Does Usaa Offer Gap Insurance Coverage

Does USAA Offer Gap Insurance Coverage?

What is Gap Insurance?

Gap insurance is a type of auto insurance that covers the difference between what you owe on an auto loan and the current market value of the vehicle in the event of a total loss. This coverage is also known as “guaranteed asset protection” or “loan/lease gap coverage.” Gap insurance is typically offered when you purchase a new car, but can also be added to an existing policy. It is important to understand that gap insurance does not cover the repair of your vehicle or the cost of rental car coverage, but rather the difference between the value of the vehicle and the amount owed on the loan.

Does USAA Offer Gap Insurance?

Yes, USAA does offer gap insurance coverage. USAA provides gap coverage for both new and used vehicles, and it can be added to existing auto insurance policies. USAA also offers a variety of other auto insurance options, such as liability coverage, collision coverage, and comprehensive coverage. USAA gap coverage is designed to protect you in the event of a total loss and can help you avoid financial hardship if your vehicle is totaled. USAA offers different levels of gap coverage, so it’s important to understand exactly what type of coverage is right for you.

What Does USAA Gap Insurance Cover?

USAA gap coverage is designed to cover the difference between the amount you owe on an auto loan and the current market value of the vehicle in the event of a total loss. This coverage is also known as “guaranteed asset protection” or “loan/lease gap coverage.” USAA gap coverage does not cover the repair of your vehicle or the cost of rental car coverage, but rather the difference between the value of the vehicle and the amount owed on the loan.

How Much Does USAA Gap Insurance Cost?

The cost of USAA gap insurance depends on a variety of factors, including the type of coverage you choose and the amount of coverage you need. Generally speaking, USAA gap coverage can cost anywhere from $20 to $50 per year. It is important to note that USAA may require you to have a certain level of liability coverage in order to be eligible for gap coverage, so it is important to understand the requirements before you purchase a policy.

How Do I Get USAA Gap Insurance?

USAA gap insurance can be purchased online or by calling USAA directly. If you choose to purchase coverage online, you will be asked to provide information about your vehicle and the amount of coverage you need. Once your coverage is purchased, USAA will send you a confirmation of coverage and you can start enjoying the peace of mind that comes with knowing that you are protected in the event of a total loss.

Conclusion

USAA gap insurance can provide peace of mind in the event of a total loss, covering the difference between what you owe on an auto loan and the current market value of the vehicle. USAA gap coverage is available for both new and used vehicles and can be added to existing auto insurance policies. The cost of USAA gap insurance depends on a variety of factors, and USAA may require you to have a certain level of liability coverage in order to be eligible for gap coverage. USAA gap insurance can be purchased online or by calling USAA directly.

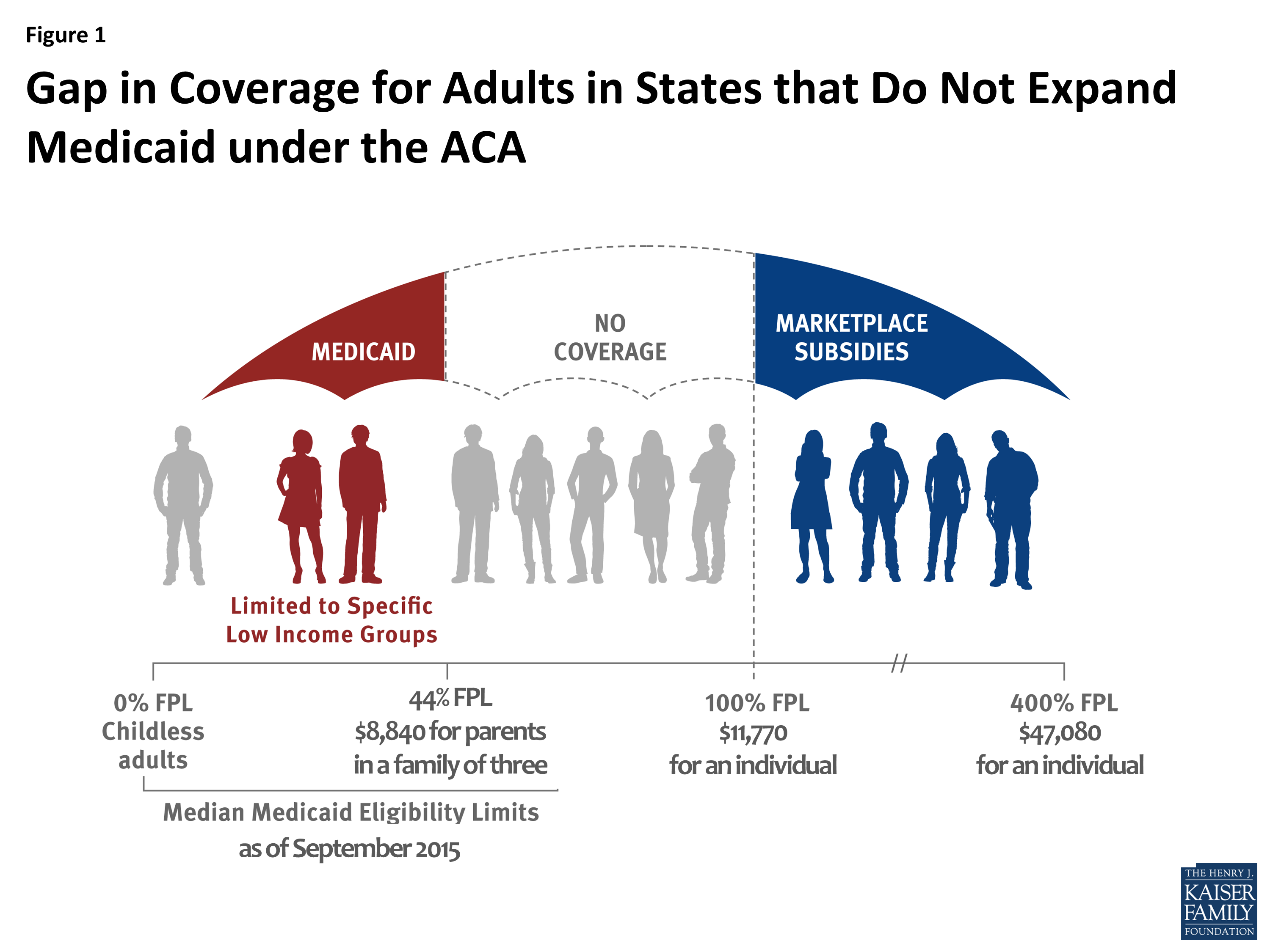

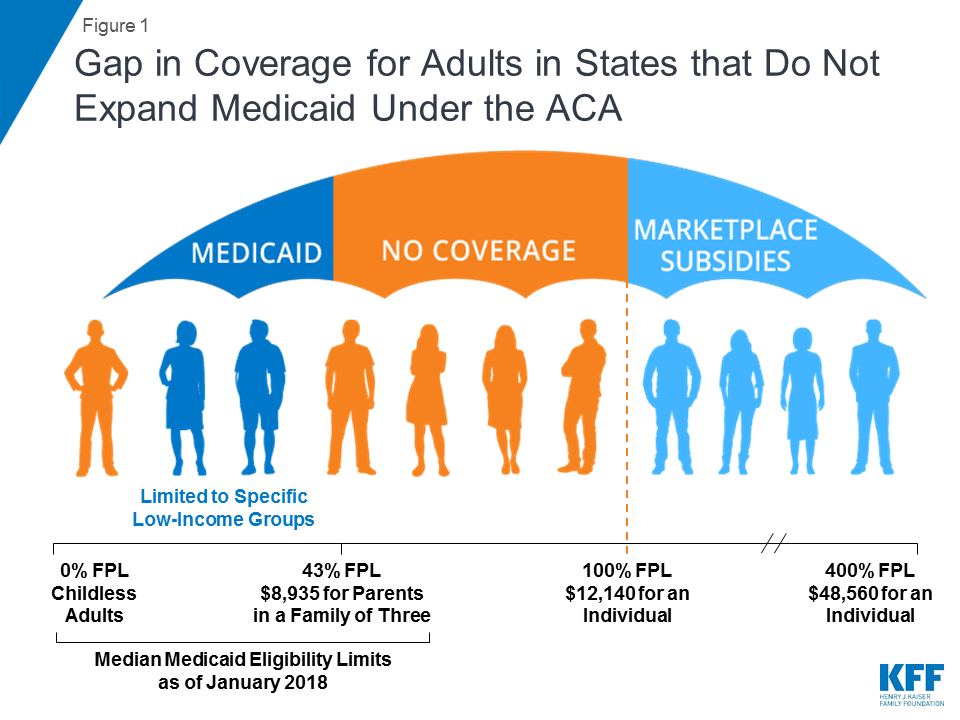

What is the Coverage Gap - Close the Gap NC

The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand

The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand

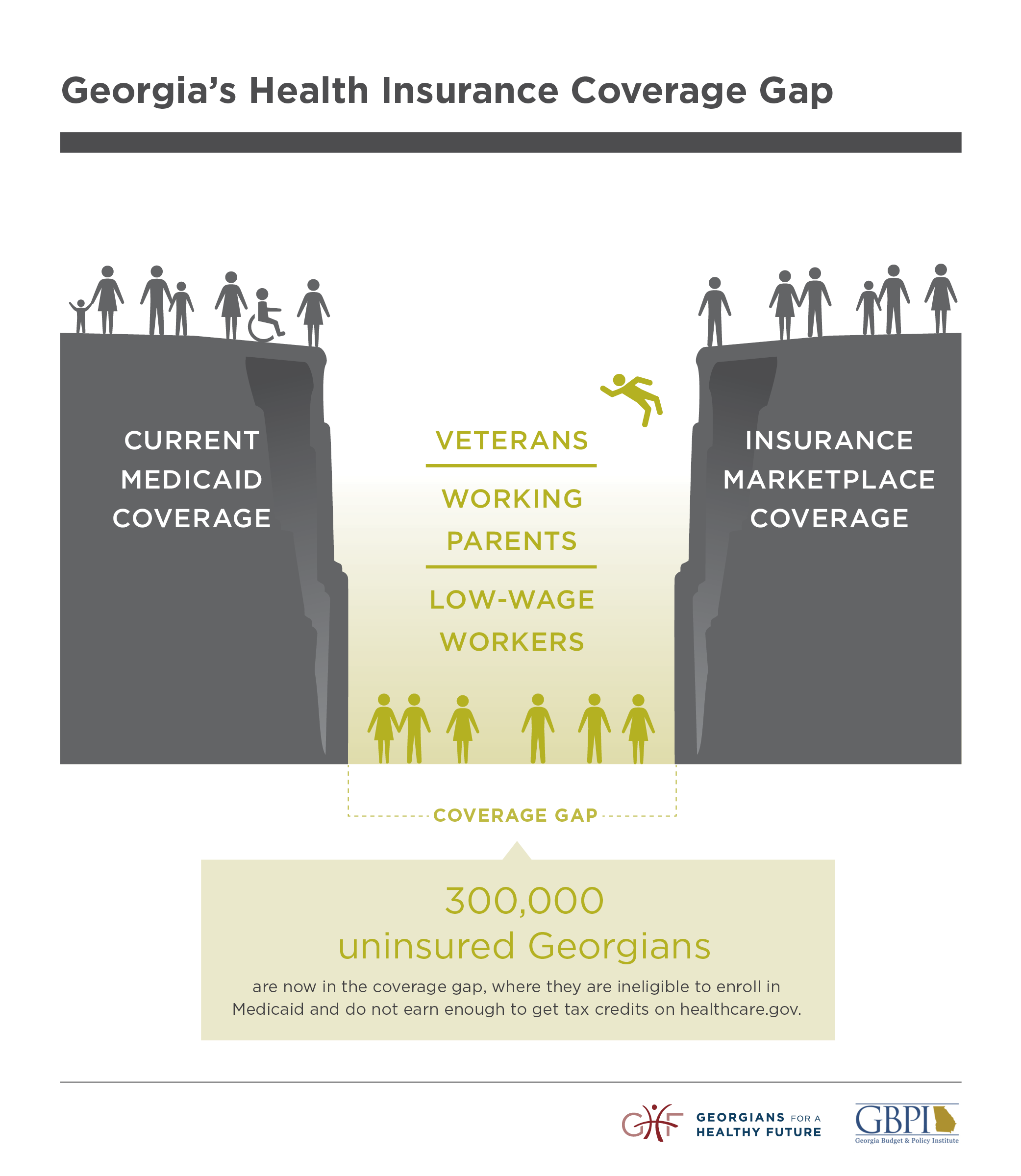

New illustrated Medicaid resource – Georgians for a Healthy Future