All Drivers Insurance On Market Street

Comprehensive Guide to All Drivers Insurance On Market Street

Why Do You Need Insurance?

Insurance is an important part of any driver’s life, no matter where they live. Insurance is designed to protect drivers from financial ruin if they are involved in a car accident. It can also provide protection against a variety of other risks, such as theft, fire, or liability. Insurance can be expensive, so it’s important to shop around and find the best rates and coverage. Market Street has a number of different insurance providers, so it’s important to understand the different types of insurance available and how they can benefit you.

Types of Insurance

The most common type of insurance on Market Street is liability insurance. This type of insurance covers costs related to property damage or bodily injury caused by the driver. It also covers the other driver’s medical bills if the accident was the fault of the insured driver. Liability insurance is required for all drivers in most states, so it’s important to make sure you have the right coverage.

Collision insurance covers damage to the insured driver’s vehicle caused by an accident. It also covers the cost of repairs to another person’s vehicle if the insured driver is at fault. Comprehensive insurance covers a variety of different risks, such as theft, fire, or vandalism. Uninsured/Underinsured motorist coverage protects the insured driver if they are in an accident with someone who does not have insurance or does not have enough insurance.

Finding the Best Rates

When shopping for insurance on Market Street, it’s important to compare rates and coverage options between different providers. There are a number of different factors that can affect the cost of insurance, such as age, driving record, type of vehicle, and the type of coverage. It’s also important to consider the level of coverage you need. Some policies may include deductibles, which can affect the cost of the policy. It’s important to read the policy carefully before signing up for any insurance.

Discounts and Bundling

Insurance companies on Market Street offer a variety of discounts and bundling options that can help reduce the cost of coverage. Discounts may be offered for a variety of reasons, such as good driving record, age, or for having multiple cars insured with the same company. Bundling different types of coverage can also result in savings. For example, if you have both collision and comprehensive insurance, you may be eligible for a discount. It’s important to ask the insurance company about any discounts or bundling options they offer.

Finding the Right Provider

When shopping for insurance on Market Street, it’s important to find a provider that is reputable and offers good customer service. It’s also important to read the policy carefully to make sure you understand the coverage and any restrictions that may apply. It’s also a good idea to read customer reviews to get an idea of how satisfied customers are with their provider. You should also check with your state insurance department to make sure the provider is licensed and in good standing.

Car insurance Big 4 grew market share in 2014; Farmers lost big

Global Vehicle Insurance Market Drivers, Restraints, Potential Growth

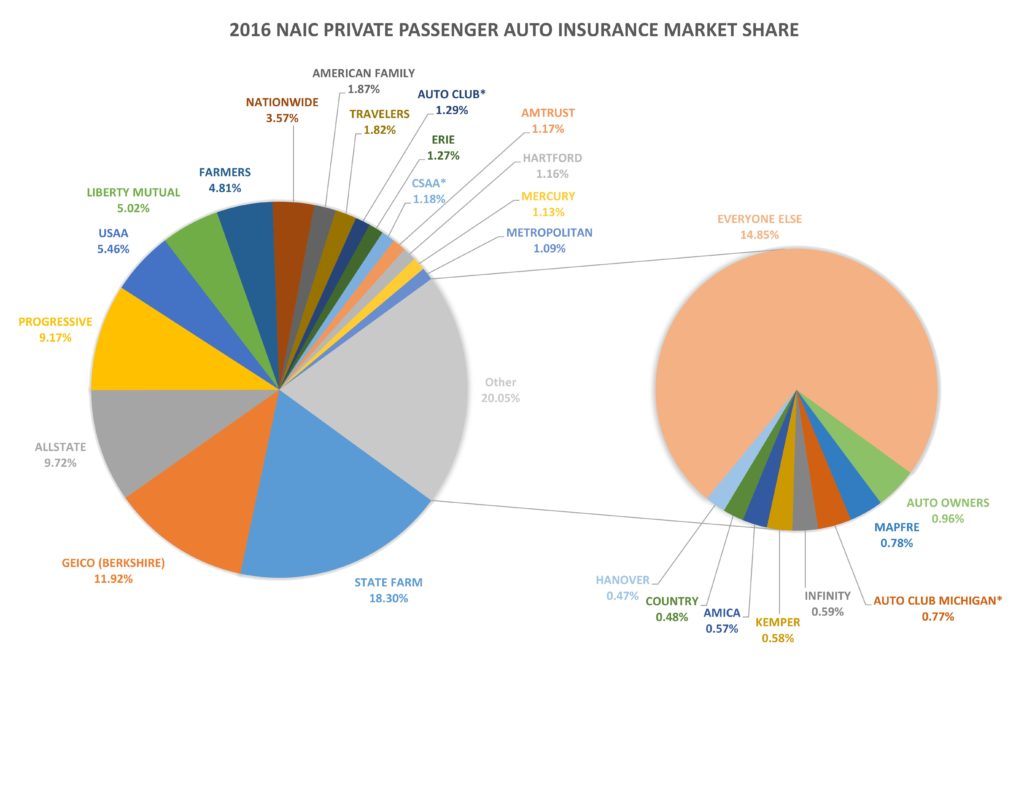

GEICO, Amtrust, Progressive auto insurance market share winners in 2016

Average Car Insurance Cost For First Time Drivers Uk - Quotes

The Insurance Clock - What time is it? - Everest Risk Group