Average Car Insurance Cost For Teen Male On Parents Insurance

Average Car Insurance Cost For Teen Male On Parents Insurance

Why Car Insurance For Teenagers Is Costly?

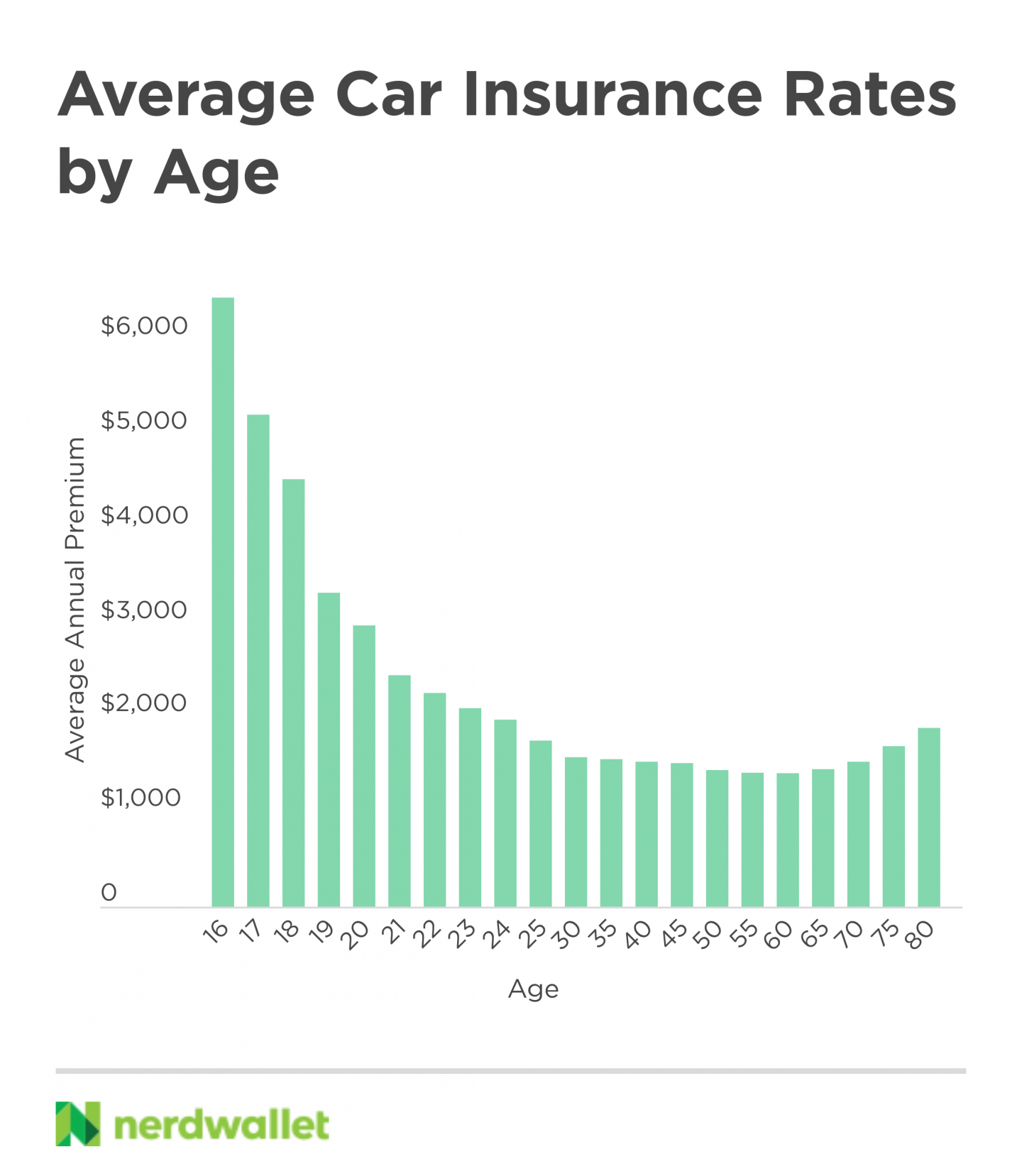

It is no secret that car insurance for teenagers is more expensive than for adults. This is due to the fact that teens lack the experience and maturity that comes with age and are considered a higher risk by insurers. Furthermore, teens are more likely to be involved in an accident, which could result in higher insurance costs. As a result, car insurance for teenagers can be quite costly, especially when added to an existing policy.

In addition to the cost of car insurance for teenagers, there are other factors that can affect the overall cost. Some of these include the type of car being insured, the teen's driving record, the teen's age, and the teen's gender. Each of these factors can have an impact on the cost of insurance.

How Much Does Car Insurance Cost For Teen Male On Parents Insurance?

The cost of car insurance for a teen male on parents insurance can vary greatly. The cost can range from as little as a few hundred dollars to as much as several thousand dollars per year. The cost will depend on a variety of factors, such as the teen's age, driving record, the type of car being insured, and the amount of coverage the teen needs.

In general, the cost of car insurance for a teen male on parents insurance will be higher than for adults. The primary reason for this is that teens lack the experience and maturity of adults, making them more prone to accidents. Additionally, teens are more likely to drive recklessly and be involved in more dangerous activities, which can result in higher insurance costs.

What Factors Affect The Cost Of Car Insurance For Teen Male On Parents Insurance?

There are a variety of factors that can affect the cost of car insurance for a teen male on parents insurance. Some of these include the type of car being insured, the teen's age, the teen's driving record, and the amount of coverage the teen needs. Additionally, the type of coverage the teen needs can also affect the cost of insurance.

For instance, if the teen is only interested in basic coverage, such as liability and collision coverage, the cost of car insurance may be lower. However, if the teen needs additional coverage, such as comprehensive or uninsured/underinsured motorist coverage, the cost of insurance may be higher. Additionally, the teen's age, driving record, and the type of car being insured can all play a role in the cost of insurance.

How To Find The Best Car Insurance For Teen Male On Parents Insurance?

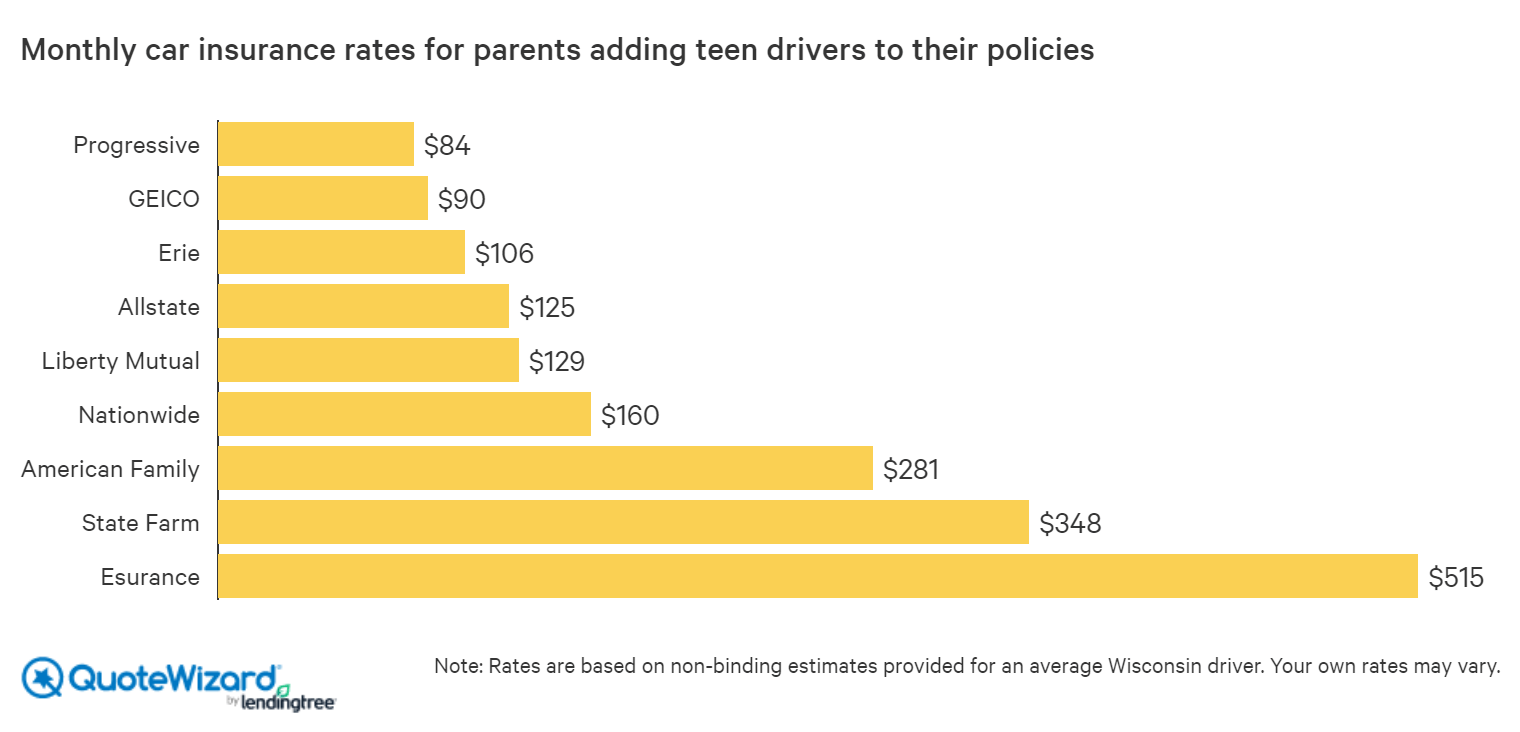

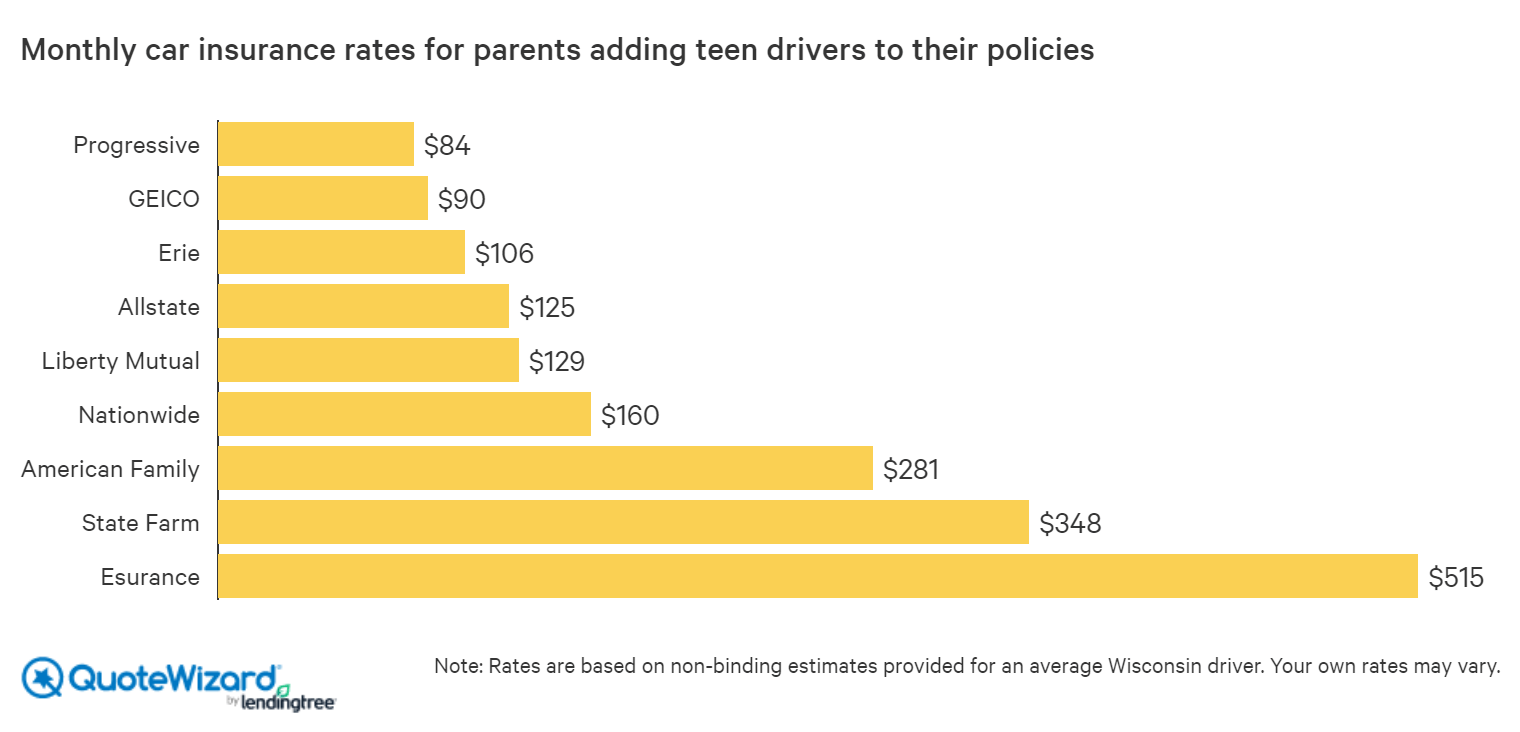

Finding the best car insurance for a teen male on parents insurance is not always easy. However, there are a few steps that can be taken to help ensure the teen gets the best coverage at the best price. First, it is important to compare car insurance rates from multiple providers. This will ensure the teen gets the best rate for the coverage he or she needs. Additionally, it is important to consider discounts and other incentives that may be available to help lower the cost of car insurance.

Finally, it is important to understand the terms of the insurance policy. This will help ensure the teen knows what is covered and what is not covered by the policy. By understanding the policy and finding the best rate, the teen can save money on car insurance.

Best Car Insurance for Teens | QuoteWizard

Best Car Insurance For Teen Drivers - ValuePenguin

Male vs. Female Car Insurance Rates | The Zebra

Average Car Insurance Rates by Age and Gender | Urban Wealth Report