIPD policies typically cover a wide range of liabilities, including legal costs, medical bills, and court costs associated with a lawsuit. The policy will also pay for any damages that may be awarded by a court if the insured is found to be at fault. BIPD generally covers bodily injury and property damage caused by an accident or negligence of the insured, their employees, or their products.

The amount of coverage is usually based on the policy limits, which are determined by the insurance company. For example, if the limit is $500,000, the insurance company will pay up to $500,000 in damages to the injured individual or their property. BIPD can provide coverage for a wide range of activities, such as business operations, recreational activities, and property damage.

What Types of Situations Does Bodily Injury and Property Damage Liability Insurance Cover?

BIPD can provide coverage for a wide range of situations, including accidents caused by negligence and accidents resulting from the use of products or services. For example, if an individual is injured in a car accident due to the negligence of another driver, BIPD can cover the medical expenses and any legal costs associated with the accident. BIPD can also provide coverage for property damage resulting from a business or recreational activity.

In addition, BIPD can provide coverage for any liability claims that may arise from the use of products or services. For example, if a business sells a defective product that causes injury or property damage, the BIPD policy will pay for any damages awarded by a court.

Are There Any Exclusions to Bodily Injury and Property Damage Liability Insurance?

BIPD policies typically exclude intentional acts, fraud, and certain types of losses, such as damage to the insured's own property. BIPD may also exclude certain types of activities or risks, such as the use of explosives, hazardous materials, and nuclear energy. It is important to read the policy carefully and understand any exclusions that may be included.

Do I Need Bodily Injury and Property Damage Liability Insurance?

BIPD is an important type of insurance for businesses and individuals who want to protect themselves from financial losses due to bodily injury or property damage caused by their negligence or the negligence of their employees. Depending on the type of business or activity you are involved in, it may be necessary to purchase BIPD in order to protect yourself from potential liabilities.

It is important to understand the coverage limits of your policy and the exclusions that may be included. It is also important to review the policy periodically to ensure that it still meets your needs. If you have any questions, it is best to speak with an insurance professional who can help you understand the coverage and make sure that you are adequately protected.

Bodily Injury Liability [What does it Cover?] | Ogletree Financial

![Bodily Injury And Property Damage Liability Insurance Bodily Injury Liability [What does it Cover?] | Ogletree Financial](https://insurancequotes2day.com/wp-content/uploads/2019/09/liability-limits-by-state.jpg)

Personal Risk Management: Insurance

Bodily Injury Liability Insurance: What You Need To Know

Bodily Injury & Property Damage Liability - RAELST

Bodily Injury & Property Damage Liability - RAELST