Limits Of Liability Auto Insurance

What is Limits of Liability Auto Insurance?

Limits of Liability Auto Insurance is a type of insurance coverage that pays for damages and losses incurred as a result of an automobile accident. This type of insurance is not mandatory in all states, but it is important to understand what it covers and its limits. Limits of Liability Auto Insurance covers damages to a vehicle, including repair costs and medical expenses, as well as losses sustained due to a vehicle being stolen or damaged in an accident. It also covers the costs of legal defense in the event of a lawsuit resulting from an accident.

What Does Limits of Liability Auto Insurance Cover?

Limits of Liability Auto Insurance covers losses and damages to a vehicle and its passengers, as well as those of other drivers and passengers who are involved in the accident. It covers medical expenses, such as hospital bills and ambulance services, as well as the cost of repairing or replacing a damaged vehicle. It also covers legal fees and court costs if a lawsuit is filed against the policyholder as a result of an accident.

Limits of Liability Auto Insurance also covers expenses related to the theft of a vehicle, including the cost of replacing the stolen vehicle. It also covers the cost of towing and storage of a vehicle if it is damaged in an accident. Additionally, it covers the cost of a rental car if the policyholder's vehicle is damaged and unable to be driven.

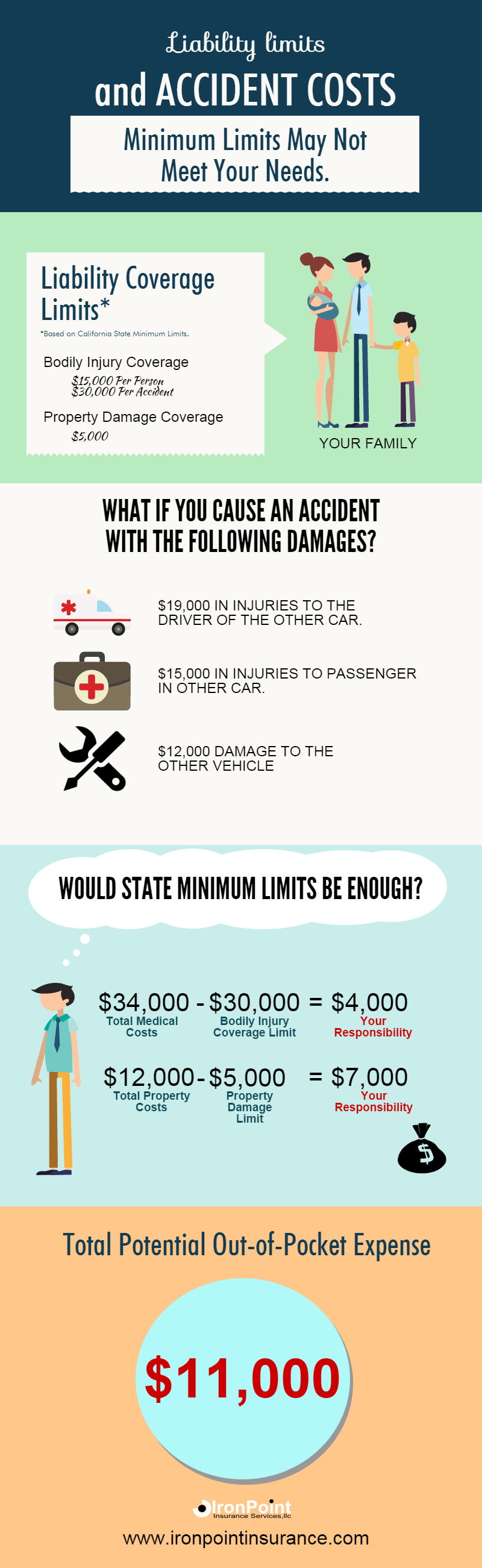

What Are the Limits of Liability Auto Insurance?

The limits of Liability Auto Insurance vary from one policy to the next. Generally, the policyholder can select a coverage limit that meets their needs. The most common limits are $25,000, $50,000, and $100,000. The higher the limit, the more expensive the policy, but it also provides the policyholder with a greater level of protection.

What are the Benefits of Limits of Liability Auto Insurance?

The main benefit of Limits of Liability Auto Insurance is that it provides financial protection in the event of an accident. It covers the cost of medical expenses and repairs, as well as lost wages and other damages. Additionally, it can provide the policyholder with legal protection if a lawsuit is filed against them as a result of an accident. Finally, it can provide peace of mind knowing that if an accident occurs, the policyholder is covered.

How Can I Get Limits of Liability Auto Insurance?

Limits of Liability Auto Insurance can be purchased from an insurance company or an independent insurance agent. The policyholder should compare different policies and coverage limits to find the best option for them. It is important to compare coverage limits, deductibles, and premium rates before purchasing a policy. Additionally, the policyholder should read the policy thoroughly before signing to ensure they understand what is covered and what is not.

Limits of Liability Auto Insurance is an important type of coverage that can provide financial and legal protection in the event of an accident. It is important to understand the coverage limits and deductibles and to compare different policies to find the best option for the policyholder's needs. Having Limits of Liability Auto Insurance provides peace of mind knowing that if an accident does occur, the policyholder is covered.

Auto Insurance Liability Limits: What Do The Numbers Mean? | Visual.ly

All the Different Types of Car Insurance Coverage & Policies Explained

Simple, Cars and Home insurance on Pinterest

Should I buy minimum liability limits auto insurance?