Illinois State Minimum Car Insurance

Friday, December 16, 2022

Edit

Illinois State Minimum Car Insurance

What is the Illinois State Minimum Insurance?

In Illinois, the state minimum car insurance is the minimum coverage of liability insurance required to drive legally. All drivers in Illinois must have the state minimum insurance coverage. The state minimum insurance includes liability coverage for bodily injury and property damage. This type of insurance is also known as liability coverage. It is designed to protect the driver from having to pay out of pocket for damage caused by an at-fault accident.

The state minimum insurance requirements are set by the Illinois Department of Insurance. The state minimum insurance requirements are based on a set of factors, such as the age of the driver, the type of vehicle, the number of miles driven, and the amount of coverage the driver is seeking.

What are the Benefits of an Illinois State Minimum Insurance Policy?

There are several benefits to having an Illinois State Minimum Insurance policy. The most obvious benefit is that it protects the driver from having to pay out of pocket for any damage caused by an at-fault accident. Additionally, having an Illinois State Minimum Insurance policy can help to lower the cost of insurance premiums since it provides the minimum amount of coverage required by the state.

Another benefit of having an Illinois State Minimum Insurance policy is that it can help protect the driver from a potential lawsuit. If an accident occurs, the driver will have a certain amount of coverage in the event that the other party files a lawsuit against them.

How Much Does an Illinois State Minimum Insurance Policy Cost?

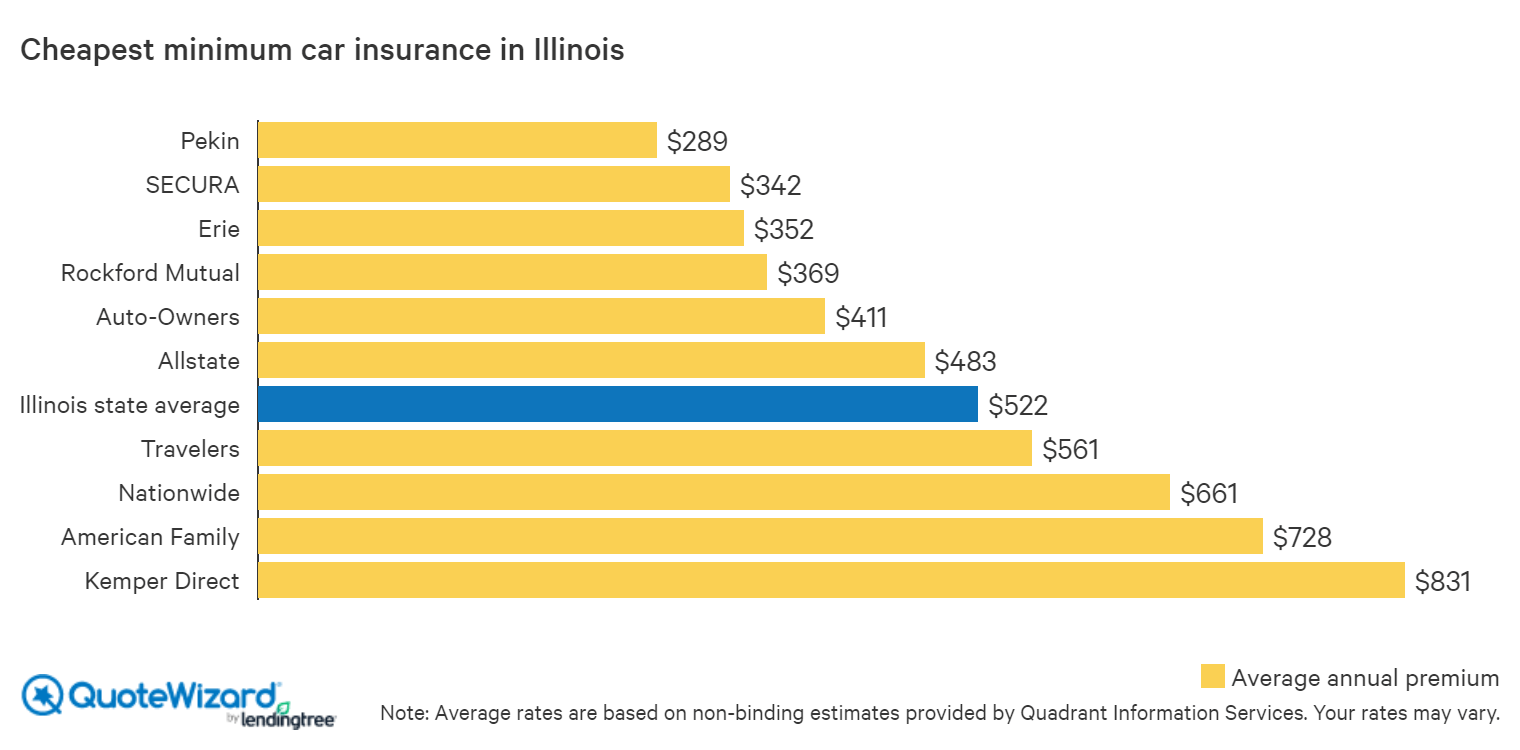

The cost of an Illinois State Minimum Insurance policy will vary depending on the type of coverage the driver is seeking. The cost of the policy will also depend on the number of miles driven, the age of the driver, and the type of vehicle. Generally, the cost of an Illinois State Minimum Insurance policy is less expensive than other types of insurance policies.

It is important to compare quotes from different insurance companies before selecting an Illinois State Minimum Insurance policy. This will ensure that the driver is getting the best coverage at the best price. Additionally, drivers should also consider any discounts that may be available.

What is the Penalty for Driving Without an Illinois State Minimum Insurance Policy?

Driving without an Illinois State Minimum Insurance policy is a serious offense. If caught, the driver will face a range of penalties, including fines, license suspension or revocation, and even jail time. It is important to note that the penalties for driving without insurance can vary from state to state.

In Illinois, a driver who is caught driving without an Illinois State Minimum Insurance policy may face a fine of up to $500 and a license suspension of up to one year. Additionally, a conviction for driving without insurance can result in a two-point penalty on the driver’s license.

How to Get an Illinois State Minimum Insurance Policy

Getting an Illinois State Minimum Insurance policy is easy and affordable. Drivers can obtain an Illinois State Minimum Insurance policy through any licensed insurance company in the state.

When selecting an Illinois State Minimum Insurance policy, drivers should make sure to read the policy carefully and understand all of the coverage limits and exclusions. Additionally, drivers should compare quotes from multiple insurance companies to ensure that they are getting the best coverage at the best price.

Conclusion

In Illinois, all drivers must have an Illinois State Minimum Insurance policy to legally drive. This type of insurance is designed to protect the driver from having to pay out of pocket for any damage caused by an at-fault accident. Additionally, it can help to lower the cost of insurance premiums and protect the driver from a potential lawsuit.

Getting an Illinois State Minimum Insurance policy is easy and affordable. Drivers can obtain an Illinois State Minimum Insurance policy through any licensed insurance company in the state. When selecting an Illinois State Minimum Insurance policy, drivers should make sure to read the policy carefully and understand all of the coverage limits and exclusions.

Best Cheap Car Insurance In Illinois – Forbes Advisor

Find Cheap Car Insurance in Illinois | QuoteWizard

Illinois Car Insurance Requirements

How Much Does SR22 Cost in Illinois