Car Insurance Adding Young Driver

Car Insurance Adding Young Driver - What You Need to Know

Understanding the Basics

Adding a young driver to your car insurance policy can be a confusing process. Not only do you need to consider the cost factor, but you also need to make sure that the driver will be properly protected in the event of an accident. To help you make the best decision, it’s important to understand the basics of adding a young driver to your car insurance policy.

Factors to Consider

The primary factor in determining the cost of car insurance for a young driver is their age. The younger the driver, the more expensive the coverage. This is because young drivers are seen as more of a risk to insurers. Additionally, the type of car a young driver drives can also affect the cost of their insurance. Luxury vehicles, sports cars, and cars with high-performance engines will cost more to insure.

Discounts for Young Drivers

It’s important to note that young drivers can often be eligible for discounts on their car insurance. Many insurance companies offer discounts for good grades and for taking driver’s education classes. Additionally, some companies offer discounts for drivers who install safety devices in their vehicles, such as airbags, anti-lock brakes, and anti-theft systems.

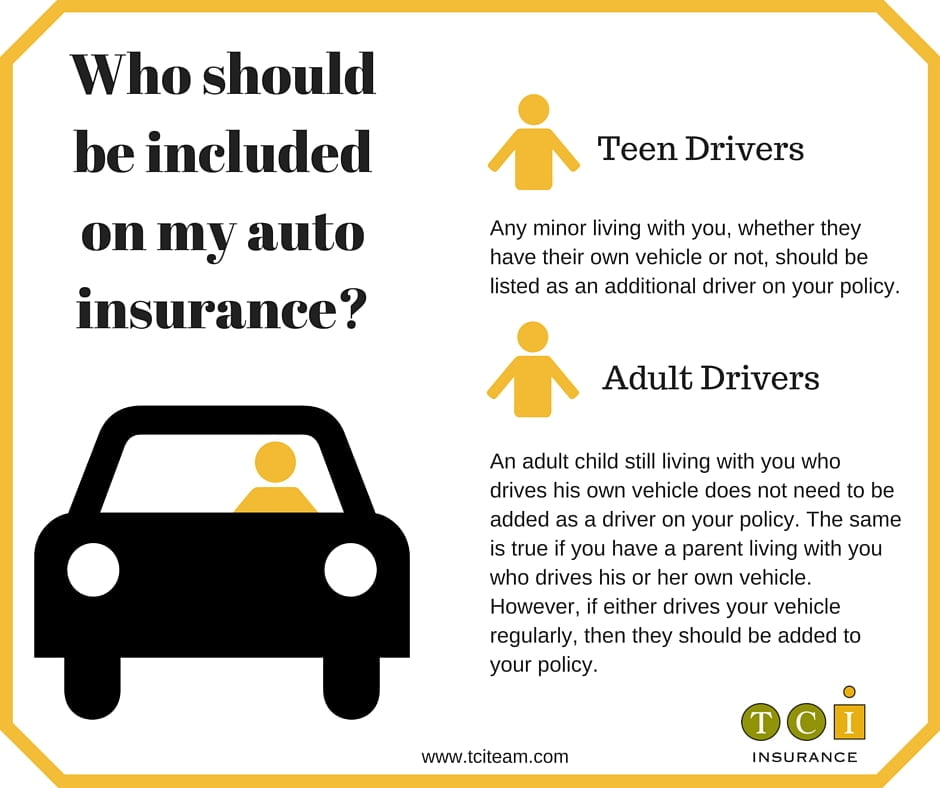

Requirements for Adding a Young Driver to Your Policy

When it comes to adding a young driver to your policy, insurance companies have specific requirements. Generally, the driver must be at least 16 years old and have a valid driver’s license. In some cases, the driver may also need to be added to the policy in person, meaning that they will need to go to the insurance company’s office and provide their information. Additionally, the driver may need to take a driving test in order to be added to the policy.

The Cost of Adding a Young Driver

The cost of adding a young driver to your car insurance policy will depend on a number of factors, such as the age of the driver, the type of car they drive, and any discounts they may qualify for. Generally, you can expect the cost of adding a young driver to your policy to be significantly higher than the cost of insuring an adult. However, there are ways to reduce the cost, such as taking advantage of discounts and shopping around for the best rate.

The Bottom Line

Adding a young driver to your car insurance policy can be a challenging process. It’s important to understand the basics of car insurance for young drivers, including the requirements for adding them to your policy, the cost, and any discounts they may qualify for. By doing your research and shopping around for the best rate, you can make sure that your young driver is properly protected while also keeping the costs of your insurance policy under control.

2017 Driver Insurance Policy | Adding A Young Driver To Your Auto

Adding a Teen Driver to Your Auto Insurance Policy: What You Need to

Adding a Teenage Driver to your Car Insurance policy - YouTube

Can I Add My Son To My Car Insurance Policy - 2020 - EMK - Insurance

Get cheap car insurance for young drivers + 6 tips from experts