What Does Car Gap Insurance Cover

Saturday, December 3, 2022

Edit

What Does Car Gap Insurance Cover?

What Is Gap Insurance?

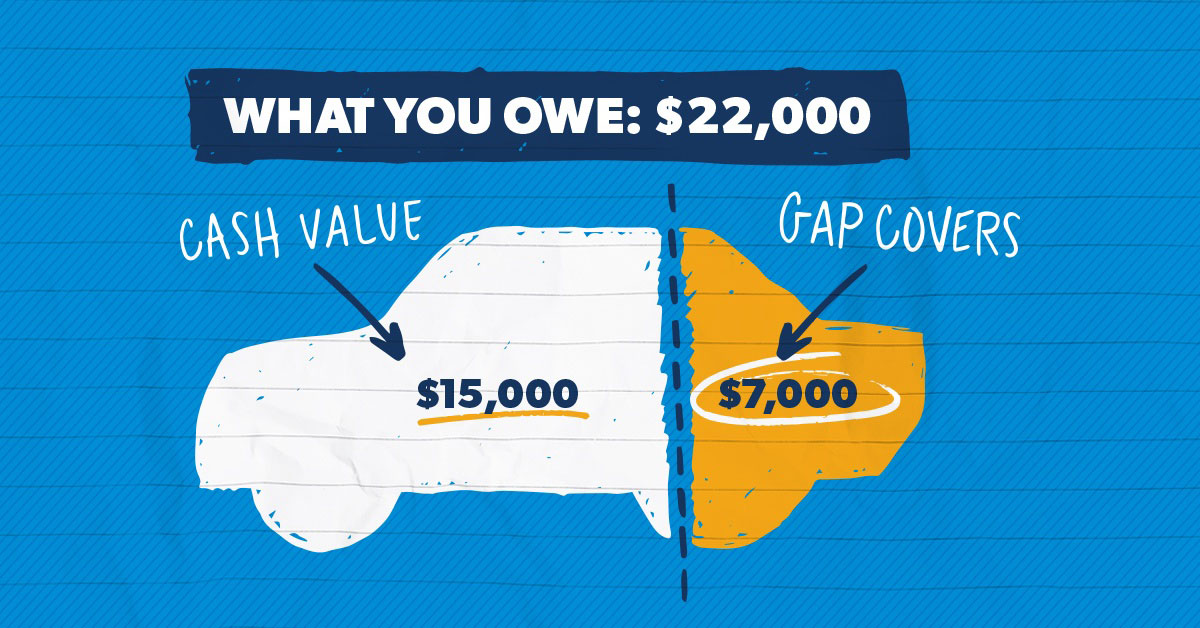

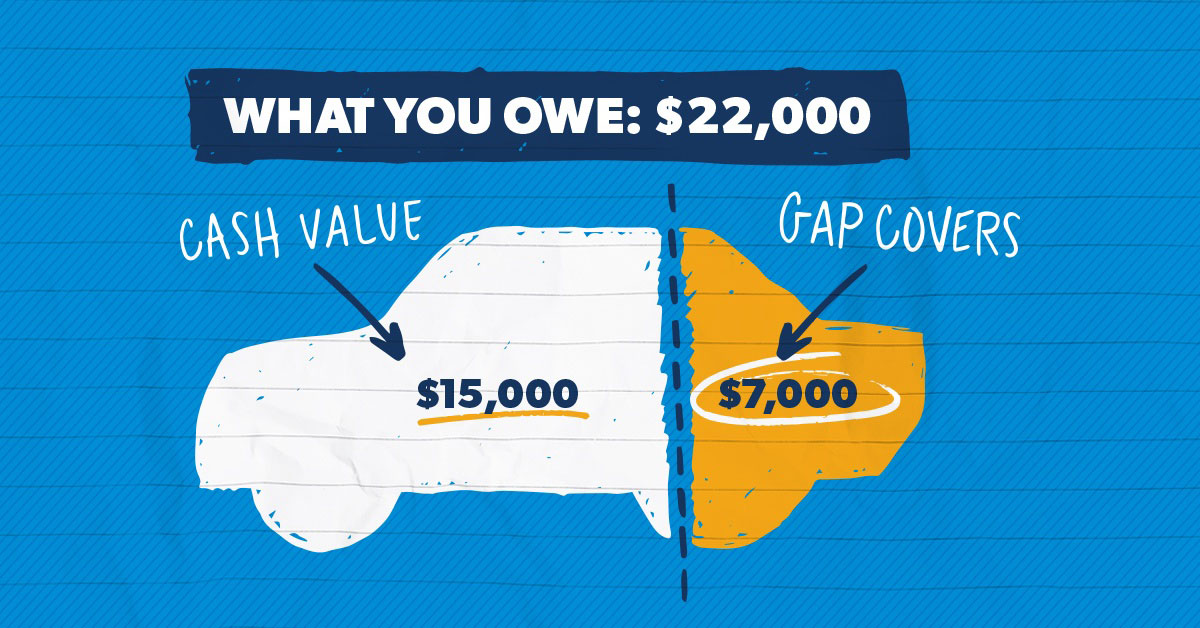

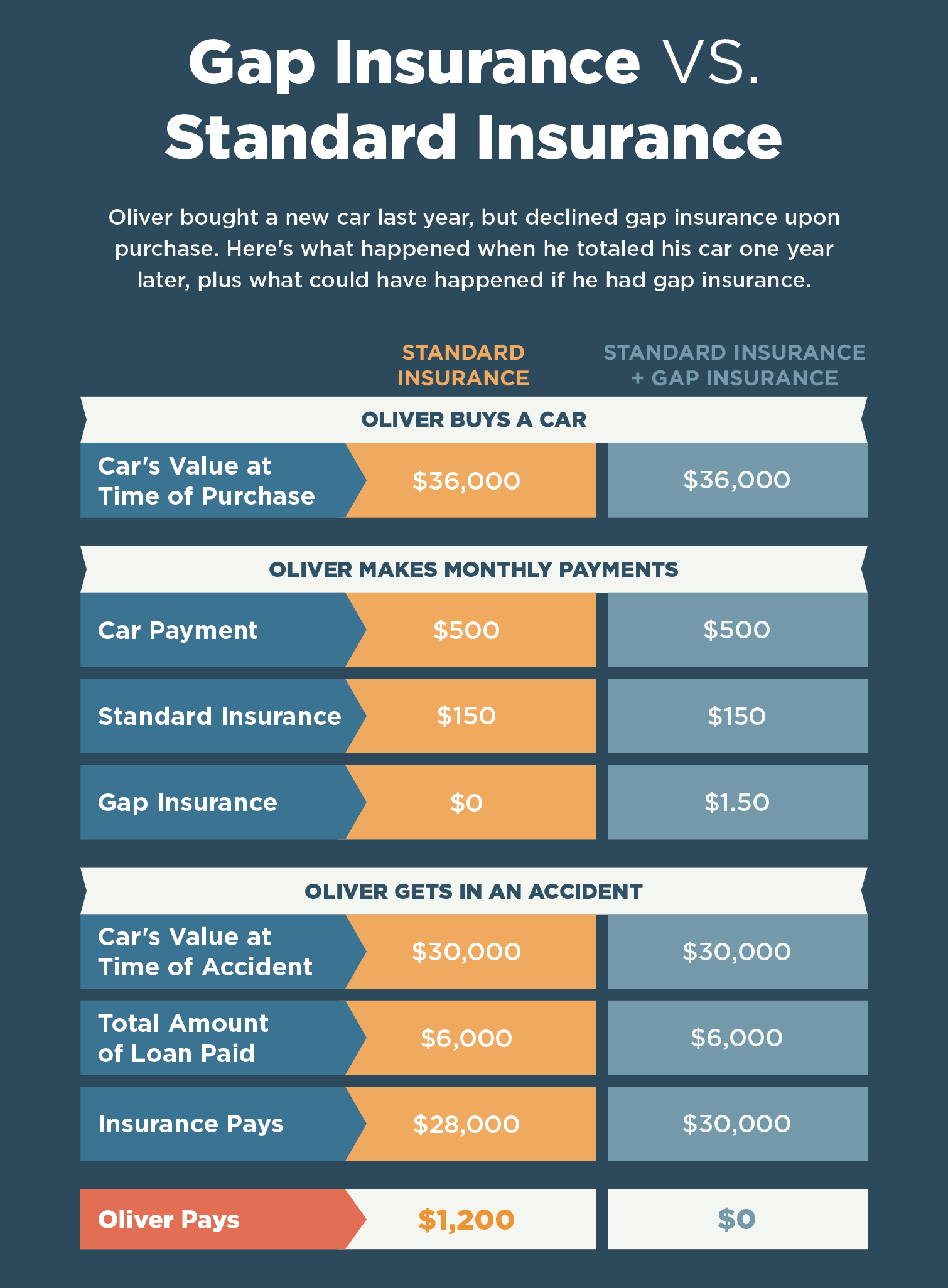

Gap insurance, also known as guaranteed auto protection, is a type of insurance policy that covers the difference between the amount you owe on your car loan and the actual value of your car. This coverage is often recommended for people who have recently purchased a car. If your car is totaled in an accident, gap insurance pays the difference between the actual cash value of your car and the balance of your loan. Without this coverage, you would be responsible for the balance of the loan, even if the car is totaled.

Do I Need Gap Insurance?

Whether or not you need gap insurance depends on the value of your car, the type of loan you have, and the amount you owe on the loan. If you owe more than the actual cash value of your car, it's a good idea to consider gap insurance. It could save you from having to pay out of pocket if your car is totaled in an accident. On the other hand, if you owe less than the actual cash value of your car, you may not need gap insurance.

How Does Gap Insurance Work?

Gap insurance typically kicks in after your regular car insurance pays out. For example, if you have a collision or comprehensive coverage policy and your car is totaled, your regular insurance will pay out the actual cash value of your car. If the actual cash value is less than the balance of your loan, gap insurance will cover the difference. Keep in mind that gap insurance does not cover any additional expenses, such as towing or rental car fees.

How Much Does Gap Insurance Cost?

The cost of gap insurance varies depending on the type of policy you purchase, the amount of coverage you need, and the insurer you purchase the policy from. Generally, gap insurance policies range from $20 to $50 per year, with higher coverage limits costing more. Many insurers also offer an option to add gap insurance to your existing auto insurance policy for an additional cost.

Do I Need Gap Insurance If I Have Lease?

If you're leasing a car, gap insurance is typically included in the lease agreement. However, it's important to check the terms of your lease to make sure this coverage is included. If it's not, you may want to consider adding gap insurance to your policy in order to protect yourself from having to pay out of pocket if your car is totaled in an accident.

Conclusion

Gap insurance is an important type of coverage for anyone who has recently purchased a car or is leasing a car. It covers the difference between the actual cash value of your car and the balance of your loan. While it's not required by law, it can help protect you from having to pay out of pocket if your car is totaled in an accident. The cost of gap insurance varies depending on the amount of coverage you need, so be sure to shop around and compare rates before purchasing a policy.

How Does Gap Insurance Work? | RamseySolutions.com

Gap Insurance Protects During Hard Times | Wichita Toyota Financing Options

Buying A Car Gap Insurance ~ designologer

What Is Gap Insurance? - Lexington Law

Do you need gap insurance for your car? How does it work?