Can I Insure A Rebuilt Title Car

Thursday, November 24, 2022

Edit

Can I Insure A Rebuilt Title Car?

What is a Rebuilt Title Car?

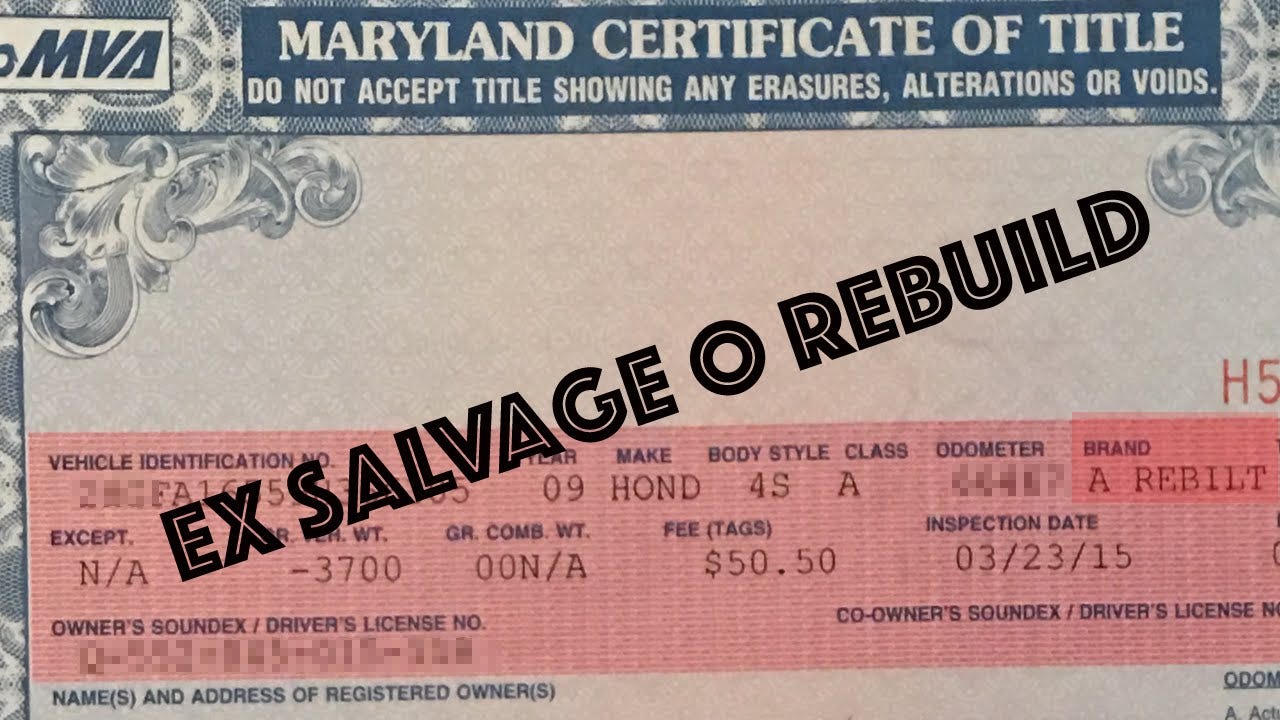

A rebuilt title car is a vehicle that has been damaged. The damage may have been caused by a collision, a flood, or another factor. The car will have been repaired, inspected, and then issued a new title by a motor vehicle department. The new title will typically say “salvage” or “rebuilt” on it. This means that the car is considered to be safe and roadworthy, but it may have diminished value due to the damage it has suffered.

Can I Insure a Rebuilt Title Car?

Yes, you can insure a rebuilt title car. However, you may find it difficult to get an insurance provider to accept a rebuilt title car. This is because the insurance company may be concerned about the car’s condition and the risk associated with insuring it.

If you are able to find an insurance provider that will accept a rebuilt title car, you will likely have to pay more for your insurance policy. This is because the insurance company will consider the car to be a higher risk than a car with a regular title.

What Type of Insurance Should I Get?

When you are looking to insure a rebuilt title car, you should get a basic liability policy. A basic liability policy will provide you with protection if you are found to be at fault for an accident. It will help cover the cost of damages to the other party involved in the accident.

It is important to note that a basic liability policy will not cover any damage to your car. If you are looking for coverage for your car, you will need to buy additional insurance. This may include collision and comprehensive coverage, which will help pay for any repairs that need to be made to your car after an accident.

What Else Do I Need to Know?

In addition to getting the right type of insurance coverage, you should also be aware of the risks associated with buying and insuring a rebuilt title car. While the car may have been inspected and deemed roadworthy, you should be aware that there may still be hidden issues that could affect its performance or safety.

You should also be aware that a rebuilt title car may be worth less than a similar car with a regular title. This means that if you need to make a claim, you may not receive the full value of your car.

Conclusion

In conclusion, you can insure a rebuilt title car, but it may be more difficult to find an insurance provider that is willing to accept it. You should also be aware of the risks associated with buying and insuring such a car. If you do decide to buy a rebuilt title car, make sure you get the right type of insurance coverage and be aware of any potential hidden issues.

Can I Insure A Rebuilt Title Car - Title Choices

flowerdesignersnyc: What Is A Rebuilt Car Title

What is Rebuilt Title Car? How can your Insure one?

Car Shopping Simplified- Buying A Salvage, Rebuilt, or Branded Title

How to Insure a Car With a Rebuilt Title: An immersive guide by Junk