Aaa Gap Insurance Cost California

The Cost of Aaa Gap Insurance in California

What is Gap Insurance?

Gap insurance, also known as Guaranteed Asset Protection, is a type of coverage that helps protect you if your car is stolen or totaled. If your car is stolen or totaled and you still owe money on it, gap insurance can help you cover the difference between what you owe and what your insurance pays. Gap insurance can be an important form of protection when you buy a new car or lease one. It is especially important if you are financing or leasing a car, as the cost of the car may be higher than the amount your insurance company will pay in the event of theft or total loss.

What Does Gap Insurance Cover?

Gap insurance covers the difference between what you owe on your car loan or lease and what your car insurance pays out in the event of a total loss. It is important to note that gap insurance does not cover any damage to your car, damage to other vehicles or property, or medical expenses. It only covers the difference between what you owe and what your car insurance pays.

How Much Does Gap Insurance Cost in California?

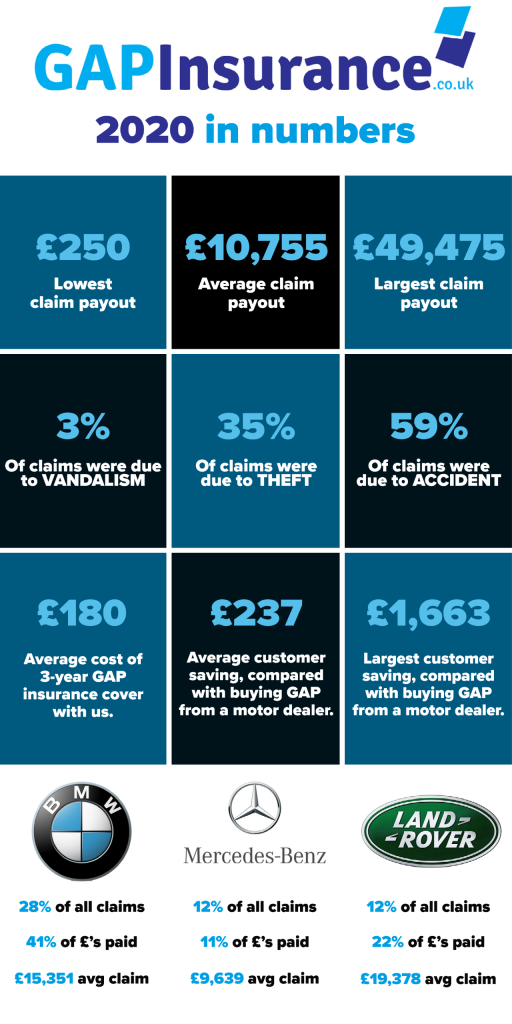

The cost of gap insurance in California varies depending on the type of coverage you choose, the value of your car, and the amount of your deductible. Generally, gap insurance costs between 2 and 7 percent of the total loan or lease amount. For example, if you are financing or leasing a car with a value of $20,000, your gap insurance may cost between $400 and $1,400. Additionally, the cost of gap insurance can also be affected by the amount of your deductible, as lower deductibles will typically result in higher premiums.

Where Can You Buy Gap Insurance in California?

Gap insurance can be purchased from a variety of sources in California. Some auto dealerships offer gap insurance when you purchase or lease a car. Additionally, many insurance companies offer gap insurance as an add-on to your existing auto insurance policy. Finally, you can also purchase gap insurance from an independent insurance provider. It is important to shop around to get the best price and coverage for your needs.

Do You Need Gap Insurance in California?

Gap insurance can be a valuable form of protection for those who finance or lease a car. It can help cover the difference between what you owe and what your insurance company will pay out in the event of a total loss. While the cost of gap insurance in California may be higher than in other states, it can be a wise investment if you are financing or leasing a car.

Conclusion

Gap insurance can be an important form of protection for those who finance or lease a car in California. The cost of gap insurance will vary depending on the value of the car and the amount of your deductible. Gap insurance can be purchased from a variety of sources, including auto dealerships, insurance companies, and independent providers. It is important to shop around for the best coverage and price for your needs.

Aaa Gap Insurance California - Aaa Auto Insurance Reviews Rates Quotes

Understanding Auto Insurance "Gap Coverage"

Is GAP insurance worthwhile? - babybmw.net

Which Insurance Companies Offer Gap Insurance

AAA: Is it Worth the Cost? — What You Need to Know - YouTube