How To Cancel Sbi General Group Personal Accident Insurance Policy

How to Cancel SBI General Group Personal Accident Insurance Policy

Overview of SBI General Group Personal Accident Insurance Policy

SBI General Insurance offers a comprehensive Group Personal Accident policy to cover death or disability due to an accident. The cover provides financial assistance to the insured members in case of any unfortunate event. The policy covers accidental death and permanent total disability resulting from an accident. It also provides compensation for partial disability, medical expenses and hospitalisation expenses due to an accident. The policy is available to members of any group, including family members, co-workers, or any other group, who are between the ages of 8 to 70 years.

Benefits of SBI General Group Personal Accident Insurance Policy

The policy provides financial protection to members in case of an unfortunate event. The policy offers various benefits such as compensation for accidental death, permanent total disability, and partial disability due to an accident. The policy also covers medical expenses, hospitalisation expenses and funeral expenses due to an accident. The policy also provides 24-hour worldwide coverage for accidental events.

Eligibility Criteria for SBI General Group Personal Accident Insurance Policy

The policy is available to any group of individuals, including family members, co-workers or any other group, who are between the ages of 8 to 70 years. All members of the group should be in good health and should not have any pre-existing medical conditions. The policyholder should also not be involved in any hazardous activities such as skydiving, bungee jumping, or any other dangerous activities.

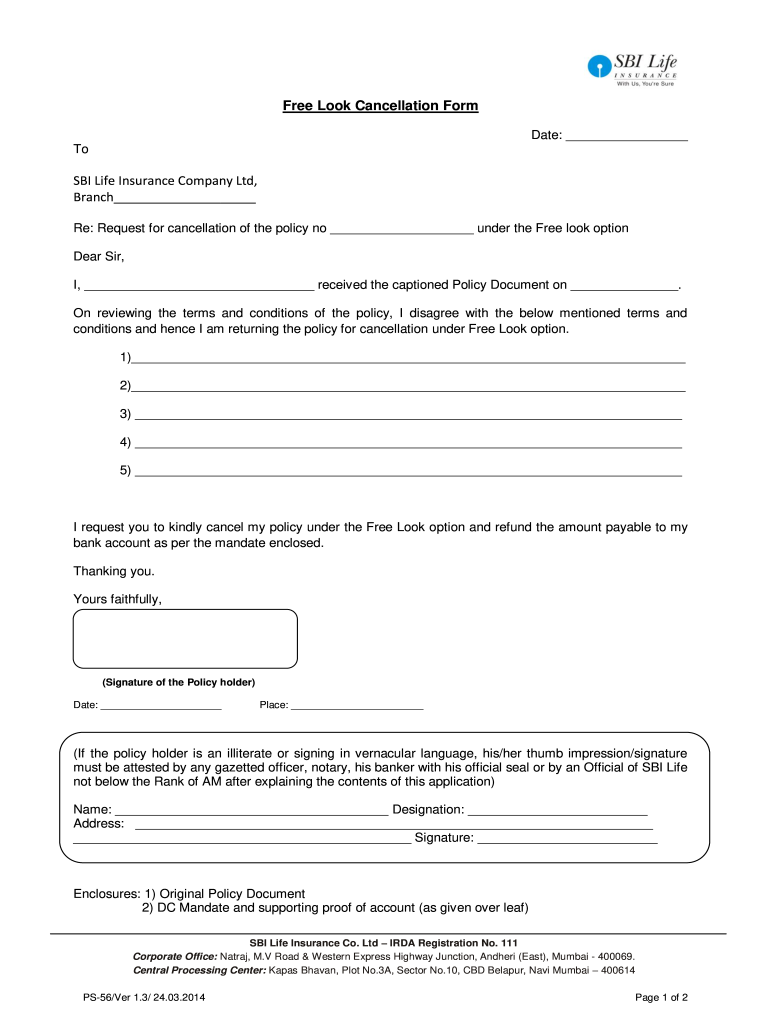

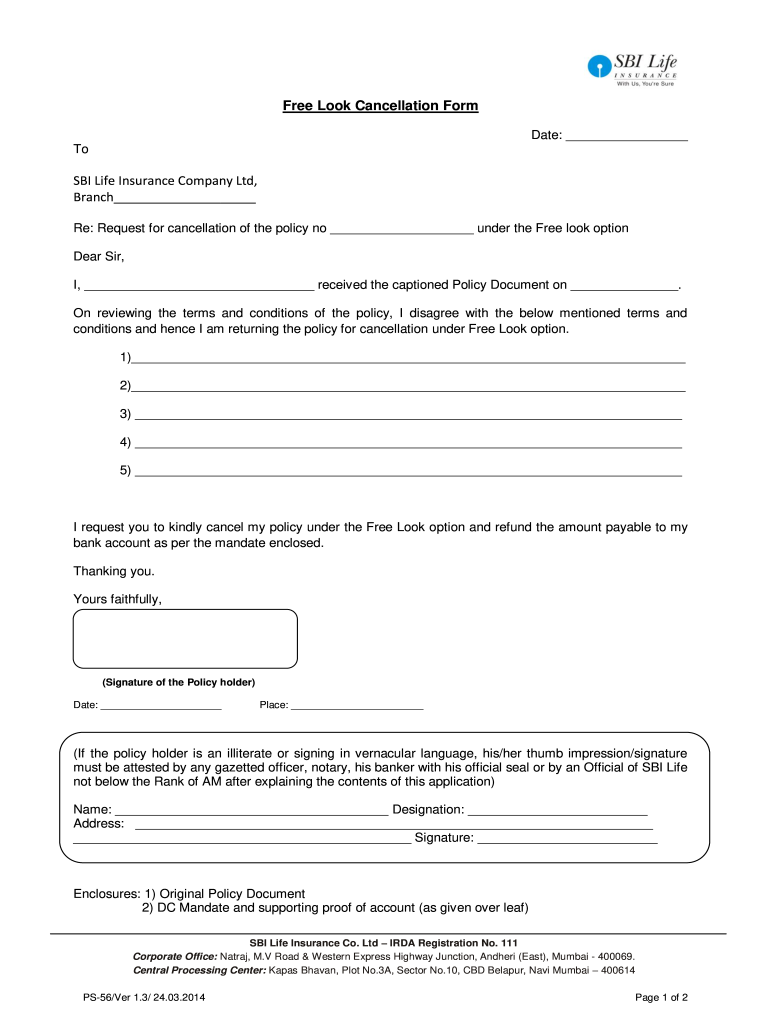

How to Cancel SBI General Group Personal Accident Insurance Policy

The policyholder may cancel the policy by submitting a written request to SBI General Insurance. The policyholder should include the policy number, the reason for cancellation, and the date of cancellation in the request. The policyholder should also provide a copy of the policy and any relevant documents, such as the medical report, if applicable. The policyholder should also include a copy of the premium payment receipt. The policyholder should also be aware that any premiums already paid will not be refunded.

Points to Note Before Cancelling SBI General Group Personal Accident Insurance Policy

The policyholder should be aware that any premiums already paid will not be refunded. The policyholder should also check with the insurer if there are any other charges that will be applicable in case of cancellation. The policyholder should also check if there is any grace period available in case of cancellation. The policyholder should also check if there are any other policies available with the same coverage and benefits.

Conclusion

SBI General Insurance offers a comprehensive Group Personal Accident policy to provide financial protection to members in case of an unfortunate event. The policyholder should ensure that all eligibility criteria are met before applying for the policy. The policyholder should also be aware of the different benefits and coverage of the policy. The policyholder can cancel the policy by submitting a written request to the insurer. The policyholder should also be aware of any applicable charges and any grace period available in case of cancellation.

How To Cancel Sbi Life Insurance Policy - Fill Online, Printable

How to Cancle or Deactivate Sbi Personal Accident Insurance policy

SBI General Group Personal Accident Insurance Policy – A Detailed

Get a personal accident insurance policy