Average Full Coverage Car Insurance Cost

Tuesday, December 13, 2022

Edit

Average Full Coverage Car Insurance Cost

What is Full Coverage Car Insurance?

Full coverage car insurance is an insurance policy that provides comprehensive protection for your car. It typically includes liability coverage, collision coverage, and comprehensive coverage. Liability coverage pays for damages you cause to other people’s property or for injuries you cause to other people. Collision coverage pays for damages to your car if you are in an accident, regardless of who is at fault. Comprehensive coverage pays for damages to your car from events such as theft, vandalism, and natural disasters.

How Much Does Full Coverage Car Insurance Cost?

The average cost of full coverage car insurance in the US is around $1,500 per year. However, the cost of full coverage car insurance varies widely by state and by individual risk factors. Drivers in some states pay as little as $500 per year for full coverage car insurance, while drivers in other states may pay as much as $3,000 or more.

Individual risk factors, such as age, driving record, and credit score, can also affect the cost of full coverage car insurance. Generally, younger drivers, drivers with poor driving records, and drivers with low credit scores are charged higher rates for full coverage car insurance.

What Factors Affect the Cost of Full Coverage Car Insurance?

There are several factors that affect the cost of full coverage car insurance. These include the type of car you drive, the amount of coverage you choose, the limits of your policy, the deductible you select, and your individual risk factors.

The type of car you drive is an important factor in determining the cost of full coverage car insurance. Generally, cars with higher safety ratings, such as SUVs and minivans, are cheaper to insure than sports cars and luxury cars. The amount of coverage you choose will also affect the cost of full coverage car insurance. Higher coverage limits, such as $100,000/$300,000/$50,000, will cost more than lower coverage limits, such as $50,000/$100,000/$50,000. The deductible you select will also affect the cost of full coverage car insurance. Lower deductibles, such as $500, will cost more than higher deductibles, such as $1,000.

Your individual risk factors, such as age, driving record, and credit score, will also affect the cost of full coverage car insurance. Generally, younger drivers, drivers with poor driving records, and drivers with low credit scores are charged higher rates for full coverage car insurance.

How Can I Save Money on Full Coverage Car Insurance?

There are several ways to save money on full coverage car insurance. One way is to shop around for the best rates. Comparing rates from multiple insurance companies is the best way to find the lowest rate for full coverage car insurance.

You can also save money on full coverage car insurance by increasing your deductible. Increasing your deductible from $500 to $1,000 can significantly reduce your premium. Additionally, you can save money by taking advantage of any discounts offered by insurance companies. Many insurance companies offer discounts for good drivers, safe drivers, and good students.

Finally, you can save money by bundling your insurance policies. Many insurance companies offer discounts if you purchase multiple policies, such as auto and home insurance, from the same company.

Conclusion

The cost of full coverage car insurance can vary widely by state and by individual risk factors. Generally, younger drivers, drivers with poor driving records, and drivers with low credit scores are charged higher rates for full coverage car insurance.

There are several ways to save money on full coverage car insurance, such as shopping around for the best rates, increasing your deductible, taking advantage of any discounts offered, and bundling your policies.

By doing your research and taking advantage of any available discounts, you can save money on full coverage car insurance and make sure you have the coverage you need.

Cheap Car Insurance in North Carolina | QuoteWizard

Average Cost of Car Insurance UK 2021 | NimbleFins

What's the average cost of car insurance in the US? - Business Insider

Average Cost of Car Insurance UK 2020 | NimbleFins

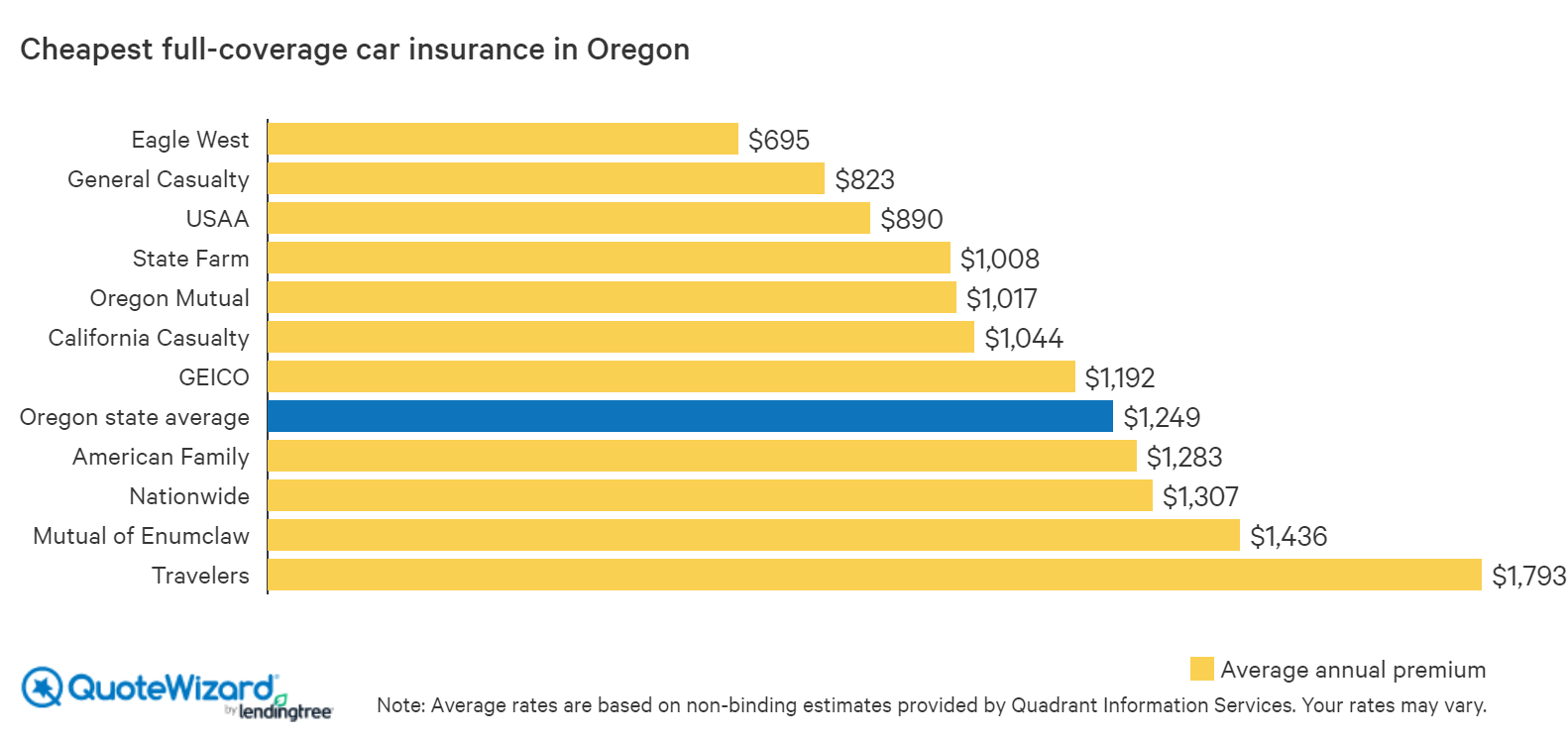

Where to Find Cheap Car Insurance in Oregon | QuoteWizard