Average Cost Of Health Insurance In Massachusetts Per Month

Friday, November 11, 2022

Edit

Average Cost Of Health Insurance In Massachusetts Per Month

What Is Health Insurance?

Health insurance is a type of insurance coverage that covers the cost of an insured individual's medical and surgical expenses. Health insurance can reimburse the insured for expenses incurred from illness or injury, or pay the care provider directly. It is often included in employer benefit packages as a means of enticing quality employees. The cost of health insurance premiums is deductible to the payer, and benefits received are tax-free.

Health insurance companies are not actually providing traditional insurance, which involves the pooling of risk, because the vast majority of purchasers actually do face the harms that they are "insuring" against. Instead, as Edward Beiser and Jacob Appel have separately argued, health insurers are better thought of as low-risk money managers who pocket the interest on what are really long-term healthcare savings accounts.

Average Cost Of Health Insurance In Massachusetts

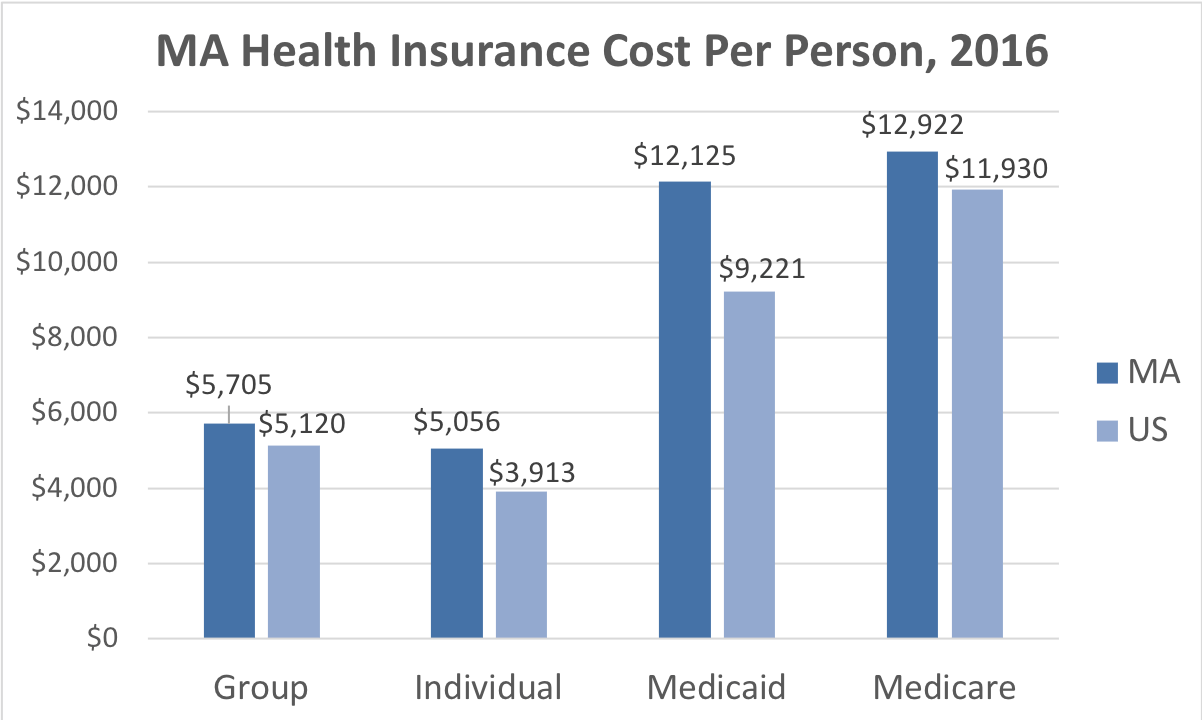

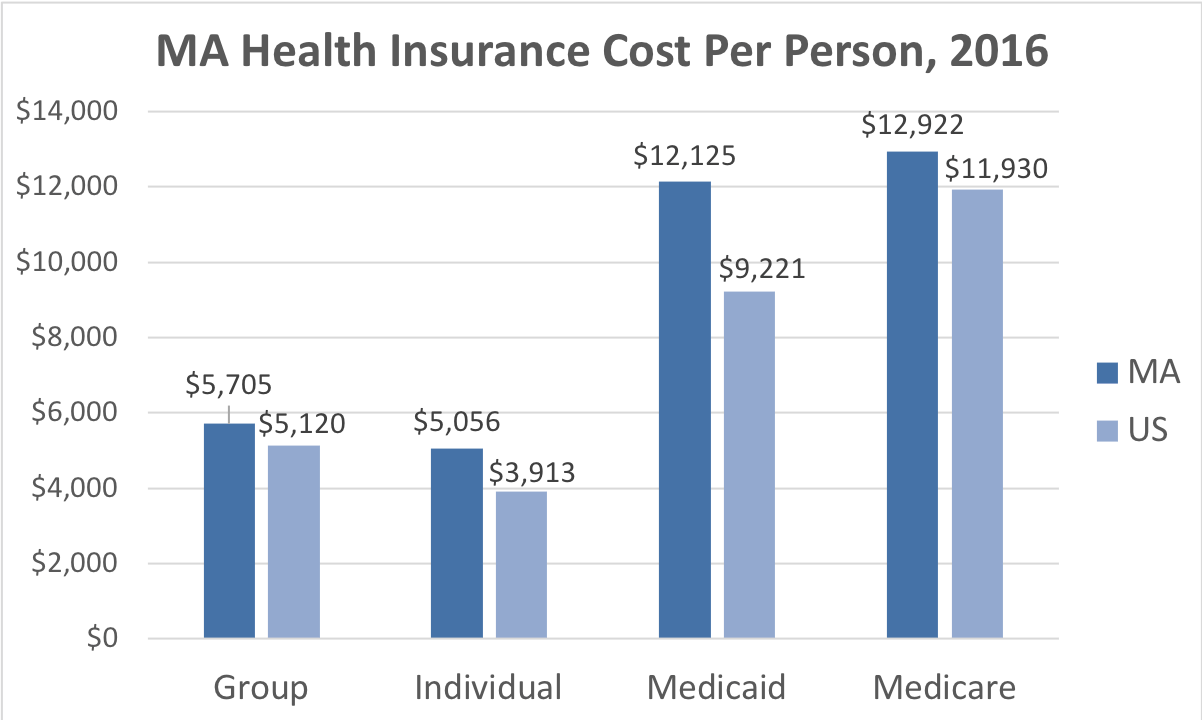

The average cost of health insurance in Massachusetts is $552 per month for an individual and $1,212 for a family of four. This is considerably less than the average cost of health insurance nationwide, which is estimated to be $477 per month for an individual and $1,202 for a family of four. This is due in part to the fact that Massachusetts has a relatively low cost of living compared to the rest of the country. In addition, the state has a well-developed health care system that includes the Massachusetts Health Connector, which allows individuals to shop for and compare health insurance plans.

The Massachusetts Health Connector is a state-run health insurance exchange that allows individuals and families to compare health insurance plans and find the one that best meets their needs. The health insurance plans offered through the Connector are offered by a variety of private insurers and provide coverage for a wide range of services. The plans are divided into four categories, based on the amount of coverage they provide: Bronze, Silver, Gold, and Platinum. The cost of the plans varies depending on the category of coverage, the age and health of the individual, and the type of plan selected.

Factors Affecting The Cost Of Health Insurance In Massachusetts

The cost of health insurance in Massachusetts is affected by a variety of factors, including the type of coverage, the age and health of the individual or family, and the type of plan selected. For instance, the cost of health insurance for an individual may be higher or lower than for a family of four, depending on the age and health of the individuals in the family. Additionally, the cost of health insurance can be affected by the type of plan selected. For example, plans with higher levels of coverage tend to cost more than plans with lower levels of coverage.

In addition to the type of coverage and the age and health of the individual or family, the cost of health insurance in Massachusetts is also affected by the location of the individual or family. Health insurance plans tend to be more expensive in areas with higher costs of living. This is due in part to the fact that health care providers in these areas may charge more for their services, and insurance companies may have to pay more for the same level of coverage.

What Are The Benefits Of Health Insurance In Massachusetts?

Health insurance in Massachusetts provides numerous benefits to individuals and families. For instance, having health insurance can help to alleviate some of the financial burden associated with medical care. Health insurance can cover the cost of doctor visits, prescription medications, hospital stays, and more. Additionally, having health insurance can provide peace of mind, as individuals and families can rest assured that they will have access to the care they need when they need it.

In addition to providing financial protection, health insurance can help to ensure that individuals and families receive quality care. Health insurance plans in Massachusetts are required to cover a wide range of services, including preventive care, mental health services, and prescription drugs. This helps to ensure that individuals and families have access to the care they need to stay healthy and maintain their quality of life.

Conclusion

The average cost of health insurance in Massachusetts is lower than the national average and is affected by a variety of factors, including the type of coverage, the age and health of the individual or family, and the type of plan selected. Additionally, having health insurance can help to alleviate some of the financial burden associated with medical care and can provide peace of mind. Health insurance in Massachusetts is also required to cover a wide range of services, which helps to ensure that individuals and families have access to the care they need to stay healthy and maintain their quality of life.

Massachusetts Health Insurance - ValChoice

Best Cheap Health Insurance in Massachusetts 2019 - ValuePenguin

Health Care Policy and Marketplace Review: The Cost of the

What Does A Basic Medical Expense Policy Cover References - Galeries

Political Calculations: The Cost of Employer-Provided Health Insurance