Louisiana High Risk Auto Insurance

Wednesday, November 9, 2022

Edit

Getting High Risk Auto Insurance in Louisiana

Understanding High Risk Auto Insurance

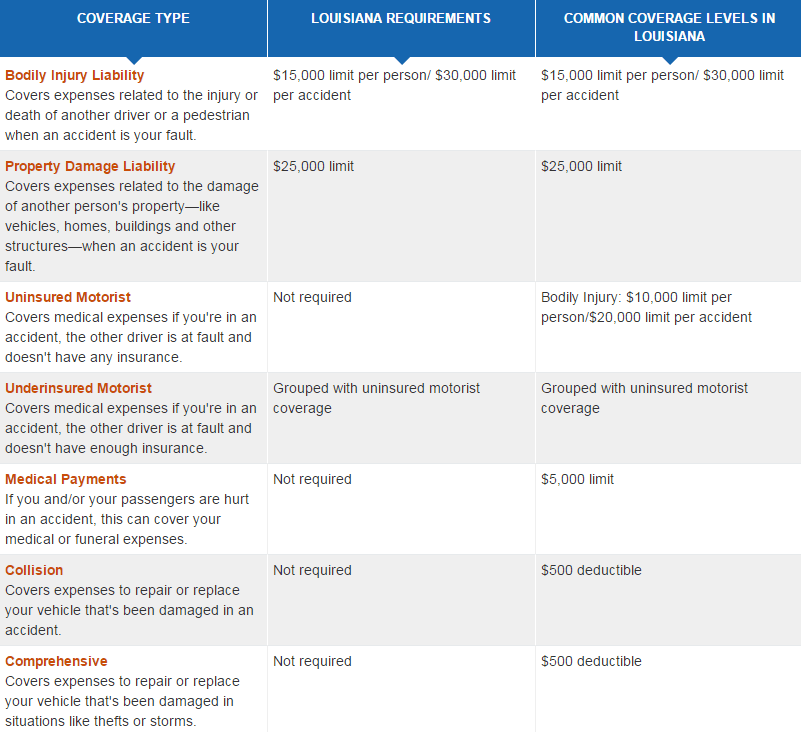

Getting auto insurance is a requirement in Louisiana, and it is important to understand the different types of coverage available. High risk auto insurance is a type of insurance that is designed for drivers who are considered a higher risk due to their driving history, age, gender, or other factors. These drivers may be more likely to be involved in an accident and more likely to make an insurance claim, so they are charged higher premiums.

High risk auto insurance typically covers the same types of coverage as a standard policy, including liability coverage, collision coverage, and uninsured motorist coverage. However, the premiums are usually higher than those for a standard policy. These policies may also come with higher deductibles and lower limits on coverage.

Reasons for High Risk Auto Insurance in Louisiana

There are several reasons why a driver in Louisiana may be considered a high risk and therefore required to purchase high risk auto insurance. Drivers who have had multiple moving violations or multiple accidents in a short period of time may be considered high risk. Drivers who have been convicted of a DUI or have had their license suspended for any reason may also be considered high risk.

Young drivers and drivers who are considered to be high-risk based on their age, gender, or other factors may also be required to purchase high risk auto insurance. In addition, drivers who have a history of not paying their premiums on time may be required to purchase high risk auto insurance.

Finding Affordable High Risk Auto Insurance in Louisiana

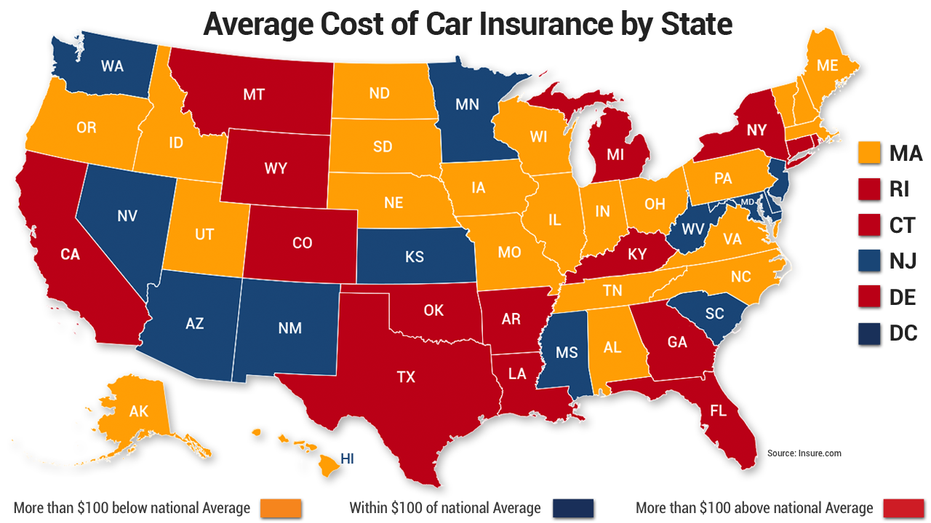

Finding affordable high risk auto insurance in Louisiana can be a challenge, as the premiums are typically higher than those for standard policies. However, there are a few things drivers can do to lower their premiums.

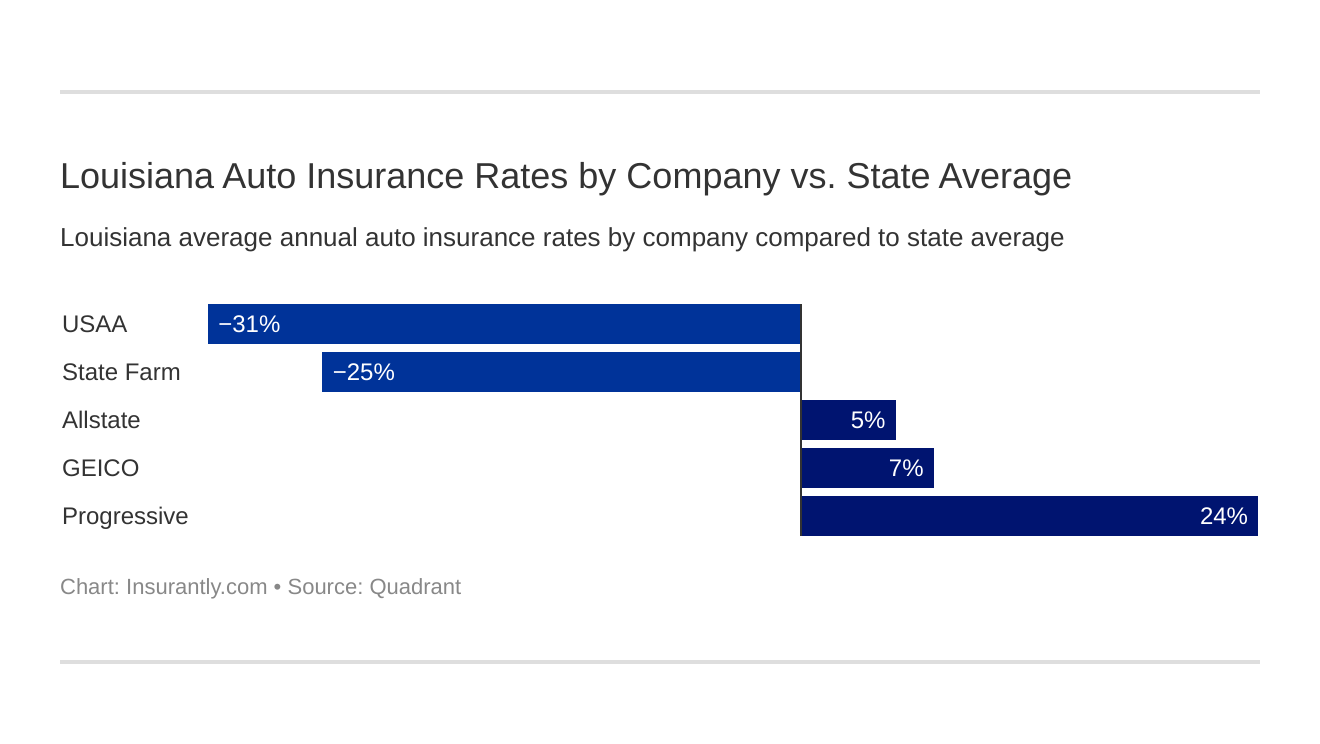

The first step is to shop around and compare rates from different insurance companies. Drivers should also look for discounts, such as those for drivers who complete a defensive driving course, who have a good driving record, or who have multiple vehicles insured with the same company.

Drivers should also look for ways to reduce their coverage, such as raising their deductibles or lowering their limits. In addition, drivers can take steps to reduce their risk, such as driving more carefully and avoiding distractions while driving.

Why Choose Us for High Risk Auto Insurance in Louisiana

At ABC Insurance, we understand the need for high risk auto insurance in Louisiana and we are committed to helping drivers find the coverage they need at a price they can afford. Our team of experienced agents is available to answer any questions you may have and to help you navigate the process of finding the best coverage for your needs.

We understand that drivers in Louisiana may be facing a number of challenges, including high premiums and limited coverage options. Our agents are dedicated to helping drivers find the coverage they need at an affordable price. We have access to a wide range of coverage options and we will work with you to find the best coverage for your needs.

Get the High Risk Auto Insurance You Need in Louisiana

At ABC Insurance, we are committed to helping drivers in Louisiana find the high risk auto insurance they need. Our team of experienced agents is available to help you every step of the way, from finding the best coverage for your needs to navigating the process of filing a claim.

We understand that getting high risk auto insurance in Louisiana can be a challenge, but our agents are dedicated to helping you find the coverage you need at an affordable price. Contact us today to learn more about our high risk auto insurance coverage options.

Cheap Car Insurance in Louisiana 2019

Louisiana Auto Insurance - Another State Farm Louisiana auto insurance

Trump calls out Louisiana's high car insurance rates | Fox Business

Louisiana Auto Insurance (Cheap Rates, Best Companies, and More)

How Can You Help to Lower Louisiana Auto Insurance Premiums?