3rd Party Liability Damage Insurance For Parachuting

3rd Party Liability Damage Insurance For Parachuting

What Is 3rd Party Liability Damage Insurance?

3rd party liability damage insurance is a type of insurance that helps to protect you against any expenses or liabilities that you may have to pay if you are found to be at fault in an accident or other incident. This type of insurance is particularly important for those who participate in high risk activities such as parachuting. It can help to cover the costs of any medical care, property damage, or other expenses that may result from an incident.

3rd party liability damage insurance is often required for those who participate in parachuting, as it can help to protect them from any legal or financial repercussions if they are found to be at fault. This type of insurance can help to provide peace of mind as it can help to cover any costs that may arise from an incident. It is important to note that this type of insurance is not a substitute for other types of insurance such as health or life insurance.

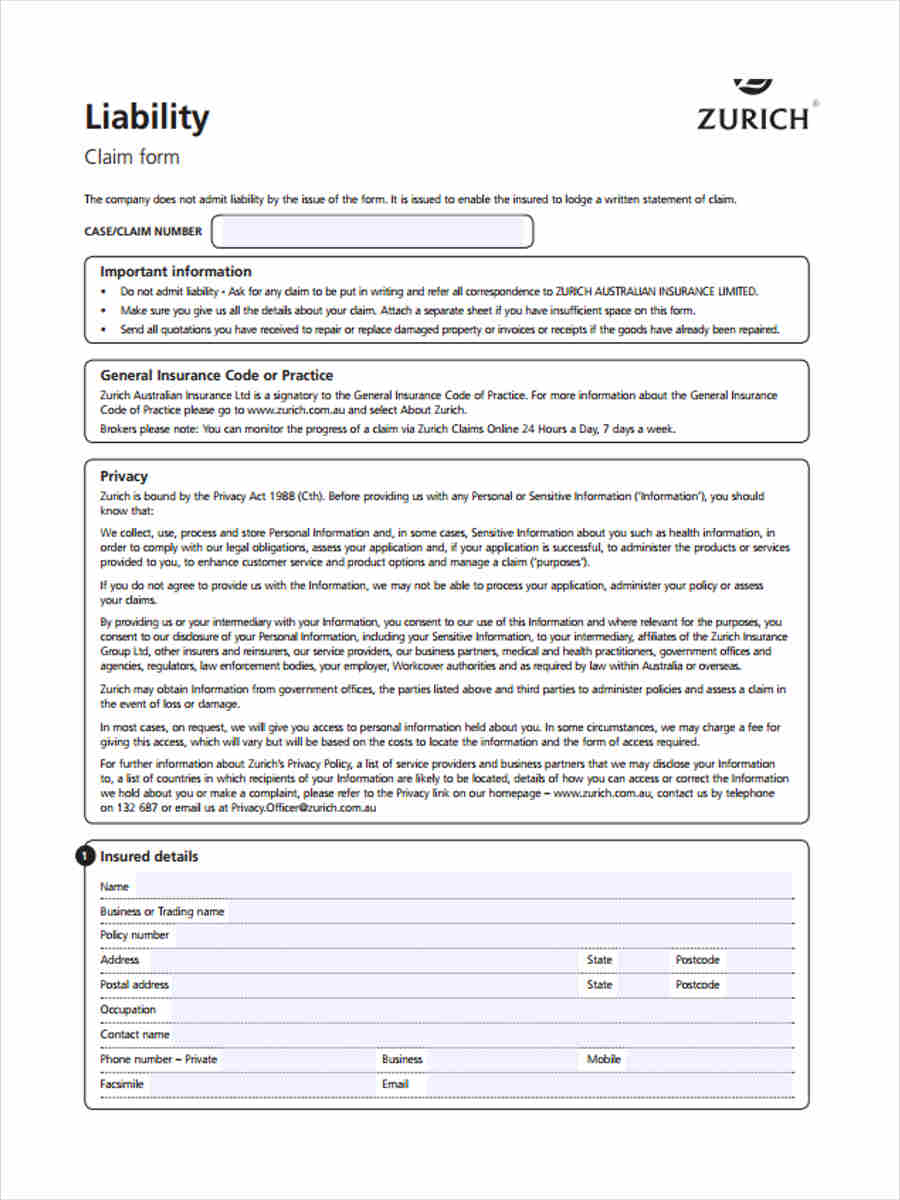

What Is Covered Under 3rd Party Liability Damage Insurance?

3rd party liability damage insurance typically covers the cost of property damage, medical expenses, and other costs that may arise from an incident. This type of insurance can help to cover the costs of any legal expenses that may be incurred if you are found to be at fault. It also helps to provide coverage for any costs that may be incurred if you are found to be liable for any other damages.

In addition, this type of insurance can help to cover any costs that may arise from an incident involving a third party. This can include costs associated with medical bills, property damage, and other costs that may arise from an incident. It is important to note that this type of insurance only covers the costs of the incident itself and does not cover any costs that may arise from a lawsuit or other legal proceedings.

What Are The Benefits Of 3rd Party Liability Damage Insurance?

The primary benefit of 3rd party liability damage insurance is that it can help to provide peace of mind. It can provide coverage for the costs that may arise from an incident, including medical bills, property damage, and other costs. This type of insurance can help to protect you financially if you are found to be at fault in an incident. It can also help to protect you from any legal repercussions if you are found to be liable for any other damages.

In addition, this type of insurance can help to provide coverage for any legal expenses that may be incurred if you are found to be at fault in an incident. This can help to provide financial security if you are found to be liable for any other damages. This type of insurance can also help to provide coverage for any costs that may arise from an incident involving a third party.

What Are The Limitations Of 3rd Party Liability Damage Insurance?

The primary limitation of 3rd party liability damage insurance is that it only covers the costs of the incident itself and does not cover any costs that may arise from a lawsuit or other legal proceedings. This type of insurance also does not provide coverage for any costs that may arise from an incident involving a third party. Additionally, this type of insurance does not cover any costs that may arise from an incident involving intentional acts or negligence.

How Much Does 3rd Party Liability Damage Insurance Cost?

The cost of 3rd party liability damage insurance can vary depending on the type of coverage that you choose and the amount of coverage that you need. Generally, the cost of this type of insurance is based on the type of activity that you are engaging in, the amount of coverage that you need, and the risks associated with the activity. It is important to note that the cost of this type of insurance can be quite expensive and should be taken into consideration when deciding whether or not to purchase this type of insurance.

Conclusion

3rd party liability damage insurance is an important type of insurance for those who participate in high risk activities such as parachuting. It can help to provide coverage for the costs that may arise from an incident, including medical bills, property damage, and other costs. This type of insurance can also help to provide coverage for any legal expenses that may be incurred if you are found to be at fault. However, it is important to note that this type of insurance does not provide coverage for any costs that may arise from a lawsuit or other legal proceedings.

Third Party Property Car Insurance | iSelect

What Is Third-party Insurance?

What is Third Party Insurance in 2020 | Third party, Insurance, Aadhar card

FREE 5+ Third Party Liability Forms in PDF

Third Party Liability Insurance In Dubai - Dubai Online Insurance