How Does Insurance Work With Leased Cars

How Does Insurance Work With Leased Cars?

Leasing a car is an attractive option for many people looking to get behind the wheel of a new car without having to worry about taking on a loan or buying the car outright. Instead of a car loan, you make payments to the leasing company while you use the car. But what about insurance? Is it different when you’re leasing a car?

What Kind of Insurance Do I Need?

When you lease a car, the same basic insurance requirements apply as if you were buying it. You need to have liability insurance which covers damage you do to other people’s property as well as medical bills in the event of an accident. You also need comprehensive and collision coverage, which covers damage to your car from an accident, theft, or other events. You may also be required to carry certain types of insurance by your state’s laws.

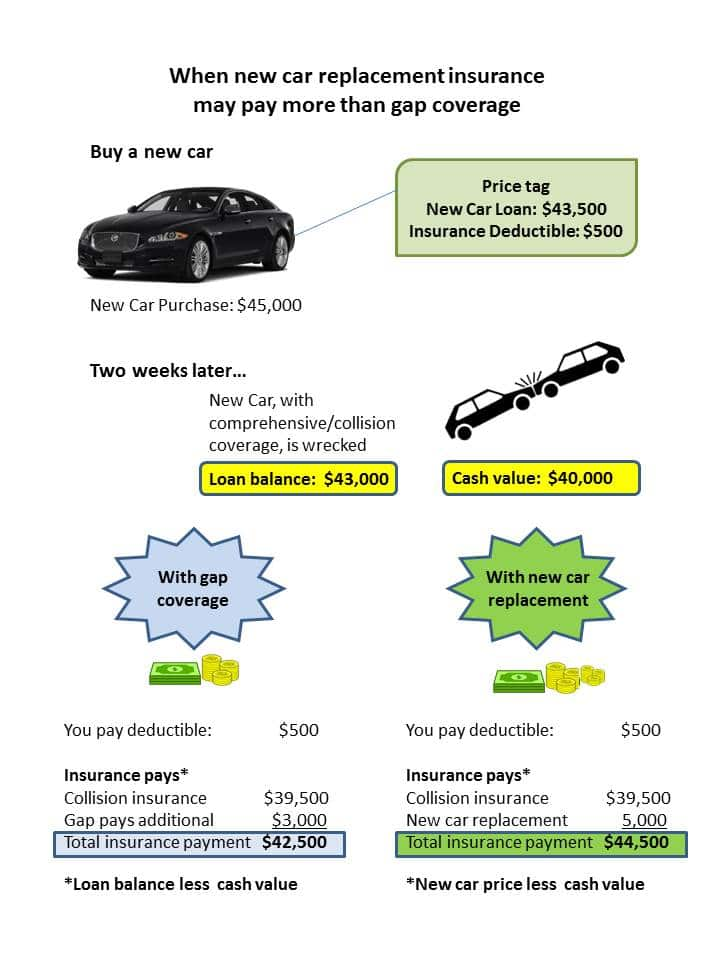

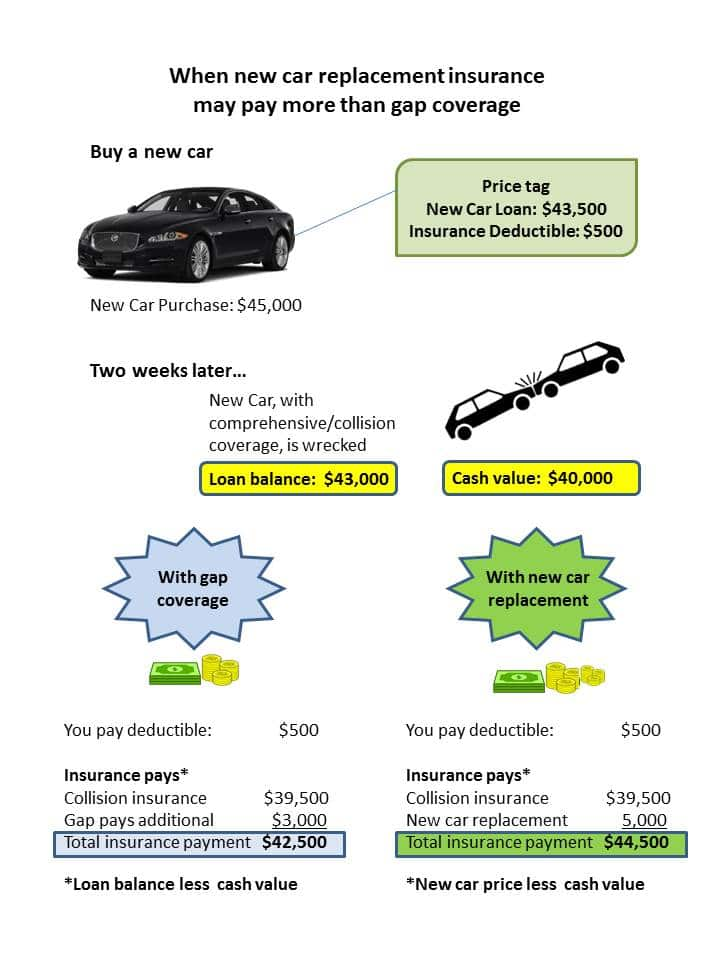

Do I Need Gap Insurance?

Gap insurance is something you might want to consider if you’re leasing a car. Gap insurance covers the difference between the book value of the car and the amount you still owe on it. That way, if your car is totaled in an accident, you won’t be stuck paying for a car you can’t use. Most leasing companies require you to carry gap insurance, so make sure to check with them before you sign the lease.

What Happens if I Don’t Have Insurance?

If you don’t have the right type of insurance or you don’t have any insurance at all, you could face some serious penalties. You could be fined by your state, and the leasing company could sue you for breach of contract. You could even have your car repossessed if you don’t have the right insurance. Make sure to check with your state’s laws and your leasing company’s requirements to make sure you have the right type of insurance.

Can I Buy Insurance Through the Leasing Company?

Some leasing companies offer insurance policies that are specifically designed for people who are leasing cars. These policies may have specific coverage that you won’t find with other insurance companies, so it’s always a good idea to check with your leasing company and see what kind of insurance they offer. Keep in mind, though, that you may be able to find better rates with other insurance companies, so make sure to shop around.

In Conclusion

Insurance is an important part of leasing a car, so make sure you know the requirements of your state and your leasing company. It’s also important to shop around to make sure you’re getting the best rate for the coverage you need. That way, you can be sure you’re covered in case of an accident or other event. Understanding how insurance works with leased cars can help you make the right decisions when it comes to protecting yourself and your car.

Gap Insurance for your New or Leased Cars

Lease a Car vs Buying a Car - Pros and Cons of Leasing and Buying a Car

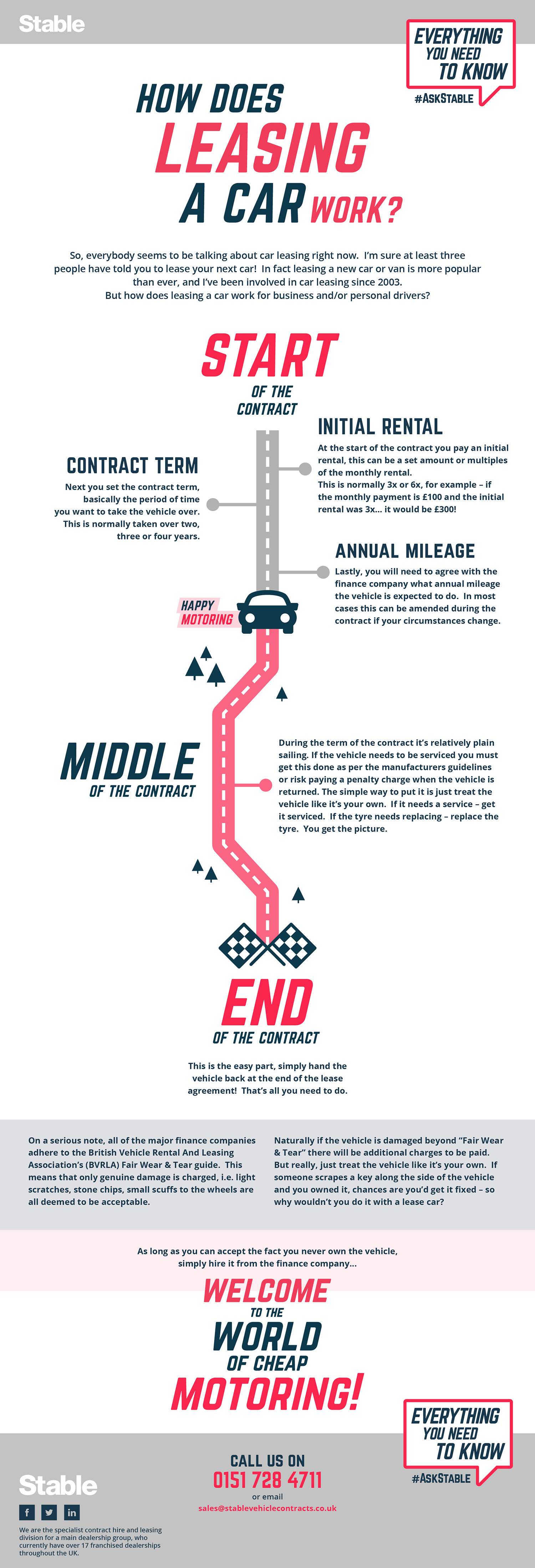

Infographic: How does leasing a car work?

Getting a Grasp on Leased Car Insurance Requirements

The Top 5 Most Popular Leased Cars ♥ | Dolly Dowsie