State Farm Multi Car Policy

Monday, December 26, 2022

Edit

State Farm Multi Car Policy: A Comprehensive Guide

Drivers who own multiple cars, or who have cars registered to the same household, may be interested in a multi car policy from State Farm. But what is multi car insurance and is it worth it? Let’s take a closer look at the ins and outs of State Farm’s multi car insurance.

What Is Multi Car Insurance?

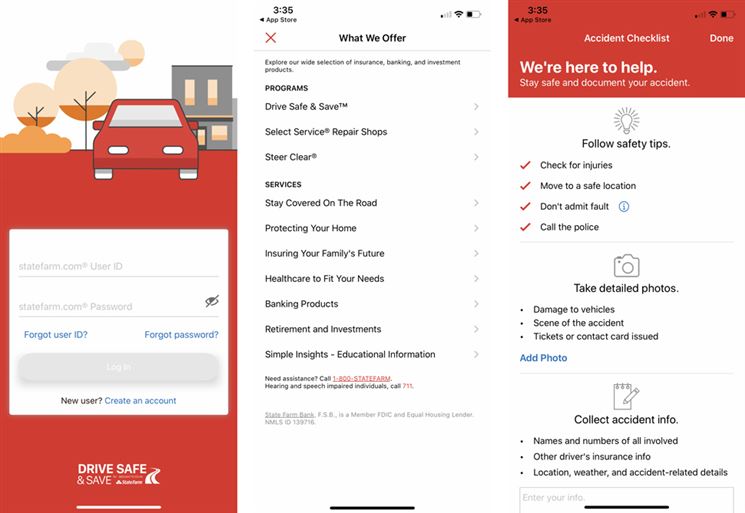

Multi car insurance is a policy that covers more than one car under the same policy. It is ideal for households with multiple cars, family members who share cars, or for people who own separate cars for business and pleasure. By having multiple cars covered under the same policy, you may be able to enjoy a variety of discounts and benefits, as well as simplified administration. State Farm’s multi car insurance policies allow you to add or remove cars as needed, so you can always have the right coverage for your needs.

What Does State Farm Multi Car Insurance Cover?

State Farm multi car insurance covers the standard types of car insurance coverage, including liability, collision, comprehensive, and medical payments. The coverage options you get with State Farm’s multi car insurance are the same as those you would get with a single car policy. However, you may be able to get additional discounts and benefits, such as discounts for having multiple vehicles or multiple drivers covered.

What Are the Benefits of Multi Car Insurance?

Multi car policies can offer a variety of benefits, such as discounts for having multiple vehicles or drivers covered, as well as the convenience of having all your cars covered under the same policy. By consolidating all your car insurance policies, you can save time and money by not having to keep track of multiple policies. Additionally, State Farm’s multi car insurance policies may offer additional discounts if you are an existing customer and have other policies with the company.

What Are the Drawbacks of Multi Car Insurance?

Multi car policies may not be the best option for everyone. If you only own one car, or if you only need to insure a single car, then you might be better off with a single car policy. Additionally, if you have multiple drivers in the same household, you may find that a multi car policy is more expensive than individual policies for each driver.

Is State Farm Multi Car Insurance Right for You?

State Farm’s multi car insurance policies can be a great option for households with multiple cars, family members who share cars, or people who own separate cars for business and pleasure. By consolidating all your car insurance policies, you can enjoy the convenience of having all your cars covered under the same policy, as well as the potential to save money on premiums. However, if you only own one car or only need to insure a single car, then a single car policy may be a better option.

If you’re considering a multi car policy from State Farm, the best way to find out if it’s right for you is to speak to an insurance agent. An experienced insurance agent can help you compare the coverage and costs of a multi car policy with those of individual policies and can help you determine which option is best for your needs.

State farm auto insurance policy pdf - insurance

Is State Farm Auto Insurance Right For You? We Did The Research

Best Car Insurance for College Students 2020

How Does State Farm Rideshare Insurance Work?