Cheap State Minimum Car Insurance Texas

Cheap State Minimum Car Insurance in Texas

Introduction

Texas is the second most populated US state and is known for its large roads and highways. As a driver, you must have car insurance to drive legally in the state of Texas. Many drivers opt for state minimum car insurance in Texas to keep costs low. This article will discuss the basics of state minimum car insurance, what it covers, and some tips on how to find the cheapest state minimum car insurance in Texas.

What is State Minimum Car Insurance?

State minimum car insurance is the minimum level of car insurance required by the state of Texas. It is the most basic form of car insurance and is typically the cheapest option. State minimum car insurance provides coverage for things like personal injury and property damage, as well as coverage for uninsured drivers. It does not provide coverage for things like collision or comprehensive coverage. It is important to note that the state minimum for car insurance in Texas is not the same as the minimum coverage required by the federal government.

What Does State Minimum Car Insurance Cover?

State minimum car insurance in Texas covers the following: personal injury and property damage liability; uninsured and underinsured motorist bodily injury and property damage; medical payments coverage; and personal injury protection. Personal injury and property damage liability coverage covers you in the event you are at fault for an accident and are found liable for the damages. Uninsured and underinsured motorist coverage covers you in the event you are in an accident with an uninsured or underinsured driver. Medical payments coverage covers your medical bills in the event you are injured in an accident. Personal injury protection covers you and your passengers in the event you are injured in an accident.

Tips For Finding Cheap State Minimum Car Insurance in Texas

The best way to find the cheapest state minimum car insurance in Texas is to shop around. Different insurance companies offer different rates, so it is important to compare rates from multiple companies. It is also important to look for discounts, such as a multi-car discount, good driver discount, or a safe driver discount. Additionally, it is important to look for a company that offers low deductibles and a good customer service rating.

Conclusion

State minimum car insurance in Texas is the most basic form of car insurance and is typically the cheapest option. It provides coverage for personal injury and property damage, as well as coverage for uninsured drivers. The best way to find the cheapest state minimum car insurance in Texas is to shop around and look for discounts. Additionally, it is important to look for a company that offers low deductibles and a good customer service rating.

Texas Minimum Car Insurance Requirements 2019 : Cheapest Car Insurance

Texas Minimum Car Insurance - Car Insurance For Texas Drivers : Minimum

PPT - Cheapest Liability Car Insurance Texas PowerPoint Presentation

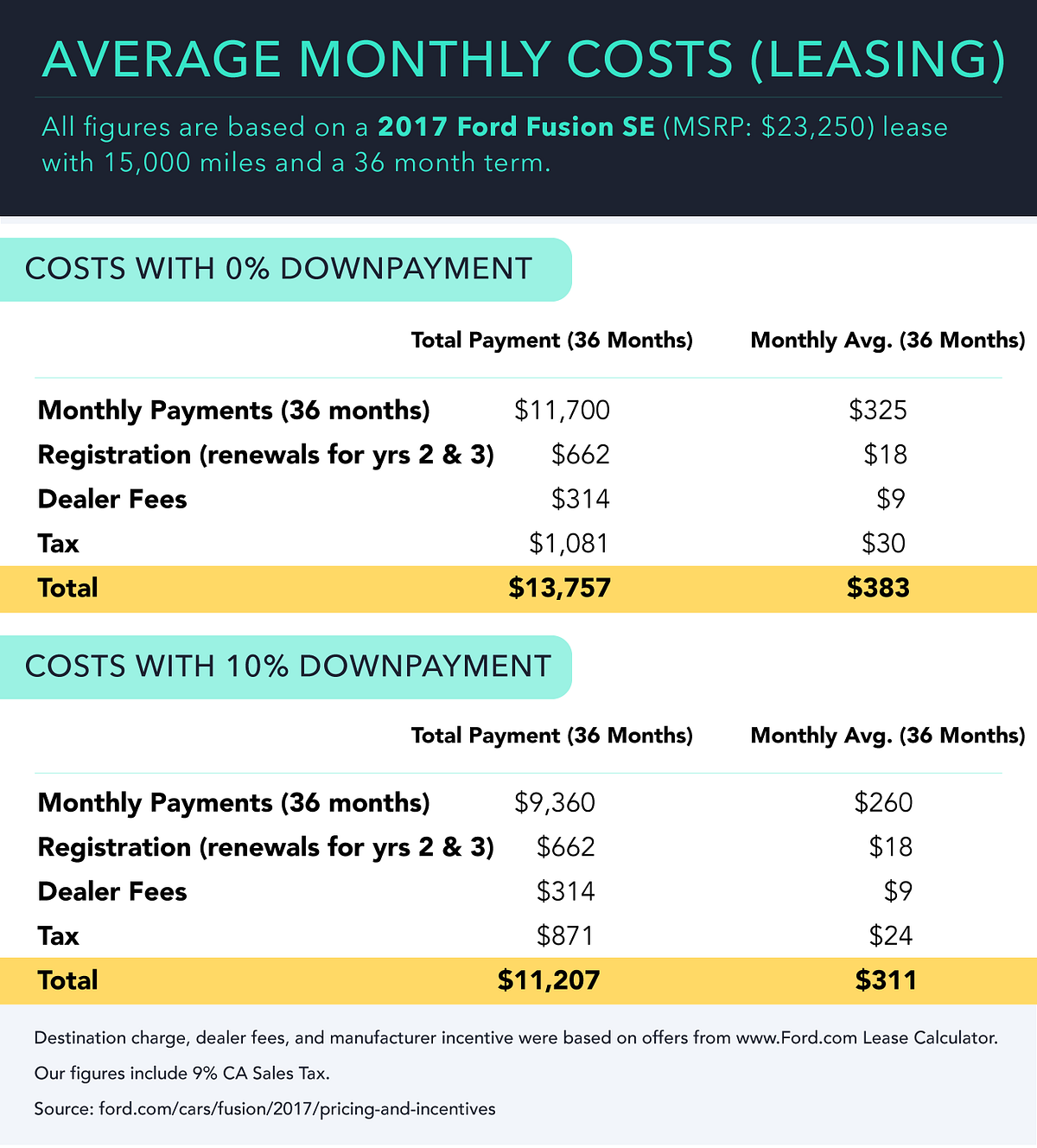

Average Monthly Car Insurance Payment / Texas Car Insurance

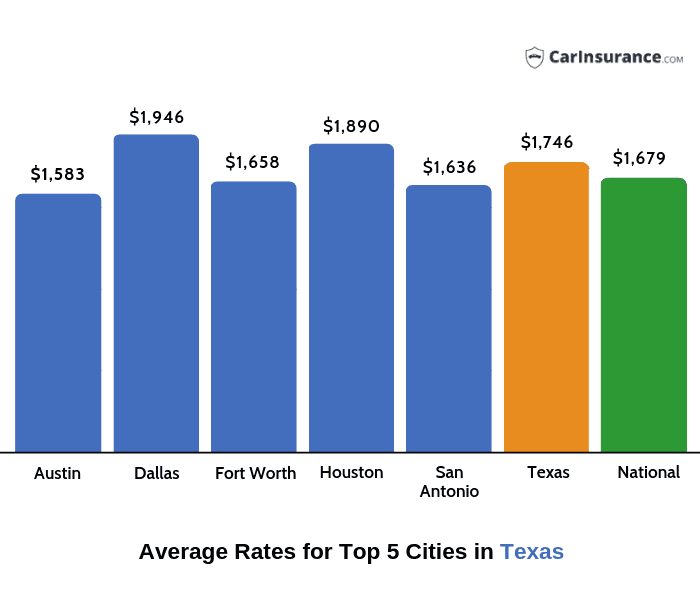

Texas Car Insurance - How Much is Car Insurance in Texas?