Avg Car Insurance For Teen

Saturday, November 5, 2022

Edit

The Average Cost of Car Insurance for Teen Drivers

Why Teen Drivers Pay More for Auto Insurance

Driving a car is a rite of passage for many teenagers. But with that right comes a lot of responsibility, including the responsibility to pay for car insurance. On average, teen drivers pay more for auto insurance than any other type of driver. But why is this so?

The simple answer is that teens are more likely to get into car accidents than other drivers. According to the Centers for Disease Control and Prevention (CDC), motor vehicle crashes are the leading cause of death among teens in the United States. As such, insurance companies take this into consideration when setting rates for teen drivers.

Another factor that insurance companies consider when setting rates for teens is their lack of driving experience. Teens are still learning the rules of the road and are more likely to make mistakes than more experienced drivers. As such, insurance companies charge more for teens to cover the extra risk.

What Affects the Cost of Teen Car Insurance?

The cost of teen car insurance depends on a variety of factors, including the type of car, the driver's age and driving record, and the type of coverage. The type of car matters because some cars are more expensive to insure than others. Teens who drive luxury cars or sports cars, for instance, will pay more for car insurance than teens who drive more affordable cars.

The driver's age and driving record also play a role in the cost of teen car insurance. Teens who are younger than 18 and have a clean driving record are likely to pay less for car insurance than teens who are older and have a less-than-perfect driving record.

The type of coverage also affects the cost of car insurance for teens. Liability coverage, for instance, is typically more affordable than comprehensive coverage. But comprehensive coverage offers more protection for teen drivers in the event of an accident.

How to Find Affordable Car Insurance for Teens

Finding affordable car insurance for teens doesn't have to be a daunting task. The best way to find cheaper rates is to shop around and compare quotes from different insurance companies. Doing so can help you find the best coverage at the lowest price.

It's also a good idea to take advantage of discounts when possible. Many insurance companies offer discounts for teens who get good grades or take a driver's education course. It's also a good idea to ask about other discounts, such as multi-car discounts or loyalty discounts.

The Average Cost of Car Insurance for Teens

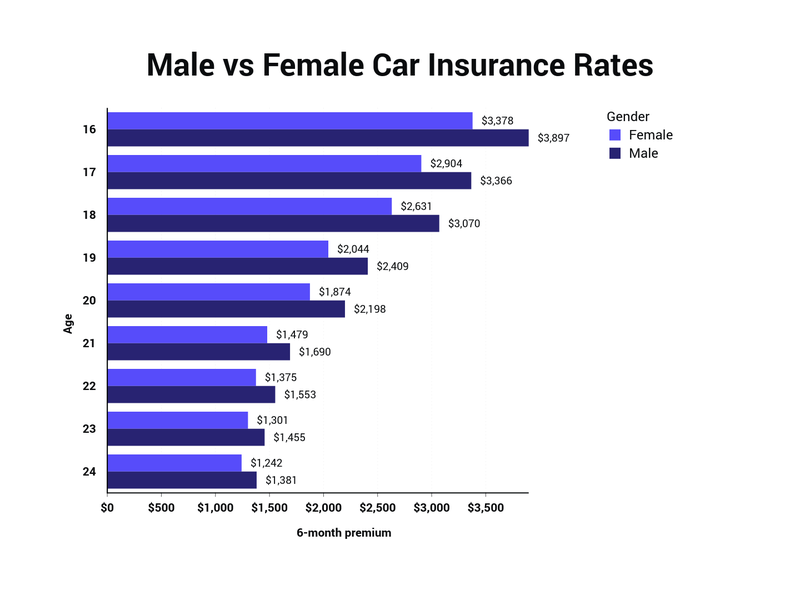

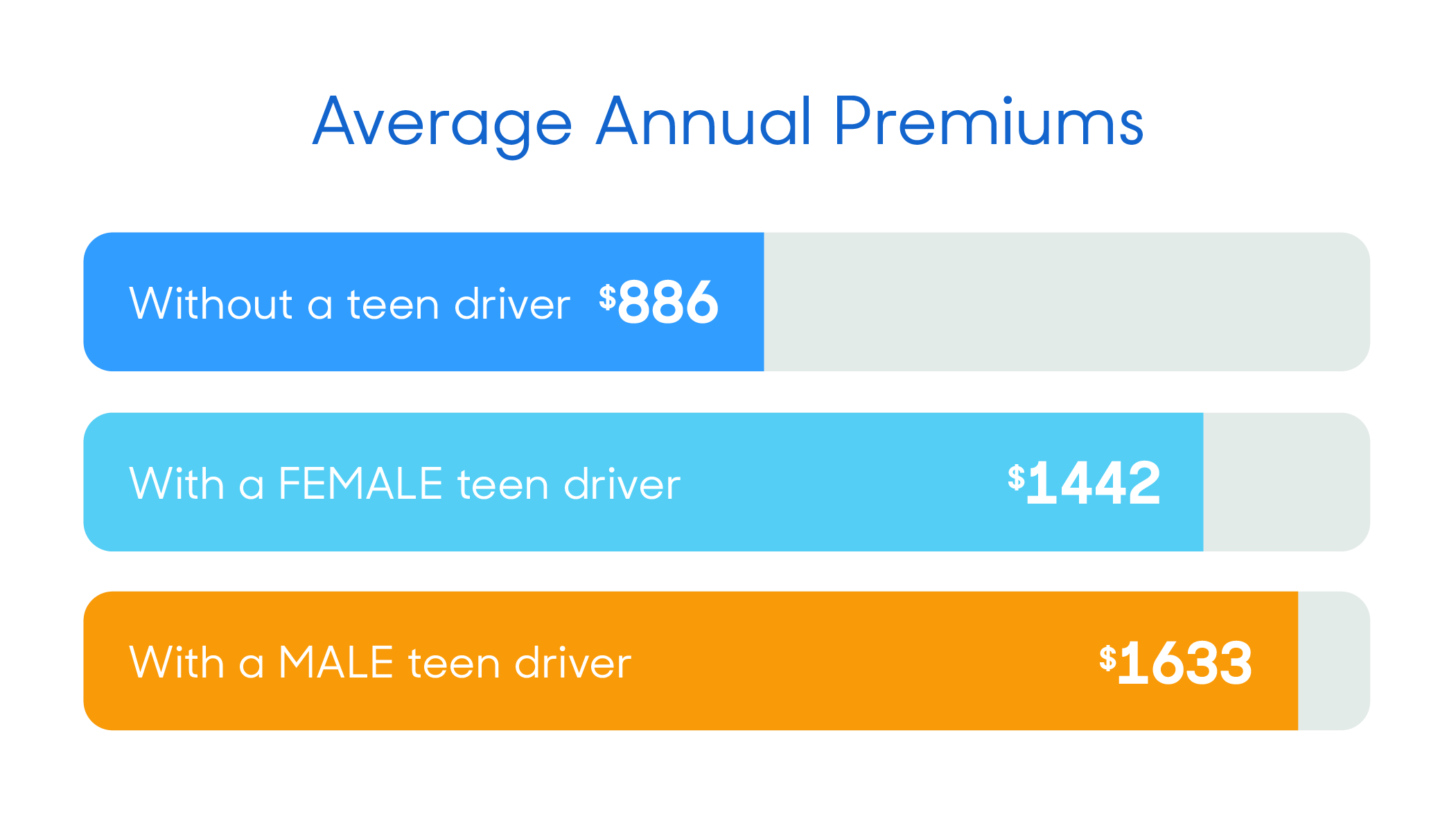

The average cost of car insurance for teens varies from state to state. On average, however, teens pay more for car insurance than any other type of driver. According to the Insurance Information Institute, the average cost of car insurance for teens is about $1,600 per year.

The cost of car insurance for teens also varies depending on the type of car and the type of coverage. Teens who drive luxury cars, for instance, will pay more for car insurance than teens who drive more affordable cars. The same is true for teens who choose comprehensive coverage over liability coverage.

The Bottom Line

Car insurance is an important part of driving for teens. On average, teens pay more for car insurance than any other type of driver. The cost of car insurance for teens depends on a variety of factors, including the type of car, the driver's age and driving record, and the type of coverage.

Shopping around and comparing quotes from different insurance companies is the best way to find the best coverage at the lowest price. Taking advantage of discounts can also help teens save money on car insurance.

At the end of the day, car insurance is an important investment for teens. But with a little research and effort, teens can find car insurance that fits their budget and their needs.

Average Car Insurance For 18 Year Old Male Per Month - New Cars Review

Male vs. Female Car Insurance Rates | The Zebra

Why is Auto Insurance for Teen Drivers SO Expensive? – ICA Agency

How to Add A Teen Driver to Your Car Insurance and How Much it Costs

How Much Does Car Insurance Cost? | Moneyshake