What Is Car Gap Insurance

What Is Car Gap Insurance?

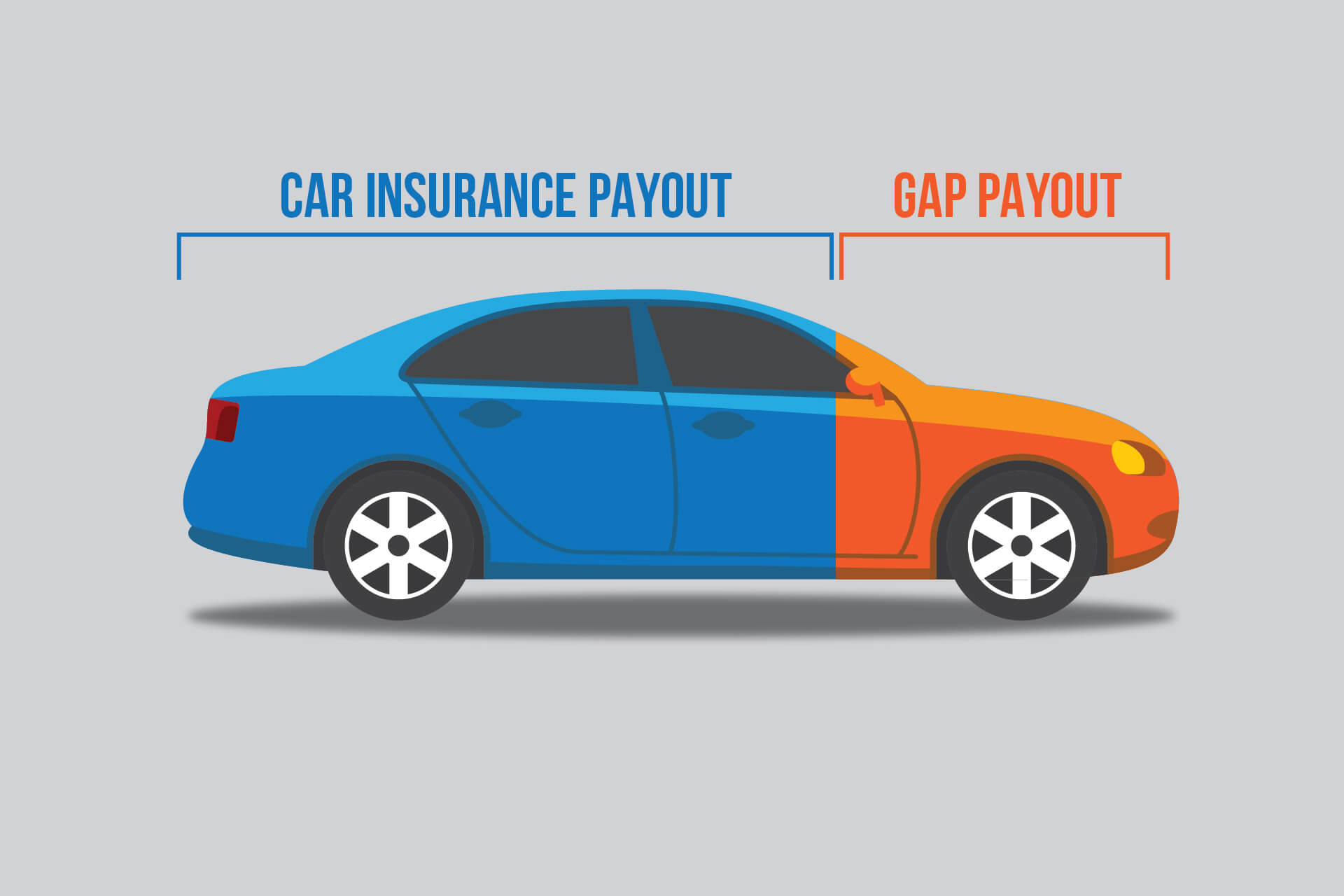

You’ve just purchased a brand new car, and you want to make sure that you’re covered in the event of an accident. You’ve heard about car gap insurance, but you’re not sure what it is or how it works. Car gap insurance, also known as gap coverage, is an optional form of auto insurance that covers the difference between the amount you owe on a financed car and the amount an insurance company will pay you in the event of a total loss.

What Does Car Gap Insurance Cover?

Gap insurance covers the difference between the actual cash value (ACV) of your car and the amount still owed on the car loan. The ACV is the amount an insurance company pays you for a total loss. It is based on the make and model of your car, its age, and its condition. The amount owed on the car loan may be higher than the ACV, and that’s where gap coverage comes in. It pays the difference between the two amounts.

When Is Car Gap Insurance Necessary?

Gap coverage is necessary when you finance a car purchase and you make a down payment of less than 20 percent of the car’s value. This is because when you finance a car purchase, you pay for taxes, fees, and other costs in addition to the car’s actual cost. This can add up to hundreds or even thousands of dollars. If you have an accident and total the car, your insurance company will only pay the ACV, which is usually less than the amount you still owe on your loan.

How Much Does Car Gap Insurance Cost?

The cost of gap coverage depends on the make and model of your car and the amount you still owe on the loan. Generally, the cost of gap coverage is between $20 and $30 per year. Some lenders and dealers may include gap coverage in your loan agreement, or you can purchase it from your insurance company. It’s important to compare the cost of gap coverage from different sources before you make a decision.

What Are the Benefits of Car Gap Insurance?

The main benefit of gap coverage is that it can save you from having to pay thousands of dollars out of pocket if your car is totaled in an accident. If you don’t have gap coverage, you could be stuck with a loan balance that is higher than the amount of money you receive from your insurance company. Gap coverage can also help you avoid a negative impact on your credit score if you can’t make loan payments due to a total loss.

Conclusion

Gap insurance is an important form of auto insurance that covers the difference between the amount you owe on a financed car and the amount an insurance company will pay you in the event of a total loss. It is necessary when you finance a car purchase and you make a down payment of less than 20 percent of the car’s value. The cost of gap coverage depends on the make and model of your car and the amount you still owe on the loan. The main benefit of gap coverage is that it can save you from having to pay thousands of dollars out of pocket if your car is totaled in an accident.

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Buying A Car Gap Insurance ~ designologer

Page for individual images • Quoteinspector.com

Used Car Gap Insurance: A Complete Check-List On How It Work