Sbi General Insurance Policy Details

Get All the Details You Need to Know About SBI General Insurance Policies

Introducing SBI General Insurance

SBI General Insurance is a joint venture between the State Bank of India, one of the largest and most trusted banking institutions in India, and Insurance Australia Group (IAG), one of the largest general insurance companies in the world. SBI General Insurance offers a wide range of insurance policies to meet the needs of individuals, families and businesses. The policies are tailored to suit their lifestyle and budget. SBI General Insurance is committed to providing quality products, excellent customer service and competitive pricing.

Types of SBI General Insurance Policies

SBI General Insurance offers various types of insurance policies such as health, motor, travel, home, and personal accident insurance. The health insurance policy covers hospitalization, medical expenses, pre and post hospitalization expenses, day care procedures, and ambulance charges. The motor insurance policy covers third party liability, own damage, and theft or loss of the insured vehicle. The travel insurance policy provides coverage for overseas travel, medical expenses, baggage loss, and trip cancellation. The home insurance policy provides protection against fire, burglary, and other accidents. The personal accident insurance policy provides coverage against accidental death, disability, and dismemberment.

Benefits of SBI General Insurance Policies

The benefits of SBI General Insurance policies include cashless hospitalization, free health check-ups, 24-hour customer service, and hassle-free claim settlement process. The policies are designed to provide comprehensive protection against various risks. The policies are also affordable and offer various discounts and benefits. The policies provide coverage for medical emergencies, hospitalization, surgeries, and other medical expenses. The policies also provide coverage for lost baggage and trip cancellations.

How to Buy SBI General Insurance Policies

SBI General Insurance policies can be purchased online from the official website of the company. The website has a simple and user-friendly interface which enables you to compare different policies and select the best one for your needs. You can also purchase the policies from the nearest branch of the State Bank of India. The customer care executives of SBI General Insurance are available round the clock to provide you with assistance in selecting the best policy.

Conclusion

SBI General Insurance is a reputed and reliable insurance company that offers a wide range of policies to meet the needs of individuals, families and businesses. The policies are designed to provide comprehensive protection against various risks and are also affordable. The policies can be purchased online or from the nearest branch of the State Bank of India. The customer care executives of SBI General Insurance are available round the clock to provide you with assistance in selecting the best policy.

[PDF] SBI General Critical Illness Insurance Policy PDF Download in

![Sbi General Insurance Policy Details [PDF] SBI General Critical Illness Insurance Policy PDF Download in](https://instapdf.in/wp-content/uploads/pdf-thumbnails/sbi-general-critical-illness-insurance-policy-3660.jpg)

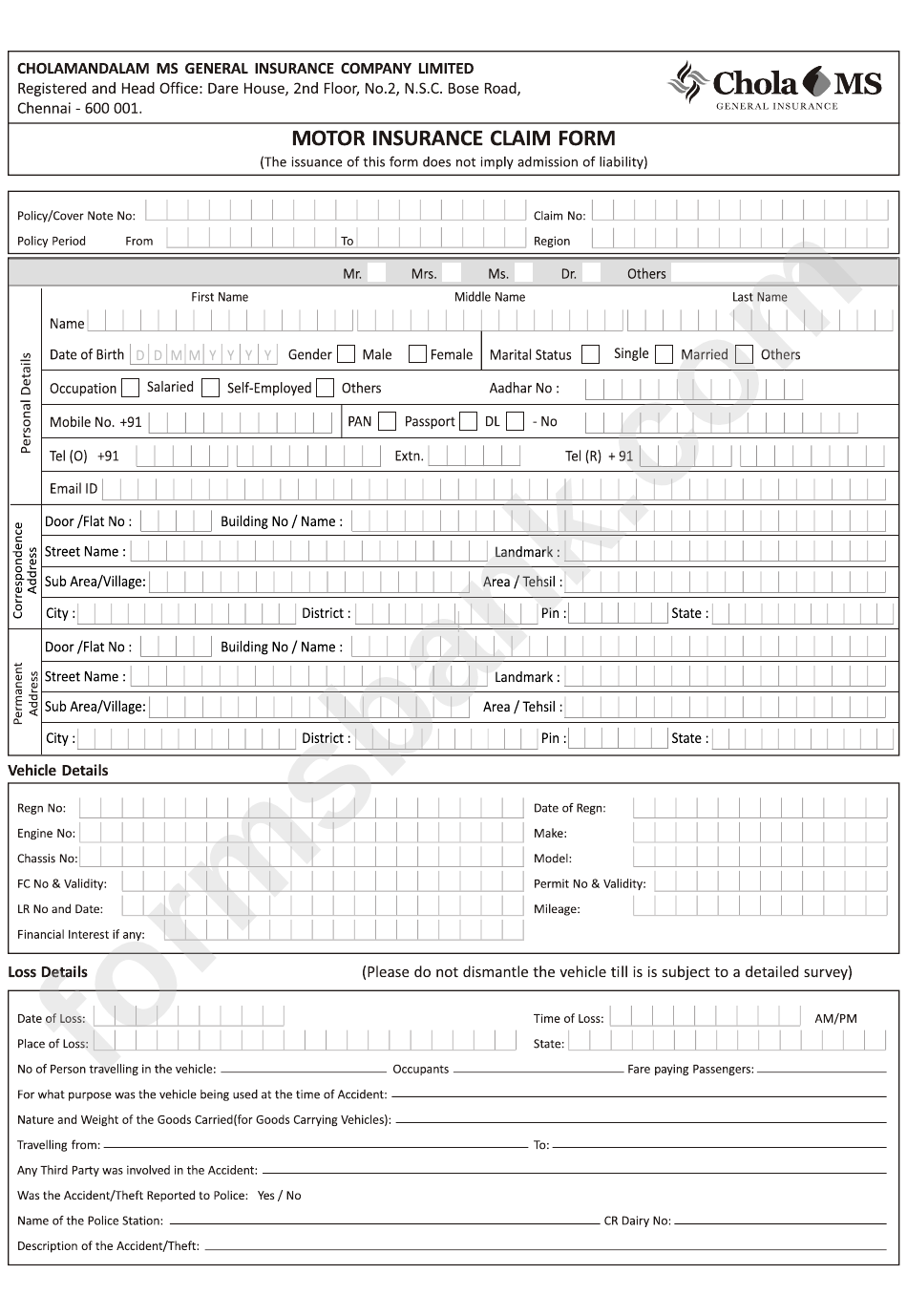

Sbi General Insurance Form Pdf - Fadia Arsadila 2022

Insurance Policy: Sbi Life Insurance Policy Details

Sbi General Insurance Claim Status - Awesome

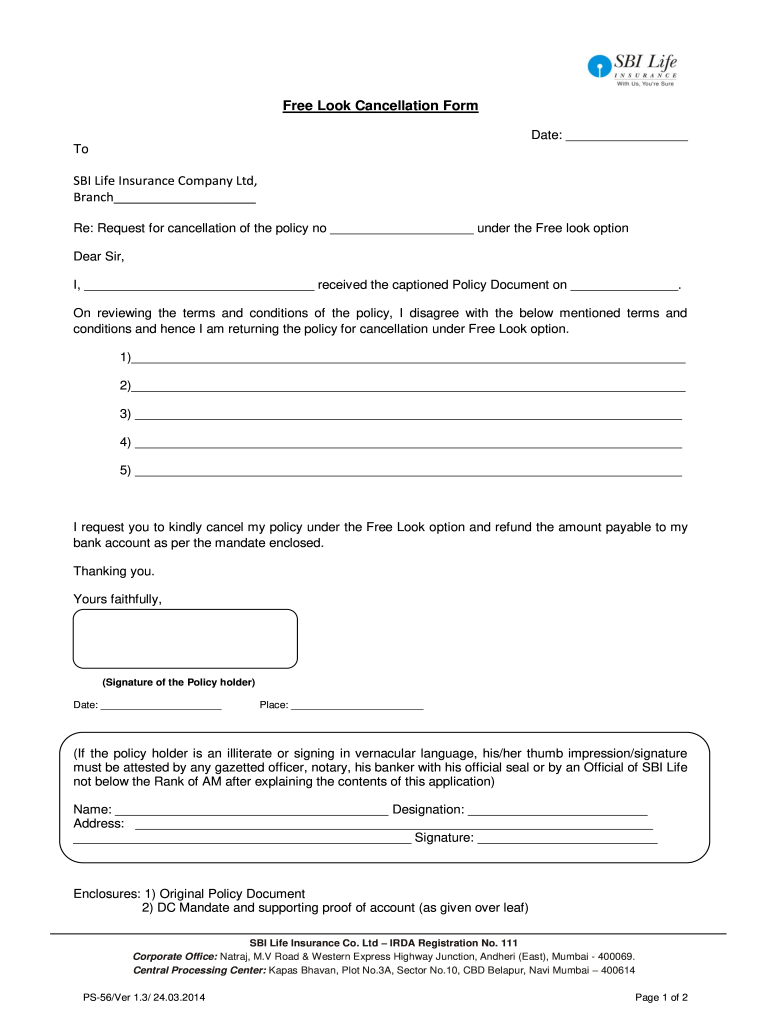

Sbi Life Insurance Cancellation Form - Fill Out and Sign Printable PDF