Cheap Car Insurance College Nerdwallet

Tuesday, December 20, 2022

Edit

Cheap Car Insurance for College Students

Getting a car is an exciting milestone for college students, but the cost of insurance can be a major drag on their wallet. Fortunately, there are ways to get cheap car insurance for college students. With the right knowledge, college students can find the coverage they need without breaking the bank.

What Factors Affect Car Insurance Rates for College Students?

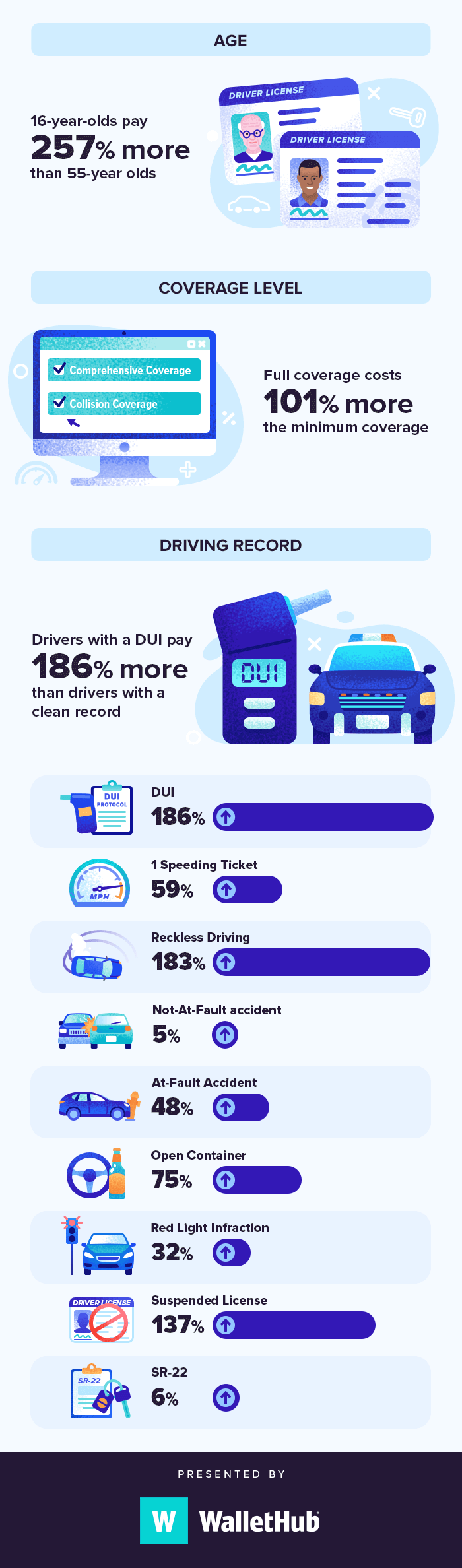

The cost of car insurance for college students is affected by a number of factors. Insurance companies consider the type of car, the age of the driver, their driving record, and the coverage they choose. Additionally, college students can qualify for discounts or other cost-saving measures depending on their situation.

Type of Car

The type of car a college student drives will significantly affect the cost of car insurance. Newer cars with more advanced safety features will be less expensive to insure than older models. Additionally, cars with higher performance capabilities, such as sports cars and luxury vehicles, will cost more to insure than sedans or other types of cars.

Age of Driver

The age of the driver is another factor that affects the cost of car insurance. Generally, younger drivers, including college students, will pay more for car insurance than older drivers. This is because younger drivers are more likely to be involved in an accident and file a claim.

Driving Record

The driving record of a college student can also affect the cost of car insurance. Drivers with a clean record of no accidents or traffic violations will typically pay less for insurance than drivers with points on their license or a history of accidents.

Coverage Choices

The coverage choices a college student makes will affect the cost of their car insurance. Generally, the more coverage they choose, the more they will pay. However, even with a limited budget, college students can find the coverage they need to stay safe on the road.

How Can College Students Get Cheap Car Insurance?

There are a number of ways college students can get cheap car insurance. One of the best ways is to shop around and compare rates from different companies. Different insurance companies offer different rates, so it pays to compare.

College students can also qualify for discounts or other cost-saving measures. Many insurance companies offer discounts for good students, safe drivers, and loyalty programs. Additionally, college students can opt for higher deductibles to lower their premiums.

Finally, college students should consider bundling their car insurance with other policies, such as renter’s insurance or health insurance. Bundling can often save college students a significant amount of money.

Conclusion

Getting car insurance can be expensive for college students, but there are ways to get cheap car insurance. By shopping around and taking advantage of discounts and other cost-saving measures, college students can find the coverage they need without breaking the bank. With the right knowledge, college students can find the coverage they need and still have money left over for other expenses.

5 Keys to Cheap Car Insurance - NerdWallet

Best Cheap Car Insurance in San Antonio for 2020 - NerdWallet

Find the Best Cheap Car Insurance - NerdWallet

What to Know About Car Insurance During College | Training Wheels

Best Full Coverage Car Insurance For College Students