Full Coverage Car Insurance State Farm

Friday, December 16, 2022

Edit

Full Coverage Car Insurance State Farm

What is Full Coverage Car Insurance?

Full coverage car insurance is an insurance policy that covers all of the losses you may experience while driving your vehicle. It includes liability coverage, which covers the cost of liability if you are found to be at fault in an accident, as well as coverage for physical damage to your car. The coverage is often referred to as "all-in-one" because it covers all of the potential costs that can come as a result of a car accident.

Full coverage car insurance is important for all drivers, regardless of their age or experience level. It provides financial protection not only for yourself, but also for your passengers and even for other drivers if you are involved in an accident. In addition, full coverage car insurance can help to protect the value of your vehicle if it is damaged or stolen.

State Farm Insurance

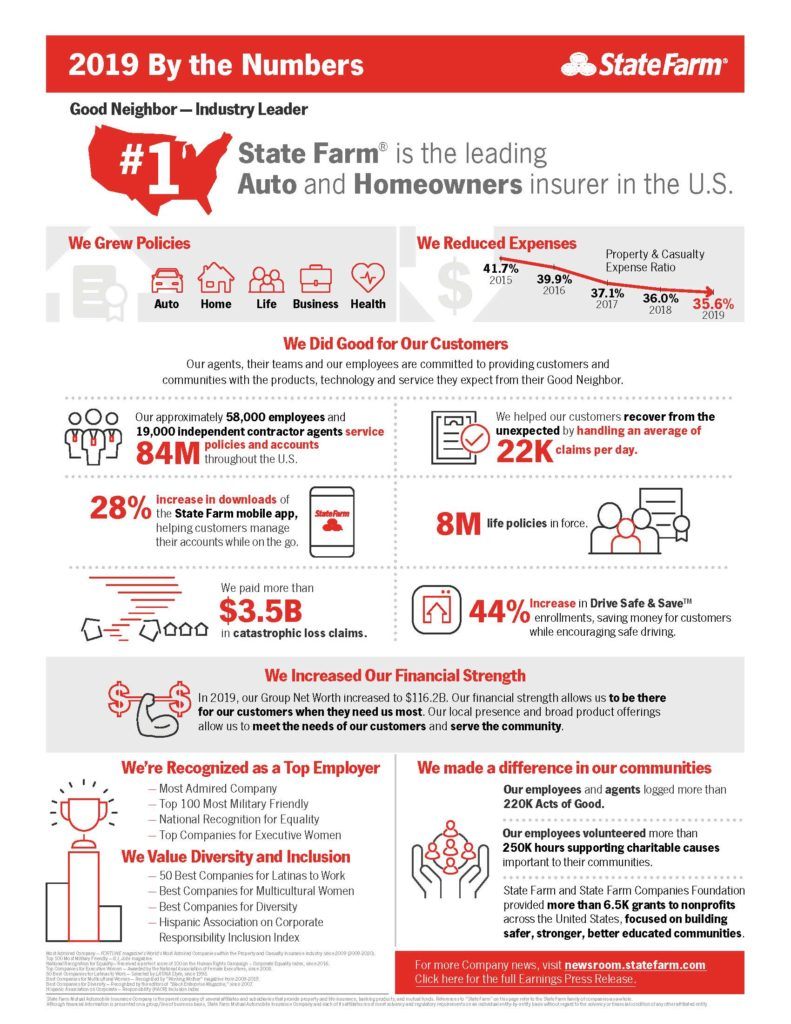

State Farm is a leading provider of full coverage car insurance. The company offers a variety of different coverage plans to meet the needs of all drivers, regardless of their budget or driving history. State Farm also offers a number of discounts and incentives to help drivers save money on their car insurance.

State Farm's full coverage car insurance includes liability coverage, which covers the cost of damages to another person's property or injuries caused to another person. It also includes coverage for medical payments, which pays for medical expenses that result from an accident. In addition, State Farm offers coverage for collision, which pays for the cost of repairing or replacing your vehicle if it is damaged in an accident.

Benefits of State Farm Full Coverage Car Insurance

State Farm's full coverage car insurance provides drivers with a number of benefits. For starters, by having full coverage car insurance, you can rest easy knowing that you will be protected in the event of an accident. In addition, State Farm offers a number of discounts and incentives that can help drivers save money on their car insurance. Finally, State Farm's customer service is known for its excellent customer service, meaning that you can get help with any questions or concerns you may have about your car insurance policy.

How to Get the Best Rate on State Farm Full Coverage Car Insurance

When it comes to getting the best rate on State Farm full coverage car insurance, there are a few things to keep in mind. First and foremost, it's important to shop around and compare rates from different companies. This will allow you to determine which company offers the best rate for your specific situation. Additionally, it's important to take advantage of any discounts or incentives that State Farm offers, such as a good driver discount, a multi-car discount, or a homeowner's discount. Lastly, it's important to make sure that you are fully aware of the terms and conditions of your State Farm car insurance policy so that you know exactly what you are covered for.

Conclusion

Full coverage car insurance is an important investment for all drivers, and State Farm is a leading provider of this type of coverage. By taking the time to shop around and compare rates from different companies, you can make sure you get the best rate on your State Farm full coverage car insurance. Additionally, it's important to take advantage of any discounts or incentives that State Farm offers to help you save money on your car insurance. Finally, it's important to make sure you are aware of the terms and conditions of your policy so that you know exactly what you are covered for.

How Does State Farm Rideshare Insurance Work?

80+ Car Insurance Full Coverage Quotes - Hutomo Sungkar

Is State Farm Auto Insurance Right For You? We Did The Research

Top 10 Car Insurance Companies in Toronto, Ontario - RateLab.ca

Top 6 fake state farm insurance card template in 2022 - KemLady