What Makes A Car A Sports Car For Insurance

What Makes A Car A Sports Car For Insurance?

Sports Car Insurance and its Advantages

Insuring a car is a must if you’re a car driver. It helps protect you financially in the event of an accident and can provide you with peace of mind. If you have a sports car, you may have noticed that insurance costs can be higher than a regular family car. This is because there are certain aspects of sports cars that make them riskier and more expensive to insure.

What Is Considered A Sports Car?

Sports cars are typically defined as cars that have powerful engines, enhanced performance, and are built for speed and agility. They are typically two-door cars with a sleek and stylish design. Sports cars can come in different shapes and sizes, but they will typically have higher horsepower than a regular car and can reach high speeds quickly. Some popular sports cars include the Porsche 911, Chevrolet Corvette, and the Mazda Miata.

Why Are Sports Cars More Expensive To Insure?

Sports cars are considered to be more of a risk to insure because they are built for speed and can easily get into an accident. This can mean higher costs for insurance companies, as they may have to pay out more money in the event of an accident. Sports cars also have higher repair costs, as they may have more complex parts that are more expensive to replace. Furthermore, sports cars are more likely to be stolen, as they are attractive to thieves.

Factors That Affect Sports Car Insurance Costs

When it comes to insuring a sports car, there are certain factors that can influence the cost of the insurance. These include the type of car, the age of the driver, driving history, and the location where the car is kept. Type of car: Different models of sports cars can be seen as more of a risk to insure. For example, a Porsche 911 may be seen as riskier than a Mazda Miata. Age of the driver: Younger drivers are typically seen as higher risk and may have to pay higher insurance premiums. Driving history: If you have a clean driving record, you may be able to get a lower insurance premium. Location: The place where you park your car overnight can affect your insurance premiums, as some areas are seen as riskier than others.

Tips To Lower Your Sports Car Insurance Costs

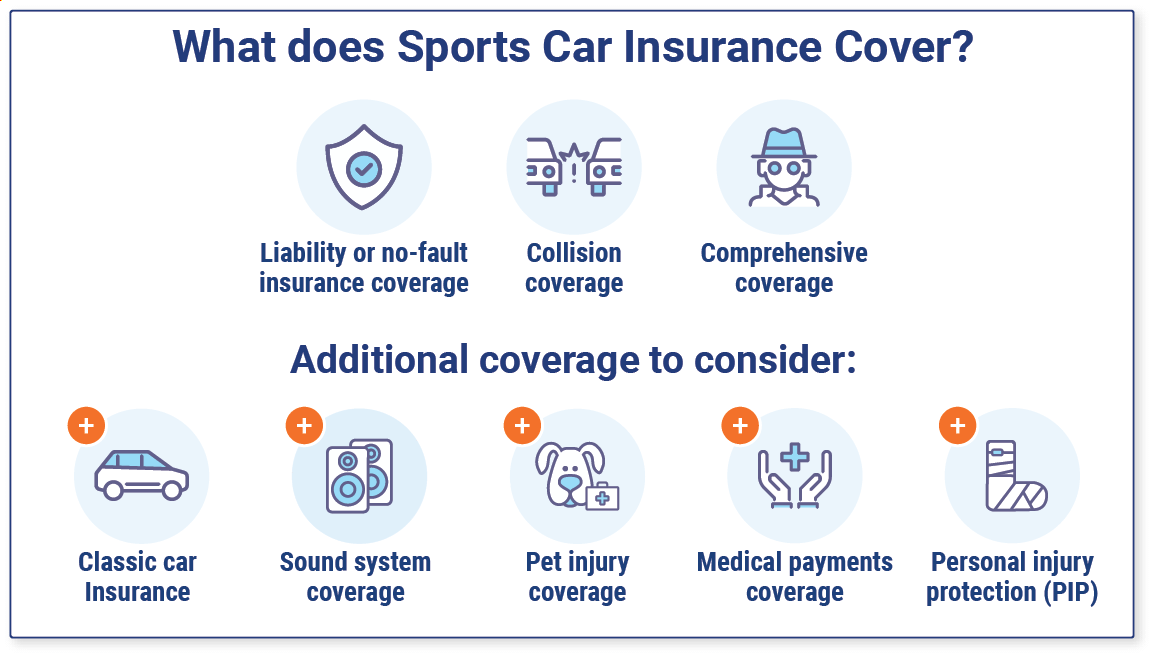

There are certain things you can do to help lower your sports car insurance costs. You can choose to pay a higher deductible, which will lower your premiums. You can also look for discounts such as a safe driver discount or a multi-car discount. Additionally, you can consider dropping certain coverage options that you may not need, such as collision or comprehensive coverage. Finally, you can shop around and compare quotes from different insurance companies to find the best deal for your needs.

Conclusion

Sports cars can be expensive to insure, but there are certain things you can do to help lower your premiums. Make sure you are aware of the factors that can affect your insurance costs and look for discounts or coverage options that you may not need. Shopping around and comparing quotes from different insurance companies is also a great way to find the best deal.

Sports Cars Insurance | American Insurance

Find the Best Sports Car Insurance for You | Trusted Choice

The Most Costly Car Insurance is For Sports Cars MILTA Technology

The Best Insurance Quotes for Sports Cars - Car.co.uk

Car Insurance Requirements for California Vehicle Owners