Monoline Hired And Non owned Auto Insurance

What is Monoline Hired and Non-Owned Auto Insurance?

Monoline hired and non-owned auto insurance is a specialized insurance policy designed to protect businesses from the liability associated with using hired or non-owned vehicles. It is most commonly used by businesses that rent or lease vehicles for business purposes, such as taxi companies, car-rental firms, and limousine service providers. It provides coverage for bodily injury and property damage resulting from an accident involving a hired or non-owned vehicle.

The coverage is unique because it is not included in standard commercial auto insurance policies. This means that businesses that rent or lease vehicles for their operations need to purchase a separate monoline policy to protect themselves from potential liability. Monoline policies typically provide higher limits of liability than standard auto policies, which is why they are an attractive option for businesses that use vehicles in their operations.

What Does Monoline Hired and Non-Owned Auto Insurance Cover?

Monoline hired and non-owned auto insurance provides coverage for liability resulting from the use of hired or non-owned vehicles. This includes damages for bodily injury, property damage, and personal injury, such as libel or slander. It also covers legal fees associated with defending a lawsuit resulting from an accident involving a hired or non-owned vehicle. It may also provide protection for the business’s financial assets, such as its vehicles, if they are damaged in an accident.

The coverage is typically provided on a “per person” or “per occurrence” basis. A “per person” policy provides coverage for each person injured or killed in an accident involving a hired or non-owned vehicle, up to the policy’s limit. A “per occurrence” policy provides coverage for all persons injured or killed in an accident, up to the policy’s limit. Some monoline policies may also provide coverage for medical payments and uninsured motorist protection.

Who Needs Monoline Hired and Non-Owned Auto Insurance?

Monoline hired and non-owned auto insurance is typically used by businesses that rent or lease vehicles for their operations. This includes taxi companies, car-rental firms, limousine services, and any other business that uses vehicles for its operations. It may also be used by businesses that provide rideshare services, such as Uber and Lyft, or delivery services, such as DoorDash and Postmates.

It is important to note that monoline policies do not provide coverage for the vehicles themselves; they only provide liability coverage for the business in the event of an accident. If the business owns the vehicles, they must purchase a separate commercial auto insurance policy to provide coverage for the vehicles.

What Does Monoline Hired and Non-Owned Auto Insurance Cost?

The cost of monoline hired and non-owned auto insurance depends on a variety of factors, such as the type of business, the number of vehicles used, and the limits of coverage purchased. Generally, the higher the limits of coverage purchased, the higher the premium. The cost of the policy may also vary depending on the insurer and the type of policy purchased. It is important to compare rates from multiple insurers to ensure that the business is getting the best rate.

In addition to the cost of the policy, businesses may also need to pay additional fees, such as a policy fee or a filing fee. Most insurers require businesses to purchase a minimum amount of liability coverage, and some may require additional coverages, such as uninsured motorist coverage. Businesses should consult with an insurance agent to determine the best coverage and limits for their operations.

How to Get Monoline Hired and Non-Owned Auto Insurance?

The best way to get monoline hired and non-owned auto insurance is to work with an experienced insurance agent. An agent can help the business determine the coverage and limits that are right for their operations and can compare rates from multiple insurers to ensure that the business is getting the best rate. They can also answer any questions the business may have about the policy, such as what is covered and how to file a claim.

It is important to remember that monoline policies do not provide coverage for the vehicles themselves; they only provide liability coverage for the business in the event of an accident. Businesses that own vehicles must purchase a separate commercial auto insurance policy to provide coverage for their vehicles.

Conclusion

Monoline hired and non-owned auto insurance is an important coverage for businesses that use vehicles in their operations. It provides liability coverage for the business in the event of an accident involving a hired or non-owned vehicle. It is important to work with an experienced insurance agent to ensure that the business has the right coverage and limits for their operations. It is also important to remember that monoline policies do not provide coverage for the vehicles themselves; they only provide liability coverage.

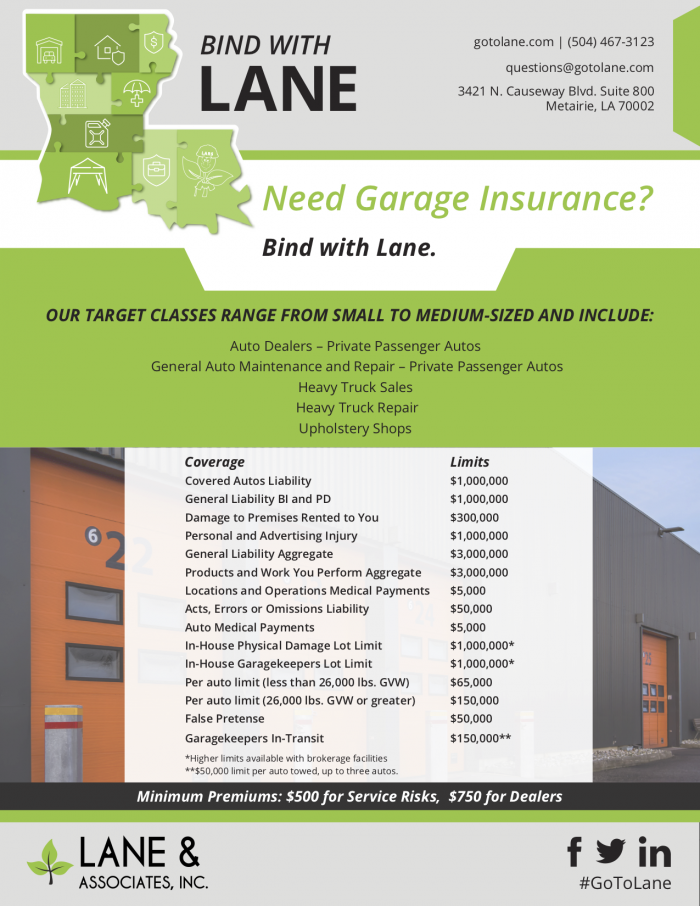

Other Coverages - Lane & Associates

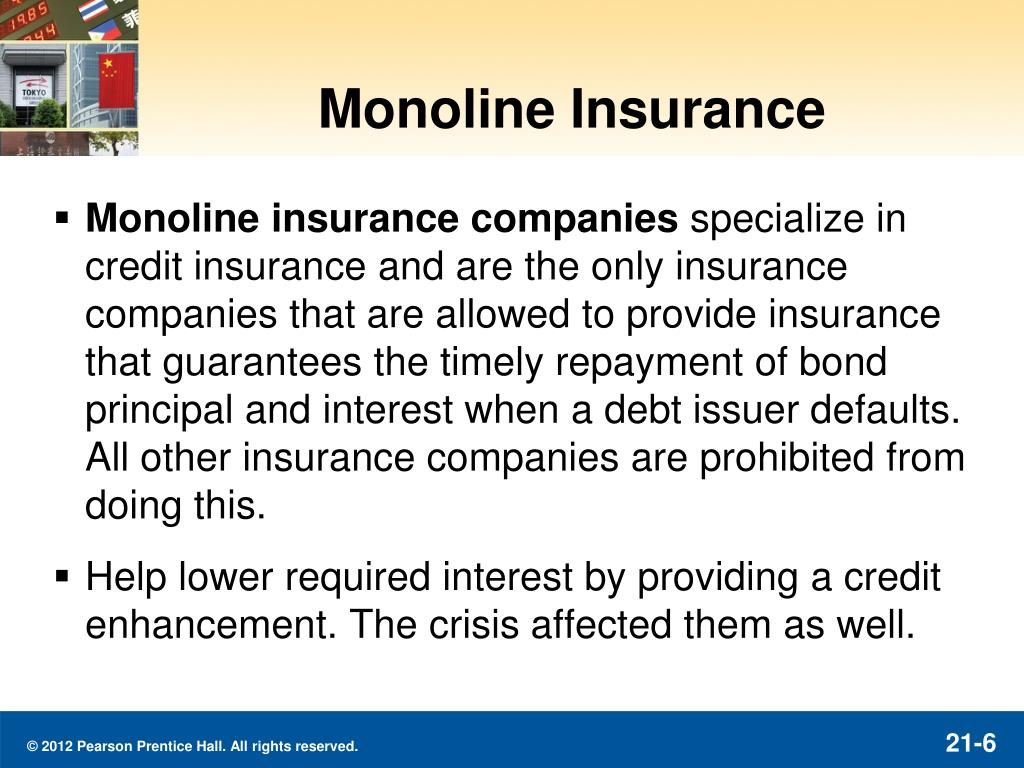

Monoline Insurance : Lmg Presentation To International Insurance

Sample - Hired Auto and Non-Owned Auto Liability Endorsement

Do I need Hired & Non-Owned Auto Coverage....

How to Buy the Right Hired Auto Coverage Insurance for your Needs?