Car Insurance No Fault States

Tuesday, December 27, 2022

Edit

No Fault Car Insurance: What You Should Know

What Is No Fault Car Insurance?

No fault car insurance is a type of car insurance policy that pays for the medical expenses of an injured driver, regardless of who was at fault in an accident. In no fault states, each driver's own insurance coverage is responsible for paying for the driver's medical expenses, no matter who caused the accident. This is known as personal injury protection (PIP). No fault car insurance is most commonly found in the United States, though a few countries in Europe and Canada also have similar systems.

What Are No Fault States?

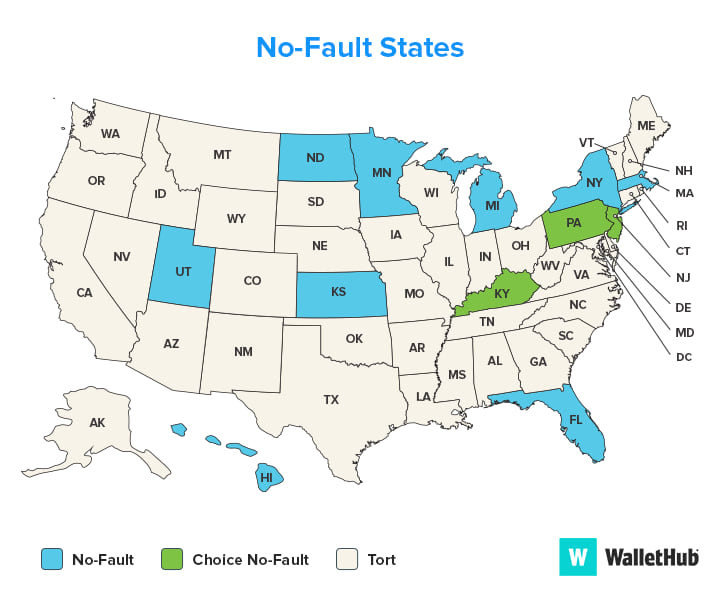

No fault states are states that have a no fault insurance system in place. In these states, each driver's own insurance company will pay for their medical expenses after an accident, regardless of who caused the accident. The following states are no fault states: Delaware, Florida, Hawaii, Kansas, Kentucky, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah.

Why Do States Have No Fault Insurance?

No fault insurance is meant to provide drivers with a way to receive compensation for medical expenses after an accident without having to go through a lengthy legal process. This reduces the cost and time involved in settling accident claims, as well as the amount of litigation in the court system. Additionally, no fault insurance helps to reduce the number of uninsured drivers on the road, as it ensures that all drivers will be able to receive compensation for their medical expenses after an accident, regardless of who was at fault.

What Are The Advantages Of No Fault Insurance?

The main advantage of no fault insurance is that it provides drivers with a way to receive compensation for medical expenses after an accident without having to go through a lengthy legal process. Additionally, no fault insurance helps to reduce the number of uninsured drivers on the road, as it ensures that all drivers will be able to receive compensation for their medical expenses after an accident, regardless of who was at fault. Lastly, no fault insurance helps to reduce the amount of litigation in the court system, as it eliminates the need for a lengthy and expensive court battle to determine who was at fault in an accident.

What Are The Disadvantages Of No Fault Insurance?

The main disadvantage of no fault insurance is that it can limit the amount of compensation that a driver can receive for medical expenses after an accident. Additionally, no fault insurance can be more expensive than traditional insurance, as it requires that each driver's own insurance company pay for the driver's medical expenses, regardless of who caused the accident. Lastly, no fault insurance can lead to increased premiums for all drivers, as insurance companies must spread the cost of the medical expenses across all drivers, regardless of who caused the accident.

Where Can I Find More Information About No Fault Insurance?

If you would like to learn more about no fault insurance, you can speak to your insurance agent or contact your state's insurance department for more information. Additionally, you can research no fault insurance online, as there are many websites and resources available that provide detailed information about no fault insurance and the no fault states.

No fault car insurance is an important type of car insurance policy that provides drivers with a way to receive compensation for medical expenses after an accident without having to go through a lengthy legal process. No fault states are states that have a no fault insurance system in place. The advantages of no fault insurance include reducing the cost and time involved in settling accident claims, reducing the number of uninsured drivers on the road, and reducing the amount of litigation in the court system. The disadvantages of no fault insurance include limiting the amount of compensation that a driver can receive for medical expenses after an accident, increased premiums for all drivers, and increased cost of insurance. If you would like to learn more about no fault insurance, you can speak to your insurance agent or contact your state's insurance department for more information.

Ultimate Guide to No-Fault Auto Insurance

How Does Car Insurance Work When You Are At Fault – Epsilonbed

Did Your Car Accident Happen in a No-Fault State? - Dailey Law Firm

States With No-Fault Auto Insurance | Reviews.com - Infogram

No Fault Insurance | Best rates in Your State | Ogletree Financial