Can You Get Gap Insurance On A Lease

Gap Insurance on a Lease: What You Need to Know

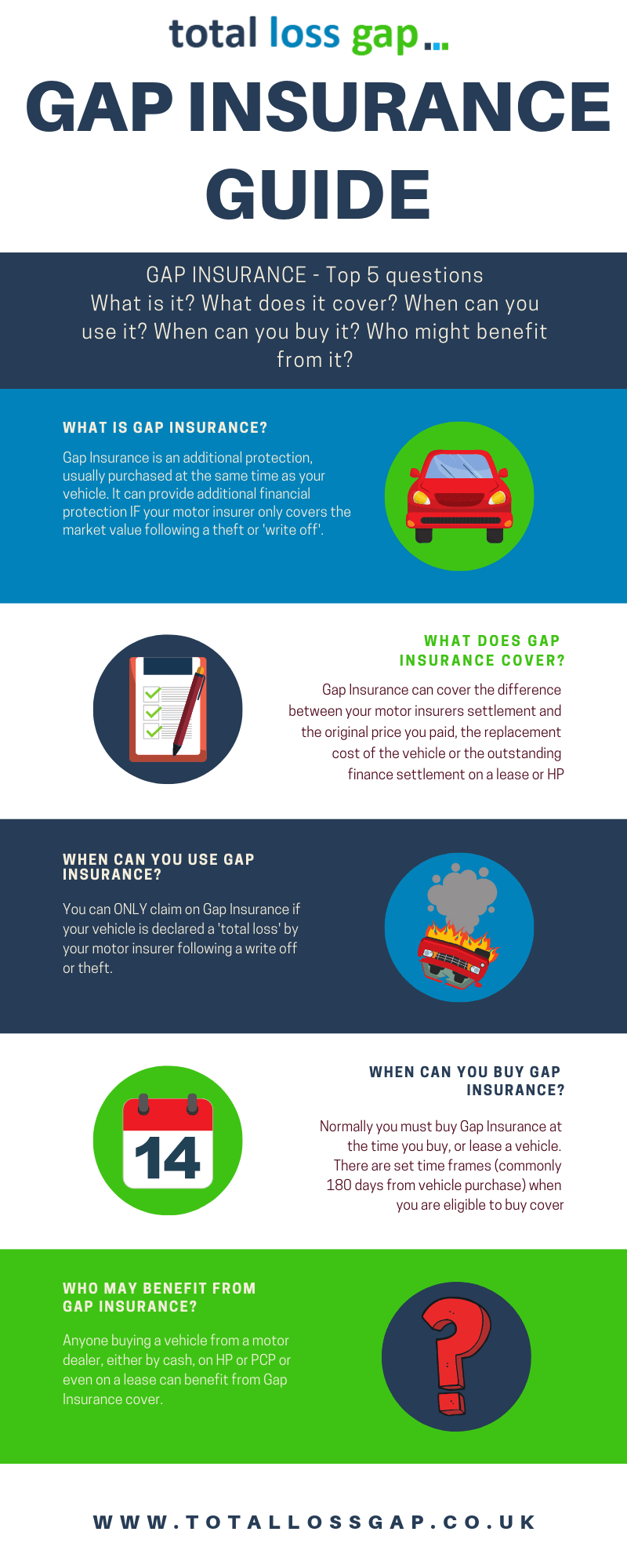

Leasing a car can be a great way to get into a new car without the huge financial commitment of buying one outright. However, if you’re leasing a car, you may want to consider gap insurance to protect yourself. Gap insurance, or gap protection, is a type of insurance coverage designed to cover the difference between what you owe on a leased vehicle and the actual cash value of the car in the event of a total loss. Here is what you need to know about gap insurance on a lease.

What is Gap Insurance?

Gap insurance is a type of insurance coverage that helps protect you in the event of a total loss. If your car is stolen or totaled in an accident, gap insurance will cover the difference between what you owe on the lease and the actual cash value of the car. This coverage can be invaluable in the event of a total loss, as it can help to cover the remaining balance on your lease and prevent you from being stuck with a large bill.

Do I Need Gap Insurance?

Gap insurance is not required when leasing a car, but it is highly recommended. If you’re leasing a car, it’s important to consider the potential financial risks associated with a total loss. If your car is stolen or totaled in an accident and you don’t have gap insurance, you may be responsible for the remaining balance on your lease. This can be financially devastating if you’re unable to cover the remaining balance.

How Much Does Gap Insurance Cost?

The cost of gap insurance can vary depending on the provider, the type of coverage, and the state in which you live. Generally speaking, gap insurance is relatively inexpensive and can often be added to your existing auto insurance policy for an additional fee. If you’re leasing a car, it’s important to shop around and compare rates to find the best gap insurance policy for your needs.

What Does Gap Insurance Cover?

Gap insurance typically covers the difference between what you owe on a leased vehicle and the actual cash value of the car in the event of a total loss. It’s important to note that gap insurance does not cover any other damages or losses associated with a total loss, such as the cost of a rental car or medical expenses. Additionally, gap insurance typically only covers the difference if the car is deemed a total loss; if it can be repaired, gap insurance will not cover the cost of repairs.

Bottom Line

Gap insurance is a type of insurance coverage designed to cover the difference between what you owe on a leased vehicle and the actual cash value of the car in the event of a total loss. While gap insurance is not required when leasing a car, it is highly recommended as it can help to protect you from financial hardship in the event of a total loss. The cost of gap insurance can vary, so it’s important to shop around and compare rates to find the best policy for your needs.

Do You Need GAP Insurance On A Lease Car? | Moneyshake

GAP Insurance - Explained in a Complete Guide | TotalLossGap

Car Lease Gap Insurance Cost - girlscandesigns

Do You Need GAP Insurance On A Lease Car? | Moneyshake

GAP Insurance - Explained in a Complete Guide | TotalLossGap