Minimum Hours To Qualify For Health Insurance

Minimum Hours to Qualify for Health Insurance

The Basics of Minimum Hours

Having health insurance is important, but it's not always easy to qualify for. One of the requirements is to have a certain number of hours worked. This can be a challenge for those with part-time jobs, who may not have enough hours to qualify for health insurance. It's important to know what the minimum hours are, and how it affects your ability to get coverage.

The amount of hours you need will depend on the type of insurance you are trying to get and the company you are working with. Generally, employers that offer health insurance will have a minimum amount of hours an employee must work in order to qualify. This can range from 20 to 30 hours per week, with some companies offering more or less depending on their policies.

For those who don't work full-time, it can be difficult to qualify for health insurance. This is especially true if the employer doesn't offer health insurance benefits, or if the employee works multiple part-time jobs. Fortunately, there are a few options available to those who don't meet the minimum hours.

Options for Those Who Don't Meet Minimum Hours

The first option is to look for an employer who offers health insurance benefits for part-time employees. This is becoming more common as the cost of health insurance has continued to increase. It may also be possible to get coverage through a family member's plan.

Another option is to purchase a health insurance policy on the open market. This can be a more expensive option, but it may be the only option for those who don't qualify for employer-sponsored health insurance.

Conclusion

The minimum hours an employee needs to work in order to qualify for health insurance varies depending on the employer and the type of insurance being offered. Those who don't meet the minimum hours may still be able to get coverage through an employer that offers part-time health insurance, or through a family member's plan. For those without any other options, purchasing a health insurance policy on the open market may be the only way to get coverage.

Minimum Hours to Qualify for Health Insurance

The Basics of Minimum Hours

Having health insurance is important, but it's not always easy to qualify for. One of the requirements is to have a certain number of hours worked. This can be a challenge for those with part-time jobs, who may not have enough hours to qualify for health insurance. It's important to know what the minimum hours are, and how it affects your ability to get coverage.

The amount of hours you need will depend on the type of insurance you are trying to get and the company you are working with. Generally, employers that offer health insurance will have a minimum amount of hours an employee must work in order to qualify. This can range from 20 to 30 hours per week, with some companies offering more or less depending on their policies.

For those who don't work full-time, it can be difficult to qualify for health insurance. This is especially true if the employer doesn't offer health insurance benefits, or if the employee works multiple part-time jobs. Fortunately, there are a few options available to those who don't meet the minimum hours.

Options for Those Who Don't Meet Minimum Hours

The first option is to look for an employer who offers health insurance benefits for part-time employees. This is becoming more common as the cost of health insurance has continued to increase. It may also be possible to get coverage through a family member's plan.

Another option is to purchase a health insurance policy on the open market. This can be a more expensive option, but it may be the only option for those who don't qualify for employer-sponsored health insurance.

Conclusion

The minimum hours an employee needs to work in order to qualify for health insurance varies depending on the employer and the type of insurance being offered. Those who don't meet the minimum hours may still be able to get coverage through an employer that offers part-time health insurance, or through a family member's plan. For those without any other options, purchasing a health insurance policy on the open market may be the only way to get coverage.

Minimum Essential Coverage

Obamacare: Minimum Essential Coverage & 10 Essential Benefits

11/2/13 Community Meeting on the Health Insurance Marketplace

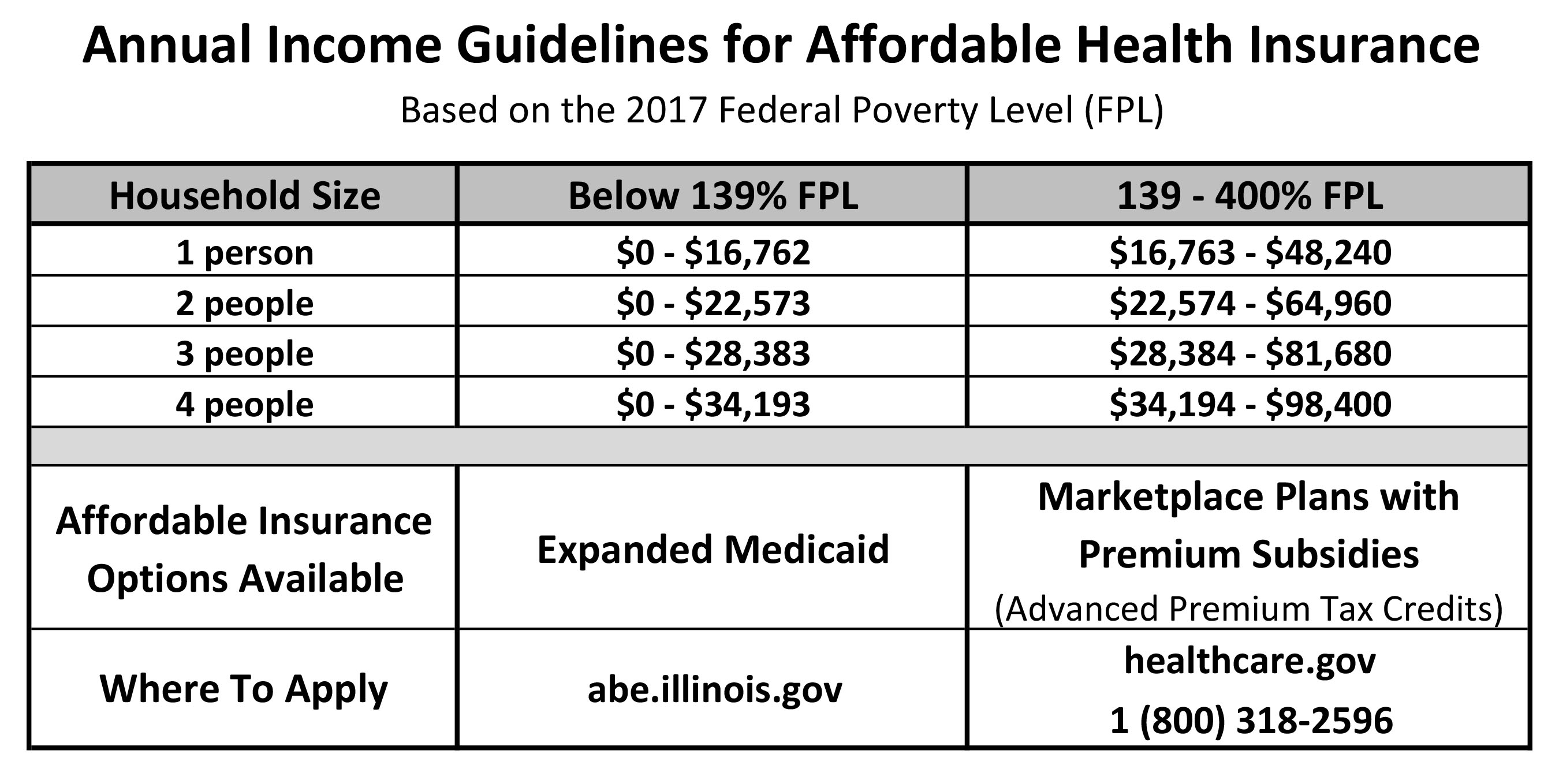

17 Images Obamacare Income Limits 2017 Chart