What Does Long term Care Insurance Not Cover

Monday, December 26, 2022

Edit

What Does Long Term Care Insurance Not Cover?

What is Long Term Care Insurance?

Long term care insurance (LTCI) is a type of insurance that helps cover the costs of long-term care, including assisted living and nursing home care. It is designed to provide financial security, as well as peace of mind, to those who need to care for an aging, chronically ill, or disabled family member. LTCI is not the same as health insurance, which typically covers medical expenses and hospital stays.

What LTCI Does Not Cover

Although LTCI can provide important financial protection for those who need long-term care, it does not cover all types of care. There are some services and expenses that LTCI does not cover, including:

1. Non-Medical Expenses

LTCI does not cover non-medical expenses such as transportation, meals, clothing, and personal care items. These expenses must be paid out-of-pocket. Additionally, LTCI does not cover home modifications, such as wheelchair ramps or wider doorways. These costs must also be paid out-of-pocket.

2. Care at Home

LTCI does not typically cover care at home, such as home health aides or companions. These services must be paid out-of-pocket. In some cases, however, long term care insurance may provide coverage for a short-term stay in a nursing home or assisted living facility.

3. Private Nursing Care

LTCI does not cover private nursing care, such as registered nurses who provide specialized care in the home. These services must be paid out-of-pocket. In some cases, however, long term care insurance may provide coverage for a short-term stay in a nursing home or assisted living facility.

4. Assisted Living Facilities

LTCI does not typically cover the cost of assisted living facilities, such as those that provide help with activities of daily living (ADLs) and personal care services. These services must be paid out-of-pocket. In some cases, however, long term care insurance may provide coverage for a short-term stay in a nursing home or assisted living facility.

5. Long-Term Hospital Stays

LTCI typically does not cover long-term hospital stays. These expenses must be paid out-of-pocket. In some cases, however, long term care insurance may provide coverage for a short-term stay in a nursing home or assisted living facility.

6. End of Life Care

LTCI does not typically cover end of life care, such as hospice care. These expenses must be paid out-of-pocket. In some cases, however, long term care insurance may provide coverage for a short-term stay in a nursing home or assisted living facility.

Conclusion

Long term care insurance can provide important financial security for those who need long-term care. However, it is important to understand that LTCI does not cover all types of care, including non-medical expenses, care at home, private nursing care, assisted living facilities, long-term hospital stays, and end of life care. These expenses must be paid out-of-pocket.

What Does Long Term Health Care Insurance Cover : What is long-term

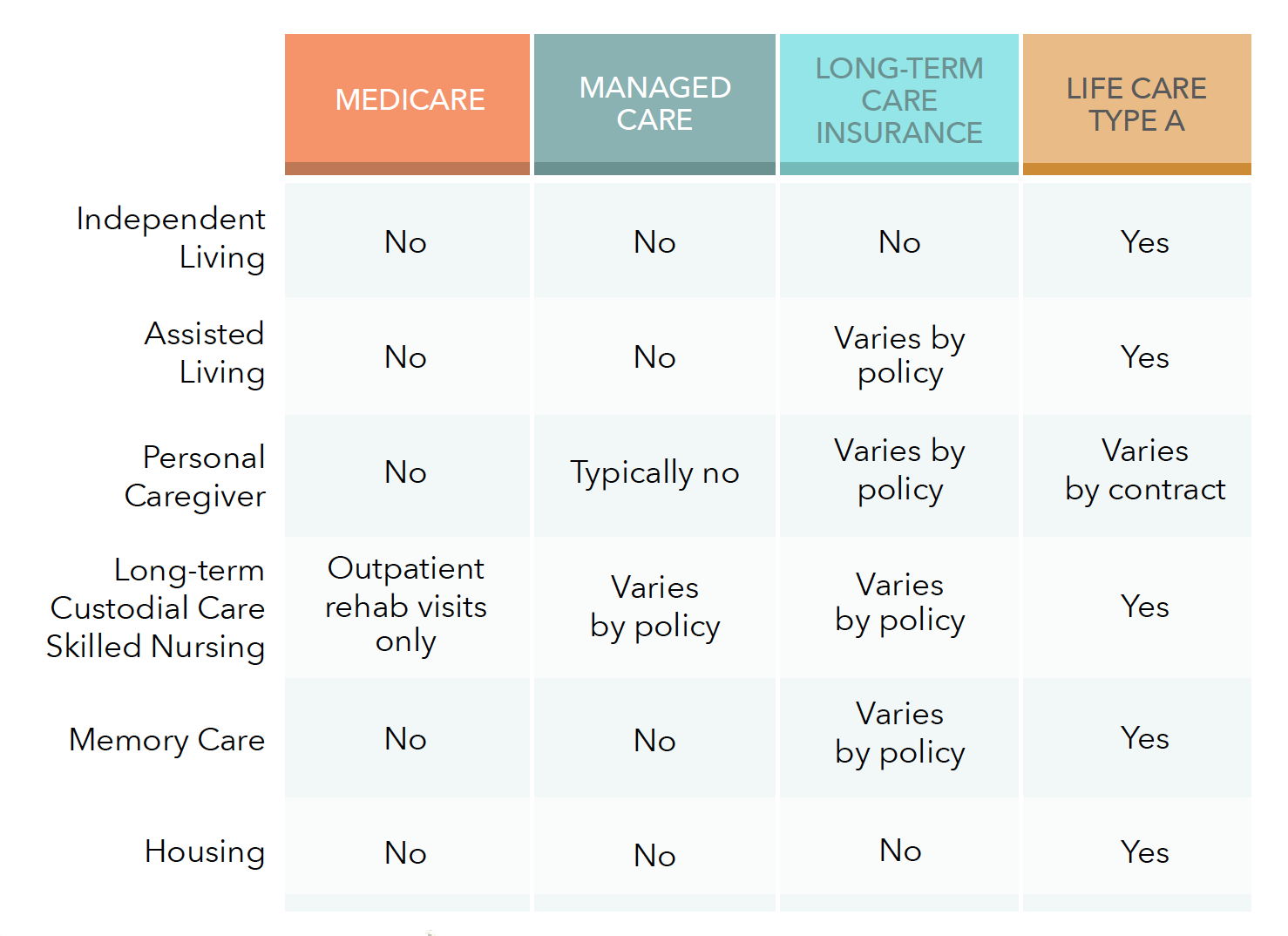

Life Care Coverage versus Health Insurance and Medicare

What Does Long-Term Care Insurance Cover? And Not Cover? - Andy

Does Long-Term Care Insurance Cover Assisted Living In Long Beach

What is Long-Term Care Insurance? Here's What You Need To Know