Cheap Insurance For Learner Permit

Monday, November 21, 2022

Edit

Cheap Insurance for Learner Permit

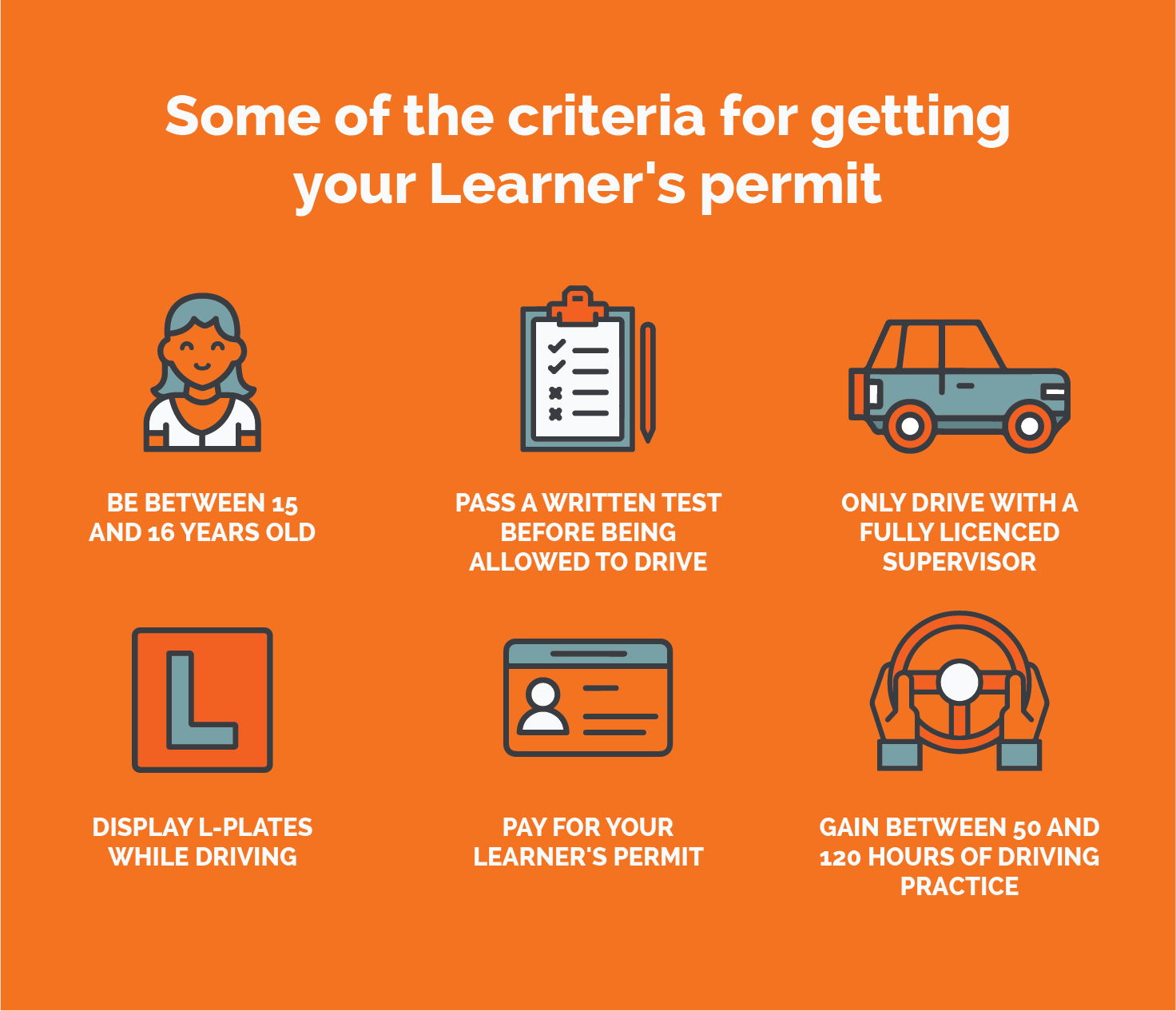

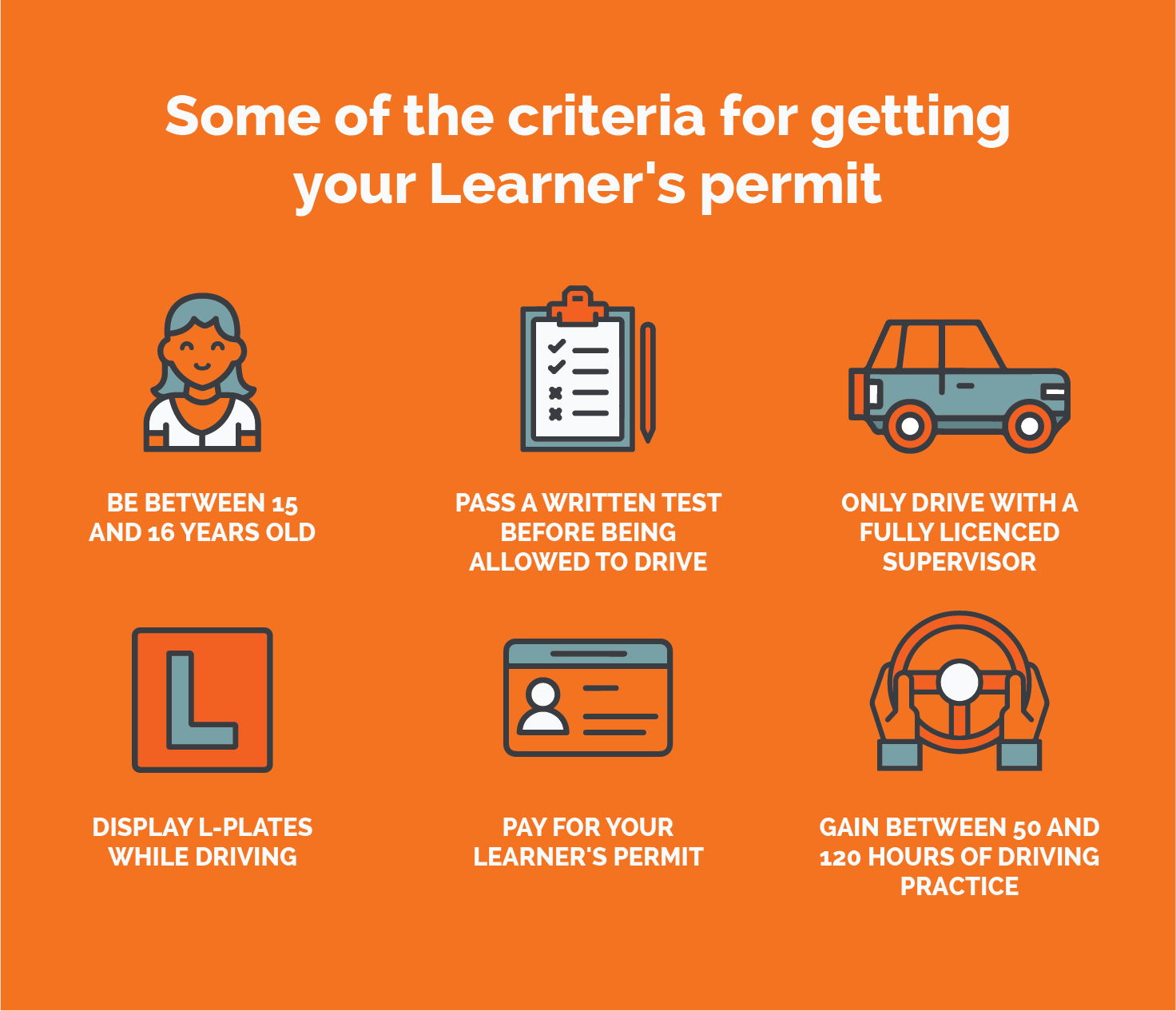

Getting Your Learner Permit

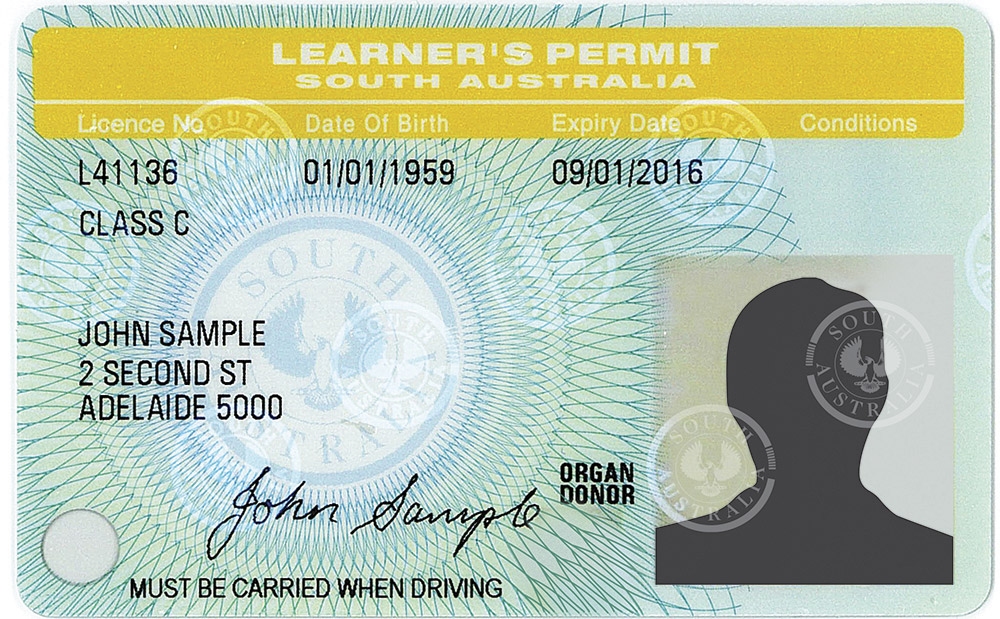

Getting your learner permit is a big step toward driving independence. After passing the written test and getting your permit, you can finally start practicing driving and get closer to passing the road test to get your driver’s license. However, before you can start enjoying the freedom of the open road, you’ll need to make sure that you’re covered by an insurance policy.

Why Do You Need Insurance?

Whether you’re driving with your learner permit or with a full license, it’s important that you have the proper insurance coverage. Most states require that you have insurance to drive legally, and it’s important to make sure that you’re covered for any potential accident or injury you may cause. In most cases, your vehicle’s primary insurance policy covers you as well, but it’s important to double check with your insurance provider to make sure you’re adequately covered.

What Types of Insurance Are Available?

There are a variety of insurance policies available to drivers with learner permits. Some of the most common types of insurance policies include liability, comprehensive, and collision coverage. Liability insurance covers any injuries or damages you cause while driving, while comprehensive and collision coverage protect your car against physical damage. Depending on where you live, you may also need to get uninsured motorist coverage. It’s important to speak with your insurance provider to find out which types of coverage are available in your area.

How Much Does Insurance Cost?

The cost of your insurance depends on several factors, including your age, driving record, and the type of vehicle you drive. Generally, insurance for learner permit drivers is cheaper than for fully licensed drivers, since you’re not yet considered an experienced driver. However, it’s still important to shop around and compare rates from different insurance companies in order to find the best deal.

How Can You Find Cheap Insurance?

If you’re looking for cheap insurance for your learner permit, you’ll need to do some research. Start by speaking with your parents, who may already have an insurance policy you can be added to. You can also compare rates from different insurance companies online, which can help you find the best deal. Finally, make sure to look for discounts, such as good student discounts or discounts for taking a driver education course.

Conclusion

Getting insurance for your learner permit is an important part of becoming a safe, responsible driver. Make sure to do your research and speak with your insurance provider to make sure you’re adequately covered. With a little bit of effort, you can find an affordable insurance policy that will protect you and your vehicle.

Learners Permit Insurance / Who Has Cheap Car Insurance Quotes for a

On The Right Track - Learner's permit

Car Insurance For Learner Permit Ireland 2021 | Link Pico

How to Get a Learner Permit in NY - Pierre Paul Driving School

Learners Permit – Alexandra School of Motoring